Startup S Corporation Foreign Shareholder

Description

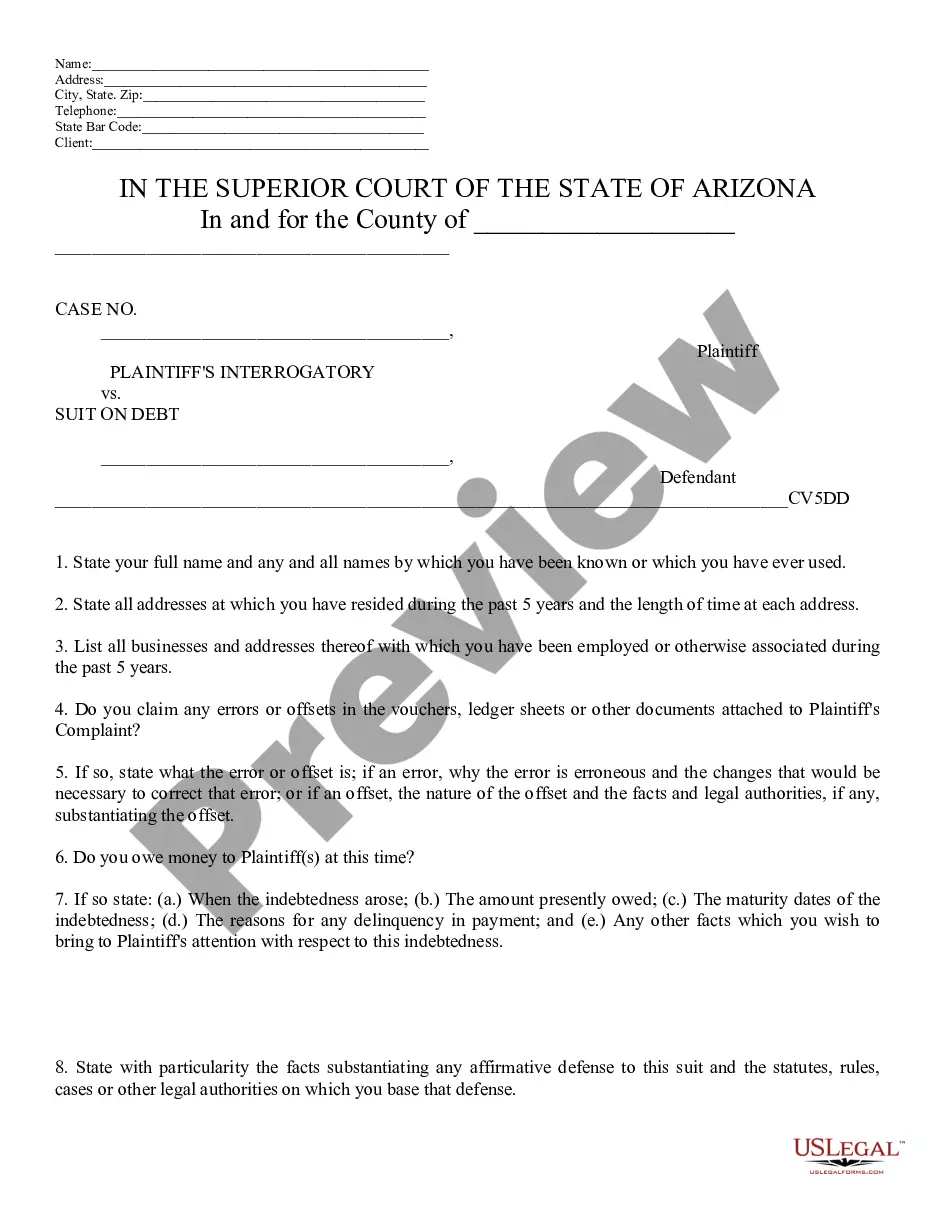

How to fill out Small Business Startup Package For S-Corporation?

Handling legal documents and processes can be a lengthy addition to your routine.

Startup S Corporation Foreign Shareholder and similar forms frequently necessitate you to search for them and comprehend how to fill them out accurately.

As a result, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and accessible online library of forms readily available will significantly aid you.

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific forms along with a range of tools to help you complete your documents effortlessly.

Is this your first experience with US Legal Forms? Register and set up an account in just a few minutes, and you’ll gain entry to the form library and Startup S Corporation Foreign Shareholder. Then, follow the instructions below to complete your document: Ensure you have located the correct form using the Preview feature and reviewing the form details. Select Buy Now when ready, and choose the subscription plan that suits your requirements. Click Download, then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience assisting clients with their legal documents. Obtain the form you need today and simplify any process without breaking a sweat.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms offers you state- and county-specific forms accessible at any time for download.

- Protect your document management processes by employing a high-quality service that enables you to prepare any form within minutes without additional or hidden charges.

- Simply Log In to your account, find Startup S Corporation Foreign Shareholder, and obtain it immediately from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

No, non-residents cannot hold shares in an S corporation. This restriction is particularly important for startups with foreign shareholders, as they must understand the implications of ownership limits. However, there are alternative structures available for foreign investors looking to participate in a U.S. business. Platforms like uslegalforms can assist you in exploring the best options for your circumstances.

Certain individuals and entities cannot be shareholders in an S corporation. Typically, non-resident aliens, corporations, and partnerships are excluded from ownership. This rule can impact startup S corporation foreign shareholders, who need to adhere to these regulations strictly. Being aware of these restrictions helps ensure compliance and maintains the integrity of your business structure.

S corporations, including those with startup S corporation foreign shareholders, face distinct ownership limitations. For instance, you can have no more than 100 shareholders, and all shareholders must be U.S. citizens or residents. Additionally, entities like corporations or partnerships cannot hold shares in S corporations. Understanding these limitations is vital for future business planning and expansion.

Eligible shareholders of a Startup S corporation foreign shareholder include individuals who are US citizens or resident aliens, as well as certain estates and trusts. This definition explicitly excludes foreign individuals, partnerships, and corporations. Understanding who qualifies can simplify your S corporation formation process. For personalized help with eligibility requirements, U.S. Legal Forms is here to support you.

An S corporation cannot have foreign shareholders, as this would disqualify it from S corporation status. Only US citizens and resident aliens are eligible to be shareholders in a Startup S corporation foreign shareholder. This rule aims to ensure compliance with IRS regulations. If you have questions regarding eligibility, reach out to U.S. Legal Forms for assistance in navigating these complexities.

A foreign trust cannot be a shareholder in a Startup S corporation foreign shareholder. S corporations are designed to provide certain tax benefits specifically to US citizens and residents. Therefore, any trust that does not meet citizenship requirements cannot participate as an owner. For accurate guidance on structuring S corporations, consider exploring our services at U.S. Legal Forms.

No, shareholders do not have to be US citizens to own shares in a Startup S corporation foreign shareholder. However, at least one shareholder must be a US citizen or a resident alien. This structure allows for greater flexibility in ownership while ensuring some level of compliance with US tax laws. Understanding these requirements is crucial for foreign investors considering forming an S corporation.

No, a foreigner cannot be a shareholder in an S Corporation. This stipulation is part of the IRS's qualifications for S Corp status. To include foreign investment, consider alternative business structures such as a C Corporation. For more information and support, explore the resources at uslegalforms.

Shareholders who are non-resident aliens, certain trusts, and partnerships are excluded from owning shares in an S Corporation. Such restrictions uphold the specific tax advantages associated with S Corps. Therefore, it is crucial to evaluate your ownership structure carefully. For assistance, uslegalforms can provide insights tailored to your situation.

Yes, a foreigner can be a shareholder in a U.S. company, but the choice of business structure matters. While S Corporations restrict foreign ownership, C Corporations allow it without limitation. Thus, if you plan to include foreign shareholders, look into forming a C Corporation for flexibility. Utilize uslegalforms for expert advice on setting up your business.