S Corporation Agreement With Japan

Description

How to fill out Small Business Startup Package For S-Corporation?

Regardless of whether it is for commercial reasons or personal issues, everyone must confront legal matters at some stage in their lives.

Filling out legal paperwork demands meticulous focus, beginning with selecting the appropriate form template.

With an extensive catalog of US Legal Forms available, you don't have to waste time searching for the correct template online. Make use of the library's straightforward navigation to locate the suitable form for any occasion.

- Access the template you require by utilizing the search option or browsing the catalog.

- Review the description of the form to ensure it aligns with your situation, jurisdiction, and locality.

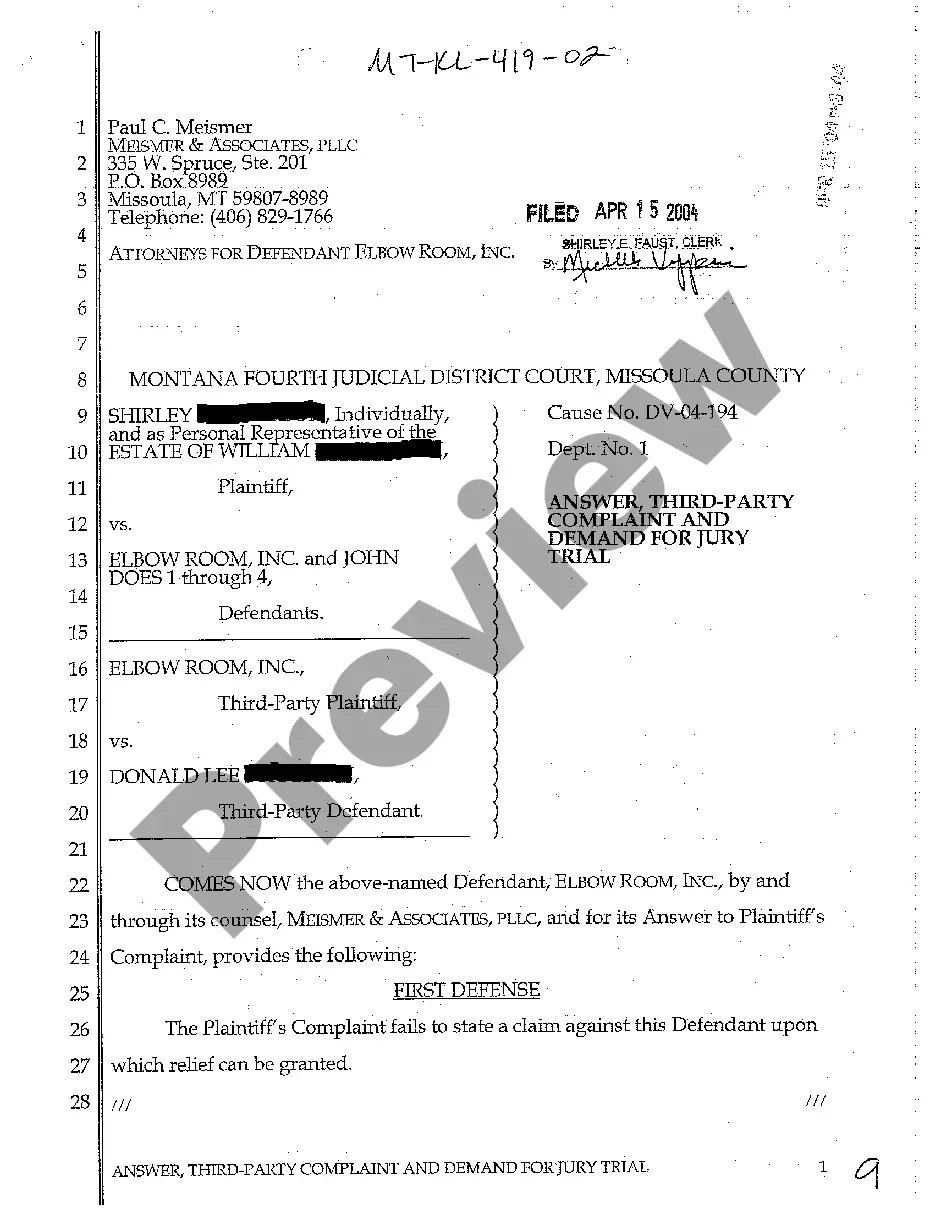

- Click on the preview of the form to examine it.

- If it is the wrong document, return to the search option to locate the S Corporation Agreement With Japan template you need.

- Obtain the file once it satisfies your requirements.

- If you possess a US Legal Forms account, click Log in to retrieve previously saved documents in My documents.

- If you do not have an account yet, you can download the document by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: either a credit card or PayPal account.

- Pick the file format you prefer and download the S Corporation Agreement With Japan.

- After it is downloaded, you can complete the form using editing software or print it out and fill it in by hand.

Form popularity

FAQ

A: Pennsylvania requires annual filings for all limited liability partnerships, domestic and foreign, as well as by restricted professional limited liability companies, domestic and foreign.

Forming an LLC in Pennsylvania involves various costs and fees. The filing fee for the Articles of Organization is $125. Legal fees range from $500 to $2,000. Additional expenses include licenses, operating costs, insurance, annual fees of $70, and state taxes.

You may update your address through myPATH by creating a profile as a new user or logging into your... How do I update the name & address for a tax account? You can update legal and doing-business-as names, physical and mailing addresses, and practitioner information for a specific tax account: Log in to myPATH .

Pennsylvania doesn't administratively dissolve LLCs. However, if you fail to file your decennial report, your LLC's name will no longer be reserved for your use. To reinstate your LLC's name, you can file your late decennial report.

Beginning in 2025, every Pennsylvania LLC will need to file an Annual Report each year to renew their LLC. Note: Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report).

The only fee to register an LLC in Pennsylvania is $125 at initial registration. Then, every 10 years your business will be required to submit a decennial report with a registration fee of $70. If you are not yet ready to file your LLC, Pennsylvania offers a name reservation option.

Pennsylvania corporations have to file an Articles of Amendment ? Domestic Corporation form with the Corporation Bureau of the Department of State. You will also have to attach 2 copies of the completed Docketing Statement ? Changes. You can file by mail or in person. You also need to pay $70 for the filing.

The Certificate of Organization PA is a document that contains important information about your company and filing this document is a requirement to form your LLC in Pennsylvania.