S Corporation Agreement With Canada

Description

How to fill out Small Business Startup Package For S-Corporation?

Acquiring legal documents that comply with national and local regulations is essential, and the web provides numerous options to select from.

However, why spend time searching for the right S Corporation Agreement With Canada template online when the US Legal Forms digital library has already compiled such documents in one location.

US Legal Forms is the premier online legal repository with over 85,000 customizable forms created by attorneys for all business and personal situations. They are straightforward to navigate with all forms categorized by state and intended use.

All documents available through US Legal Forms are reusable. To re-download and fill out forms you've previously acquired, access the My documents section in your account. Enjoy the most comprehensive and user-friendly legal documentation service!

- Our specialists stay informed about legal updates, ensuring that your form is current and compliant when you acquire a S Corporation Agreement With Canada from our platform.

- Acquiring a S Corporation Agreement With Canada is quick and easy for both existing and new users.

- If you have an account with an active subscription, Log In and download the document you need in your selected format.

- If you are new to our site, follow the steps below.

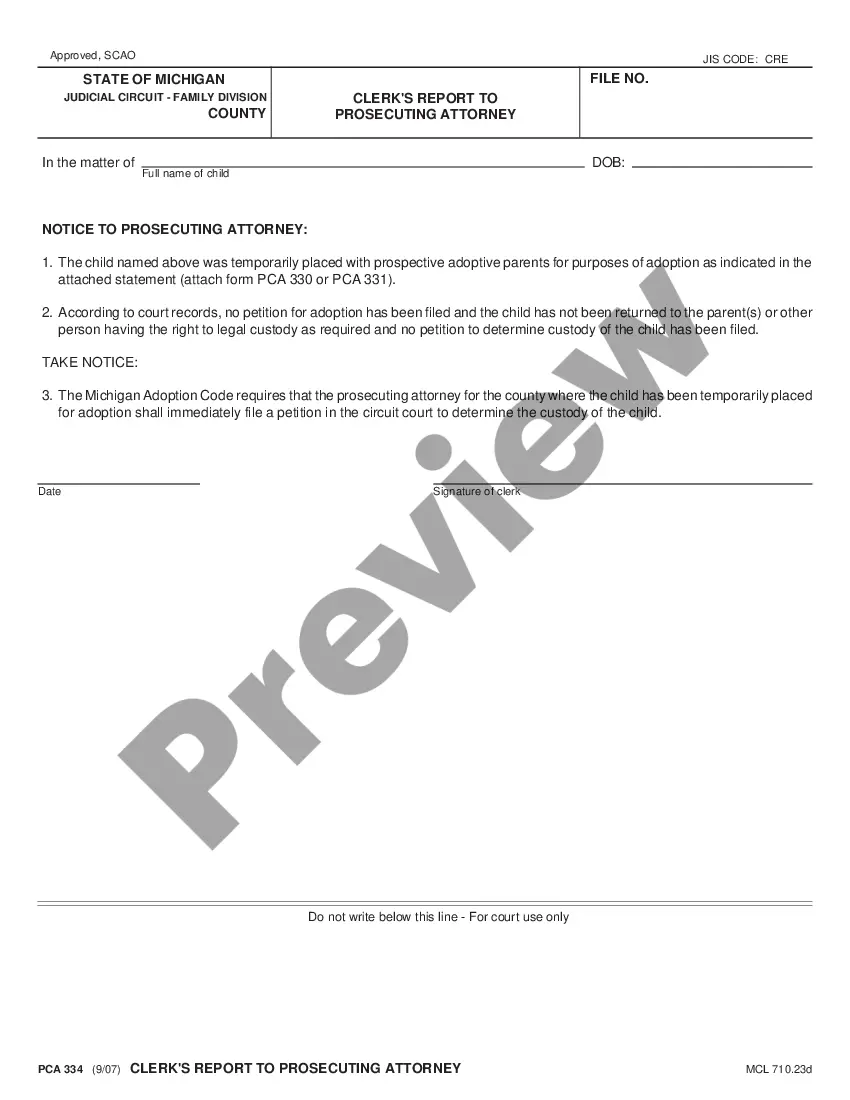

- Review the template using the Preview option or the text description to confirm it fits your requirements.

Form popularity

FAQ

Link: mypath.pa.gov.

MyPATH, which stands for 'my Pennsylvania Tax Hub', provides many self-service options such as registering a new tax account, accurately and securely filing returns, making payments, managing your accounts, and interacting with the department.

Adding an attachment in myPATH is easy. If the action you are performing allows for an attachment, you will see an Attachments section and an Add or Add Attachment button. Select Add Attachment. A new window will open allowing you to browse you computer for a file to attach.

Log in to myPATH. Select the Manage My Profile link from the top right of the page. Under the More... tab, select the Search Submissions hyperlink from the Submissions panel.

When responding to a notice on myPATH, can I send attachments electronically? Access the myPATH homepage. ... Select the Respond to a Letter option from the Additional Services panel. Enter your Letter ID. Select your ID type and enter your FEIN or SSN. Select Search. Select Submit Documentation.

MyPATH, which stands for 'my Pennsylvania Tax Hub', provides many self-service options such as registering a new tax account, accurately and securely filing returns, making payments, managing your accounts, and interacting with the department.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

PATH ID. Each taxpayer in the department's tax system is assigned a unique 10-digit PATH ID. You can register using your PATH ID instead of using an SSN or FEIN. Revenue ID. Each taxpayer in the department's legacy tax system was assigned a unique 11-digit ID referred to as the revenue ID or Business Partner (BP) ...