Business S Corporation Form For Sale

Description

How to fill out Small Business Startup Package For S-Corporation?

Securing a reliable source for accessing the latest and most suitable legal templates is a significant part of managing bureaucracy.

Selecting the correct legal documents requires precision and careful consideration, which is the reason it is crucial to obtain Business S Corporation Form For Sale samples solely from credible origins, such as US Legal Forms. An incorrect template could squander your time and prolong your current situation.

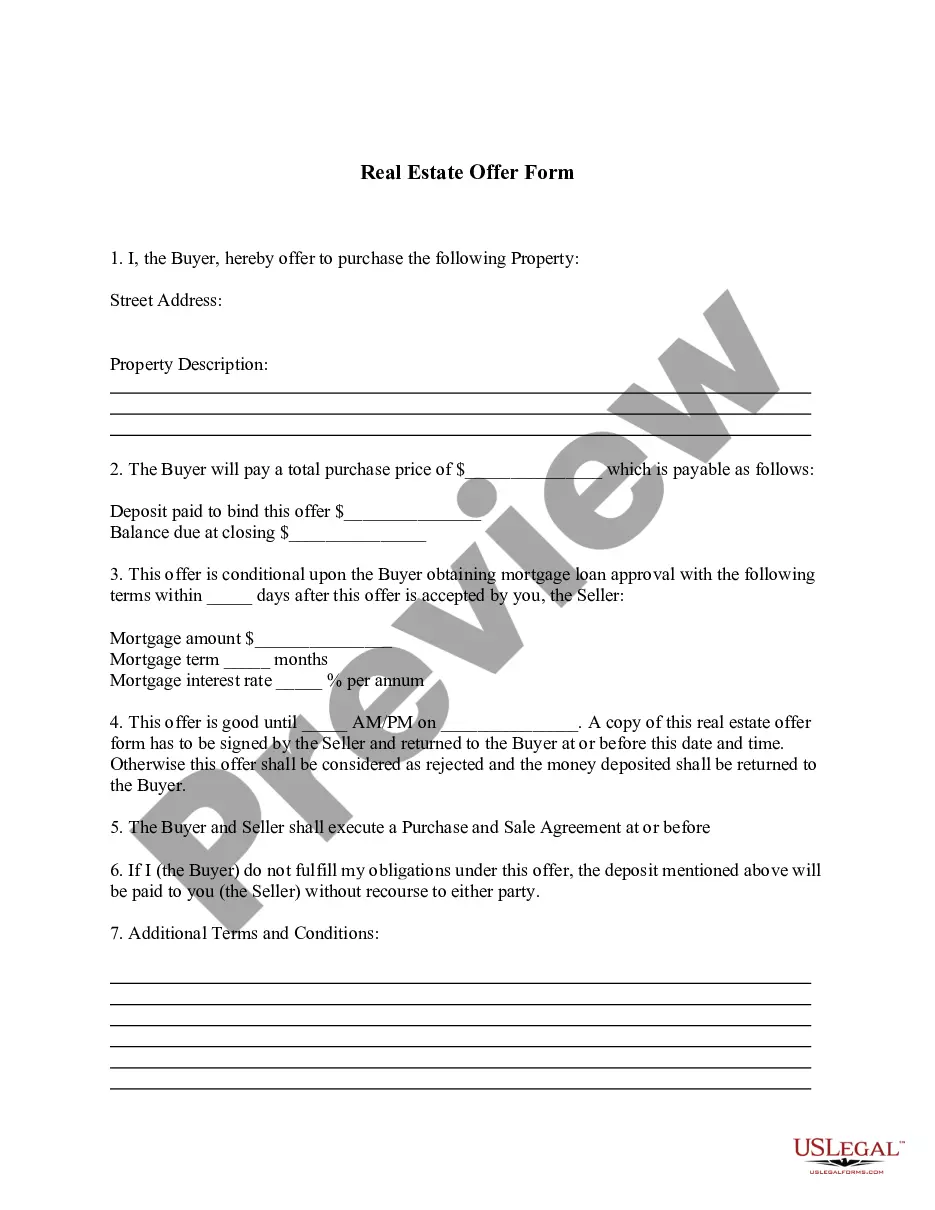

Once you have the form on your device, you can edit it with an editor or print it out and fill it in by hand. Eliminate the complications related to your legal documents. Explore the vast US Legal Forms repository where you can locate legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search option to find your template.

- Review the form’s details to verify if it aligns with your state and region's requirements.

- Access the form preview, if available, to confirm that the document is indeed the one you are seeking.

- If the Business S Corporation Form For Sale does not fulfill your needs, continue searching for the correct template.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you have not created an account yet, click Buy now to obtain the form.

- Select the pricing plan that meets your requirements.

- Proceed with registration to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Business S Corporation Form For Sale.

Form popularity

FAQ

You report the sale of business assets on your tax return by using form 4797 to capture the details of the sale. This includes information on the assets sold, the proceeds received, and any related deductions. Completing this step accurately ensures that all income and deductions are considered during tax preparation. For seamless compliance with the business S corporation form for sale, ensure all records are organized before filling out the necessary forms.

in gains tax applies to S corporations if certain assets are sold within five years of becoming an S corporation. For example, if an entity sells appreciated property owned before it elected S corporation status, the entity may face a builtin gains tax on that profit. This tax can affect how you handle your business S corporation form for sale, so understanding it is crucial for financial planning. Consulting with a professional can help you navigate these tax implications effectively.

Businesses can be incorporated as either a C Corporation or an S Corporation. In both, ownership percentage is based on the shares owned. If you want to transfer ownership, the process is the same for both. Shares can be sold, gifted or bequeathed.

corporation or Ccorporation With both types, a shareholder agreement has detailed guidelines for selling, gifting or bequeathing shares to new owners, making this process fairly easy.

Schedule D (Form 1120-S), Capital Gains and Losses and Built-in Gains. Corporations that elect to be S corporations use Schedule D (Form 1120-S) to report: Capital gains and losses. Sales or exchanges of capital assets.

Asset Sales: S Corporations As we mentioned above, S corporations are pass-through entities, which means that the company itself does not pay taxes on the sale of its assets. Rather, the income from the sale of its assets passes through to the shareholder, who is responsible for paying taxes.

To reduce the tax burden, it is usually preferable to sell an S Corp by selling stock instead of assets. However, people buying an S Corp may prefer an asset sale, as this type of sale can provide advantageous deductions for appreciation and may allow for a basis reset.