Personal Loan Document Form For Green Card Renewal

Description

How to fill out Personal Loan Agreement Document Package?

Creating legal documents from the ground up can frequently be somewhat daunting.

Specific situations may require extensive investigation and significant financial investment.

If you are seeking a more uncomplicated and cost-effective method for generating Personal Loan Document Form For Green Card Renewal or any other forms without unnecessary complications, US Legal Forms is readily accessible.

Our online collection of over 85,000 current legal documents covers nearly all aspects of your financial, legal, and personal matters. With just a handful of clicks, you can effortlessly obtain state- and county-specific forms meticulously assembled by our legal experts.

Ensure the form you select complies with the regulations and legislation of your state and county. Choose the most appropriate subscription plan to obtain the Personal Loan Document Form For Green Card Renewal. Download the file, fill it out, acknowledge, and print it. US Legal Forms holds a solid reputation and boasts over 25 years of experience. Join us today and simplify the document completion process!

- Utilize our service whenever you need a dependable option to easily locate and download the Personal Loan Document Form For Green Card Renewal.

- If you are a returning visitor and already have an account with us, just Log In to your account, choose the form, and download it, or retrieve it anytime from the My documents section.

- Don't possess an account? No issue. Establishing one requires minimal time and is easy to navigate.

- Before you proceed to download the Personal Loan Document Form For Green Card Renewal, consider these pointers.

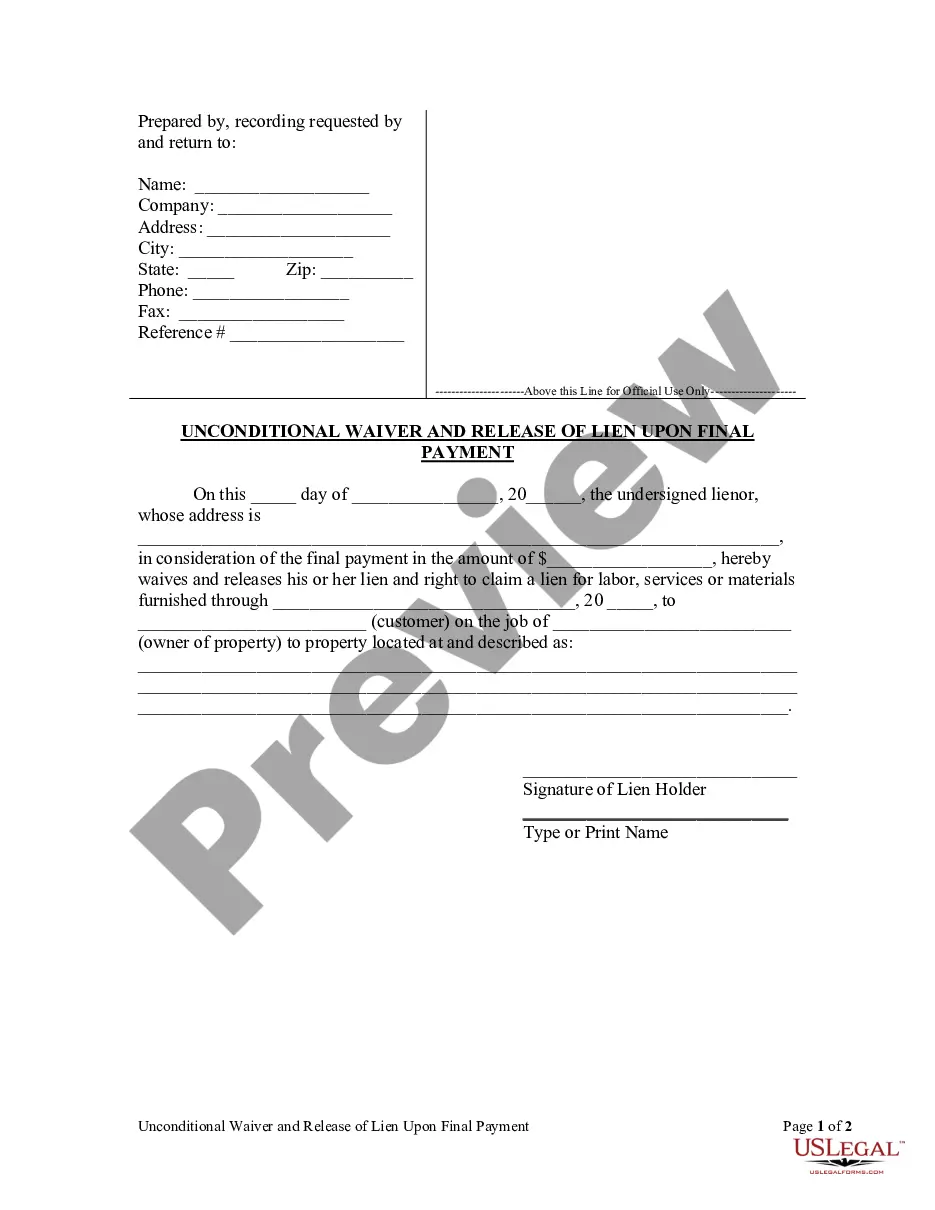

- Examine the document preview and descriptions to confirm you have the correct form.

Form popularity

FAQ

Century Codes: The year code can be found through (last 2 digit of year + (last 2 digit of year/4))/7.

The Century Code for dates in the 2000s is 6. 2000 is a leap year, since it can be divided by 400, and the date is in a January or February, so subtract 1 from the total in the final step. Answer: 0 + 0 + 1 + 6 - 1 = 6.

Calculate the Year Code Y Take the last two digits of the year, divide by 4, remove the remainder. For my birthday, 89 / 4 = 22. Add the number to the last two digits of the year, 22 + 89 = 111For dates in the 1700s, add 4. For dates in the 1800s, add 2.

The Common Statute Table (CST) is a list of offenses from North Dakota Century Code and provides a common charging reference for criminal justice agencies. The CST is updated in July of every odd numbered year to reflect legislative changes. Between legislative sessions, the CST is updated once per month, as needed.

The North Dakota Century Code ? also abbreviated as N.D.C.C. ? comprises the laws of North Dakota enacted by the North Dakota State Legislature. You may see or hear the North Dakota Century Code referred to as the North Dakota statutes, the Century Code, and the Code.

The Legislative Research Committee's Subcommittee on Judiciary and Code Revision chose the name of the new 14-volume codification to be North Dakota Century Code as a commemoration of the 100th anniversary of establishment of Dakota Territory in 1861. The 14 volumes appeared between the years 1959 and 1960.

There are no hard-and-fast rules as to the age at which a child is considered mature enough to testify as to a preference regarding residential responsibility. A court might find a ten year old in one case mature enough to express a preference, but find otherwise regarding a thirteen year old in another case.

Contact information for clerks of district court is available at ndcourts.gov/court-locations. File your completed name change documents with the Clerk of District Court in the North Dakota county where you have resided for at least 6 months before filing the Petition. Note: You'll be asked to pay an $80.00 filing fee.