Loan Document Form For Pag Ibig

Description

How to fill out Personal Loan Agreement Document Package?

Drafting legal documents from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more affordable way of creating Loan Document Form For Pag Ibig or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of over 85,000 up-to-date legal documents covers almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant templates carefully put together for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can quickly locate and download the Loan Document Form For Pag Ibig. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Loan Document Form For Pag Ibig, follow these tips:

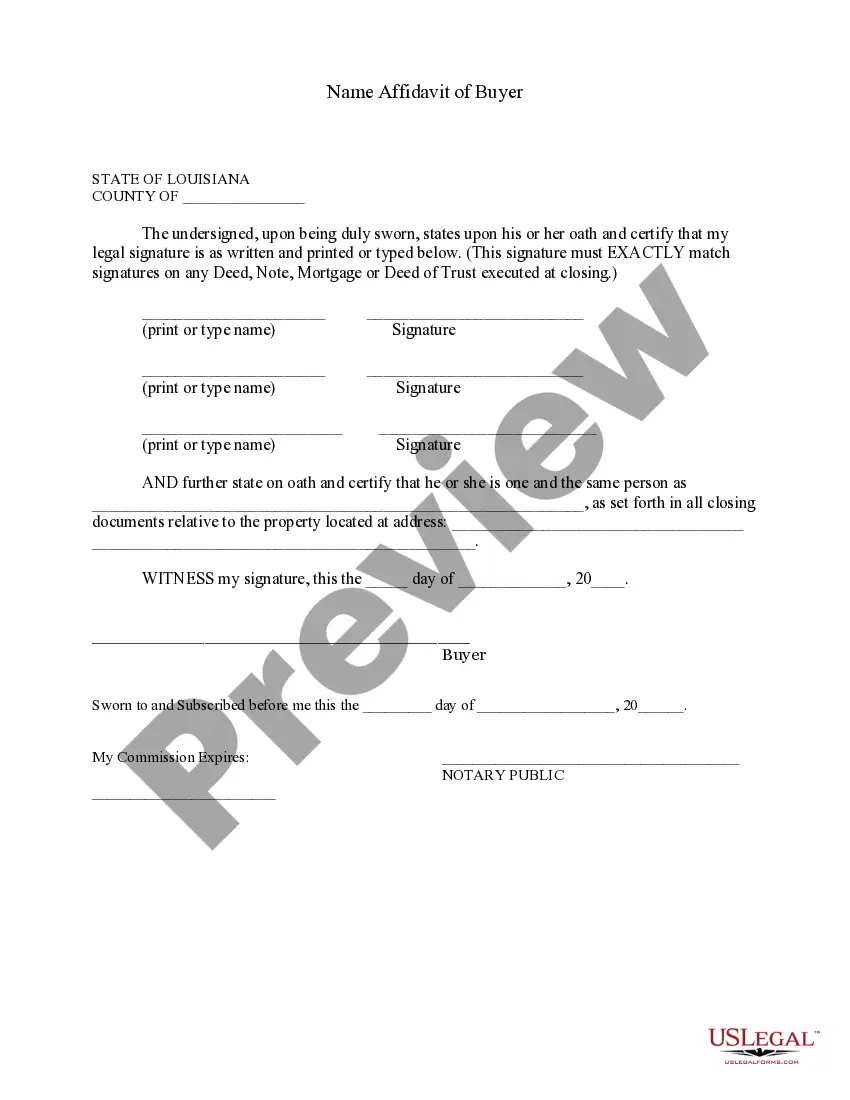

- Check the form preview and descriptions to ensure that you have found the document you are searching for.

- Check if form you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Loan Document Form For Pag Ibig.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us now and turn document completion into something simple and streamlined!

Form popularity

FAQ

After you submit your complete documents, the Pag-IBIG Housing Loan takes around 17 processing days. Wondering how many days it takes for the Pag-IBIG Housing Loan release? If they approve your housing loan, they will release the proceeds three days after you submit the required post-approval documents.

STEP 1. COMPLETE THE REQUIREMENTS TO APPLY FOR A Pag-IBIG HOUSING LOAN ? Housing Loan Application? Updated Tax Declaration and Tax Receipt? Vicinity Map of Property? Valid IDs? Additional Requirement by Loan Purpose? Certified True Copy of Title? Proof of Income

Loan Application Form Personal details and contact information. Employment status and history. Current income and outgoings (especially related to dependents, child support, alimony, etc.) Recent tax returns. Liabilities, debts, and existing loans.

If you don't have a Pag-IBIG membership yet, just follow these Pag-IBIG online application steps: Fill out the online form by entering your last name, first name, middle name (tick the box if there's no middle name), and date of birth (following the mm/dd/yy format). Input the CAPTCHA code and click the Submit button.

How to fill out pag ibig online: Go to the official website of Pag-IBIG Fund. Click on the "E-Services" tab. Select the option for "Membership Registration." Fill out the required information accurately, including personal details, contact information, and employment information.