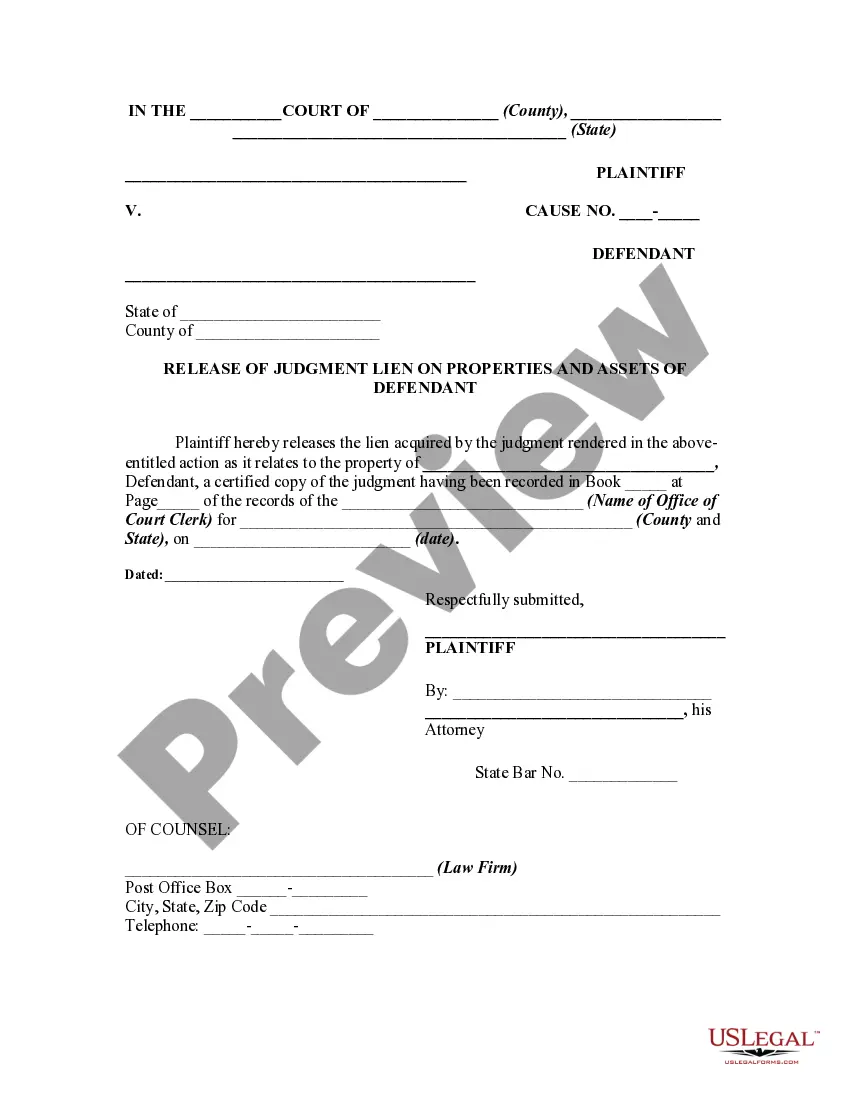

Release Judgment Lien Form Texas

Description

How to fill out Release Of Judgment Lien - Full Release?

Dealing with legal documents and processes could be an effort-demanding addition to your daily routine.

Release Judgment Lien Form Texas and similar forms usually necessitate you to locate them and understand how to fill them out accurately.

As a result, whether you are addressing financial, legal, or personal issues, utilizing a thorough and user-friendly online collection of forms at your disposal will be incredibly beneficial.

US Legal Forms is the top online service for legal templates, providing more than 85,000 state-specific documents and a variety of resources that will assist you in completing your paperwork promptly.

Simply Log In to your account, locate Release Judgment Lien Form Texas, and download it instantly in the My documents section. You can also access previously saved forms.

- Browse the collection of pertinent documents available with just one click.

- US Legal Forms offers you state- and county-specific documents ready for download at any time.

- Protect your document management processes with high-quality support that allows you to prepare any document in minutes without extra or concealed fees.

Form popularity

FAQ

To remove a judgment in Texas, you often need to file a motion with the court that issued the judgment. This may require legal representation to navigate the process correctly. Once the judgment is resolved, you can use the Release Judgment Lien Form Texas to ensure that the lien is properly released from your record.

To file a judgment lien in Texas, start by preparing a judgment lien form that reflects your court judgment. Complete the release judgment lien form Texas accurately and file it with the county clerk where the property is located. This action secures your interest in the property until the judgment is satisfied, protecting your financial rights.

The first step in lien release or removal is to contact the judgment creditor or its attorneys, inform them that the lien is invalid (see Part One below) or is currently showing against the homestead (see Parts Two and Three below) and then make formal demand that the creditor execute a partial release?or legal action ...

The property owner will need to have the judgment lien removed so the title can be cleared and the property sold. A knowledgeable California debt settlement attorney can have the lien taken off, possibly without payment to the creditor or debt collector.

The easiest way to get a satisfaction and release of judgment is to pay the entire amount of the original judgment. In some cases, you can offer a lump sum payment for less than the amount owed. Sometimes a creditor will accept this over a years-long payment plan.

To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

Call the clerk's office. Tell the clerk you want to schedule a hearing on a Motion to Set Aside Default Judgment. The clerk will give you a date and time for the hearing. Make sure the hearing date is far enough away.