Assignment Overriding Royalty Interest With Negative Capital Account

Description

How to fill out Assignment Overriding Royalty Interest With Negative Capital Account?

Individuals commonly link legal documentation with something intricate that solely an expert can manage.

In a certain sense, this is accurate, as composing Assignment Overriding Royalty Interest With Negative Capital Account necessitates considerable knowledge of subject criteria, encompassing state and local statutes.

Nonetheless, with the US Legal Forms, matters have become more straightforward: ready-to-use legal templates for any life and business event tailored to state laws are compiled in a single online directory and are now accessible to everyone.

Create an account or Log In to move to the payment page. Complete the payment for your subscription using PayPal or your credit card. Choose the format for your document and click Download. Print your file or upload it to an online editor for quicker completion. All templates in our catalog are reusable: once purchased, they remain saved in your profile. You can access them whenever necessary via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers more than 85,000 current forms organized by state and application area, making the search for Assignment Overriding Royalty Interest With Negative Capital Account or any other specific template a matter of minutes.

- Previously registered users with a valid subscription must Log In to their account and click Download to acquire the form.

- New users of the service will first need to register for an account and subscribe before they can download any paperwork documentation.

- Here is a step-by-step guide on how to obtain the Assignment Overriding Royalty Interest With Negative Capital Account.

- Review the page content thoroughly to ensure it meets your requirements.

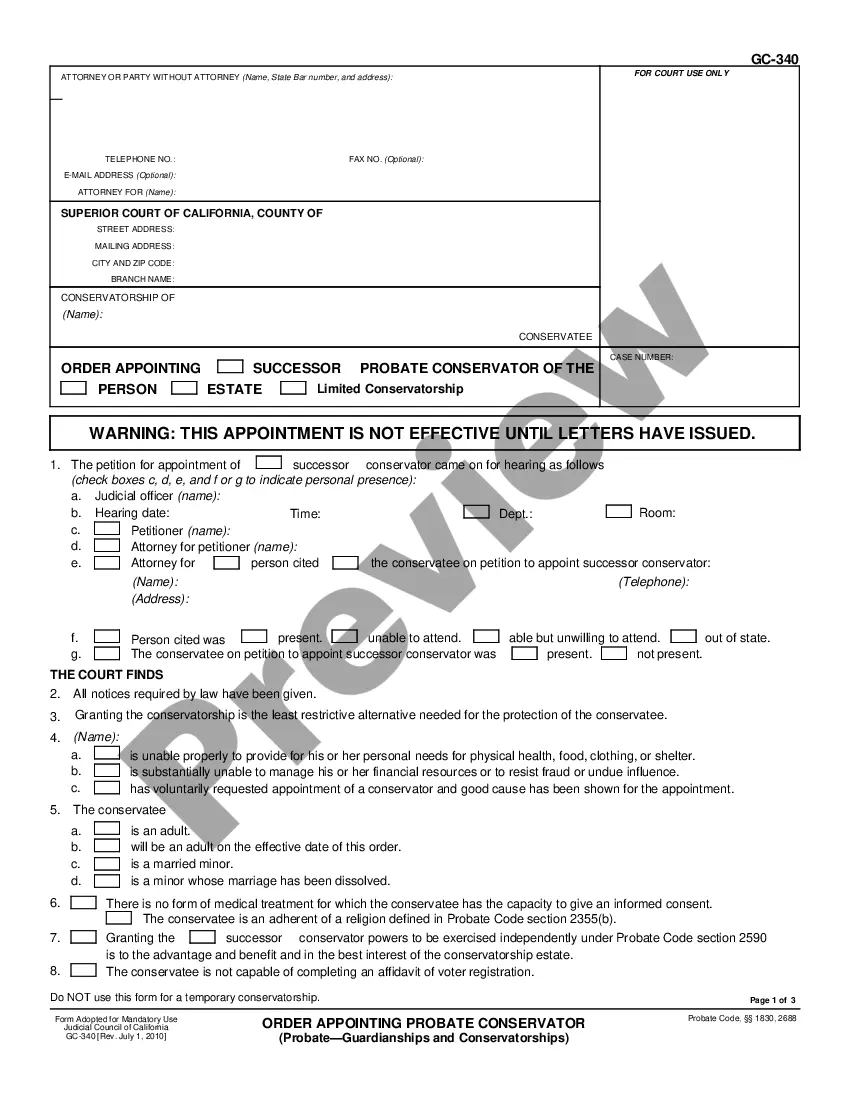

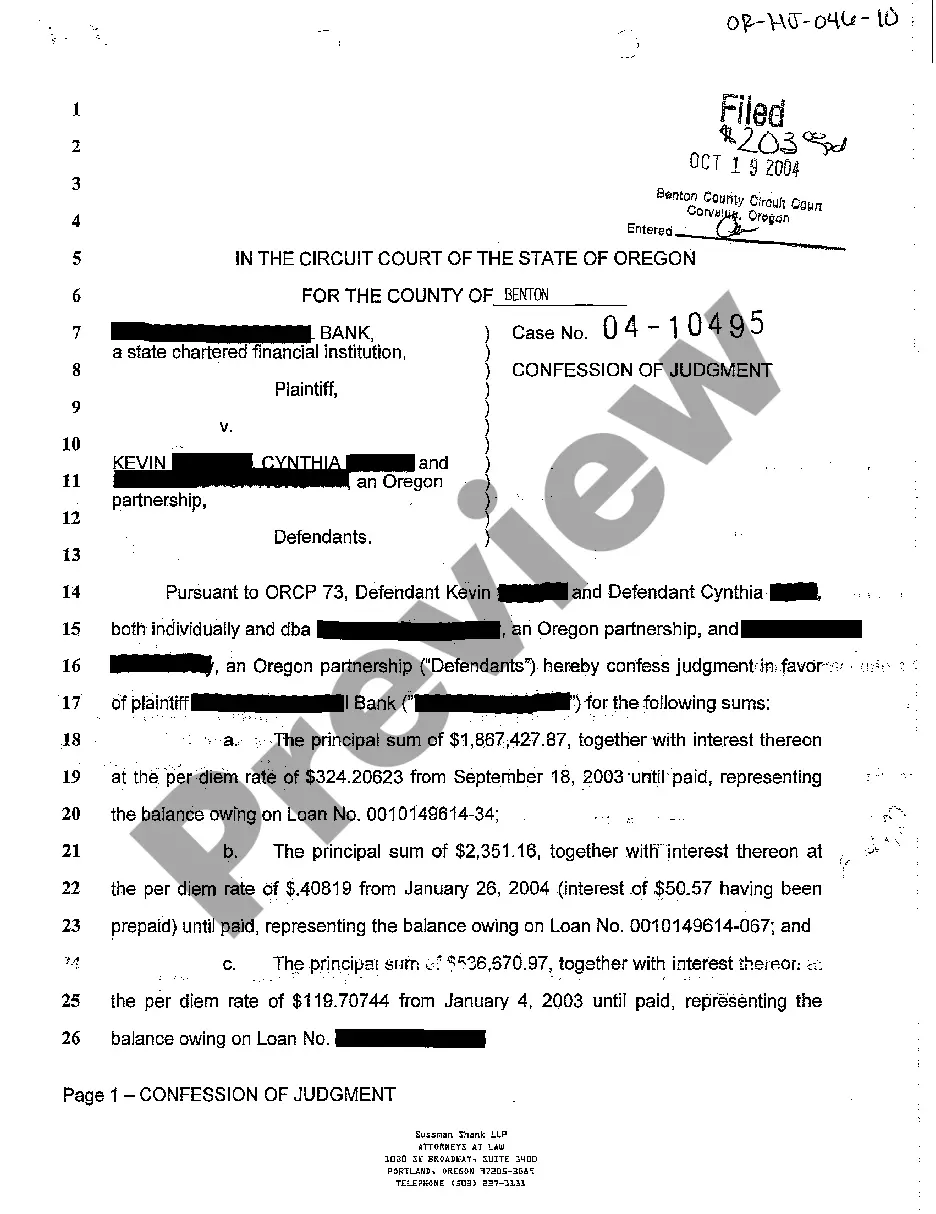

- Read the form description or confirm it through the Preview option.

- If the previous form doesn't fit your needs, search for another sample using the Search field in the header.

- Once you locate the appropriate Assignment Overriding Royalty Interest With Negative Capital Account, click Buy Now.

- Choose the pricing plan that aligns with your needs and budget.

Form popularity

FAQ

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests.100 25 = 75 percent (NRI)$1,000,000 $250,000 = $750,000 (monthly NRI)More items...?

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.