Marital Status Married With One Child

Description

How to fill out Affidavit Of Marital Status Of Married Person?

Legal administration can be exasperating, even for experienced experts.

When you are looking for a Marital Status Married With One Child and lack the time to spend searching for the appropriate and current version, the procedures can be challenging.

With US Legal Forms, you can.

Access a repository of articles, tutorials, handbooks, and resources highly pertinent to your circumstances and requirements.

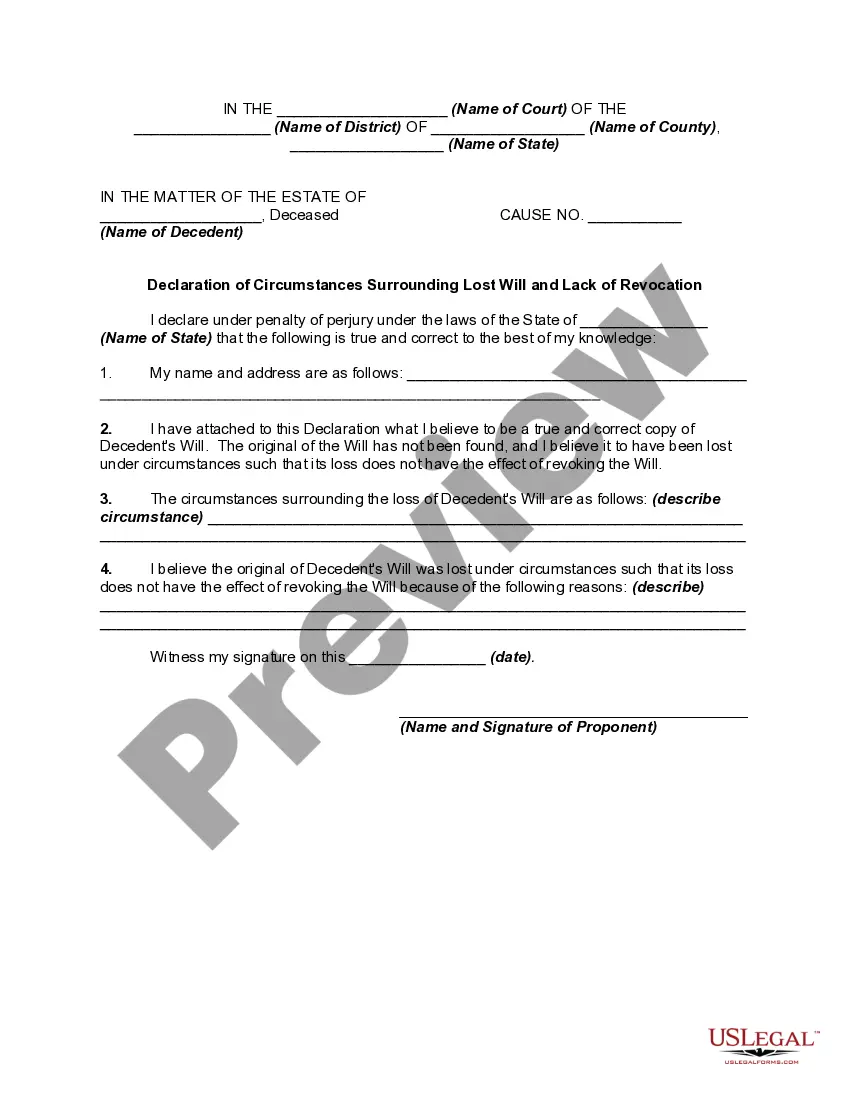

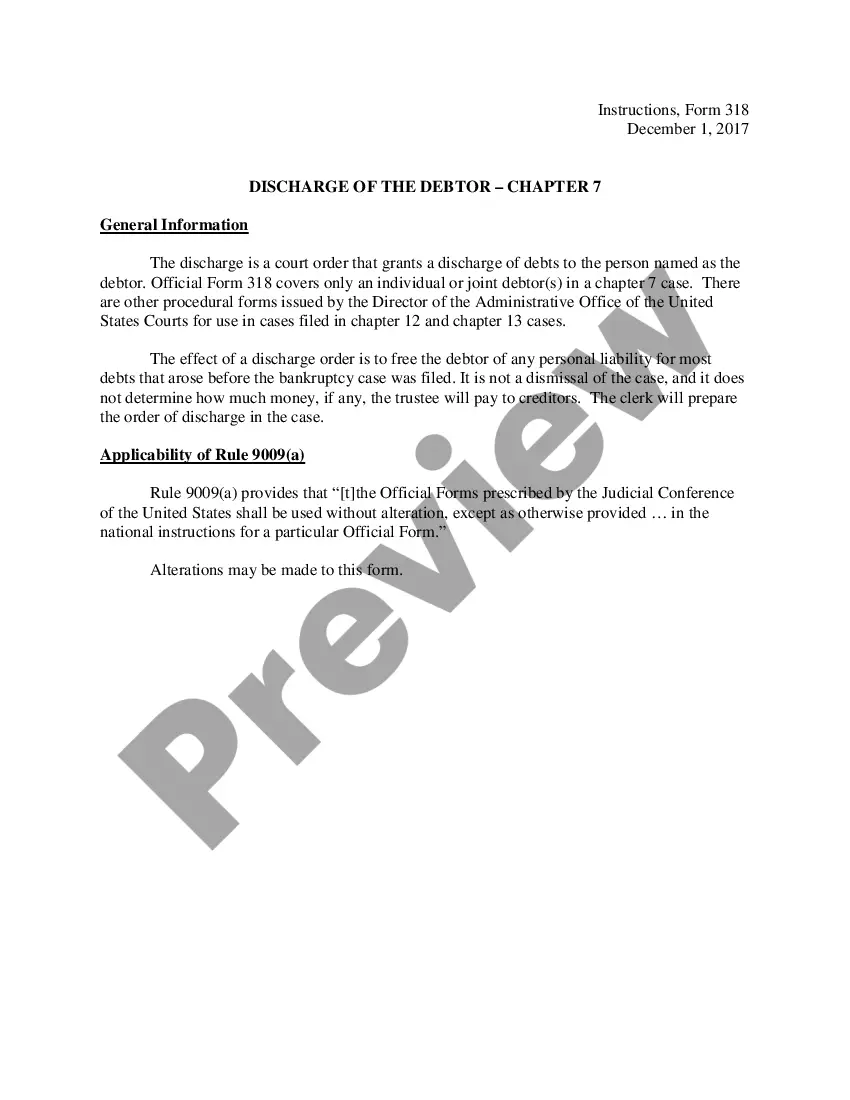

Verify this is the correct form by previewing it and reviewing its description.

- Save time and effort searching for the documents you require, and use US Legal Forms’ enhanced search and Review feature to find Marital Status Married With One Child and secure it.

- If you hold a membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check out My documents tab to view the documents you have previously saved and to manage your folders as needed.

- If it’s your initial experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the platform.

- Here are the steps to follow after obtaining the necessary form.

- A comprehensive web form repository could be a transformative solution for anyone looking to handle these situations efficiently.

- US Legal Forms is a frontrunner in online legal documents, boasting over 85,000 state-specific legal forms available around the clock.

- Utilize cutting-edge tools to manage and control your Marital Status Married With One Child.

Form popularity

FAQ

A qualifying surviving spouse is a person who meets specific criteria under tax law, particularly in relation to their marital status. Generally, this status applies to individuals who were married and have at least one dependent child. To qualify, you must have been married for the whole year when your spouse passed away, and you must provide a home for your child. Ultimately, understanding your status as a married individual with one child can help optimize your tax benefits and financial planning.

Whether you should claim 1 or 0 when married often correlates with your specific situation, particularly if your marital status is married with one child. Claiming 0 usually results in higher withholdings, which can lead to a larger tax refund. On the other hand, claiming 1 allows for more available income each month. It's essential to evaluate your financial needs through careful planning, and uslegalforms can provide effective resources to aid in this decision.

If your marital status is married with one child, usually, you can claim two withholdings: one for yourself and one for your child. This approach helps reduce the amount of taxes withheld from your paychecks. However, individual circumstances can vary significantly, so it is wise to consider your overall financial situation. Tools at uslegalforms may assist you in calculating the optimal number of withholdings for your needs.

Federal withholding is often lower for individuals with a marital status married with one child compared to those who are single. This is because the tax brackets and credits available can favor married couples. However, proper planning is crucial to ensure that you do not under-withhold and face a tax bill later. Utilizing resources like uslegalforms can help clarify your options.

When determining your withholding percentage, consider your marital status married with one child. Typically, you may choose a lower percentage if you want to receive a larger paycheck throughout the year. However, it is essential to calculate your expected tax liability accurately. You can use the IRS withholding calculator for guidance tailored to your specific situation.

Determining whether to file jointly or separately involves analyzing various factors including income, deductions, and available credits. If you have a marital status married with one child, filing jointly usually maximizes tax benefits. However, if separate filing reduces your tax liability, consider that option. Tools from platforms like USLegalForms can guide you further in making this decision.

If your marital status is married with one child, determining your withholding can streamline your tax filing process. Generally, aiming for 1 or 2 allowances on your W-4 form is advisable, depending on your financial circumstances. Review your expected earnings and deductions to make informed choices about your withholdings.

For those with a marital status married with children, filing jointly is often the most beneficial method. This status provides access to more credits and typically results in a lower tax rate. Nevertheless, each situation is unique, so assess your options to find the best filing strategy.

The refund you receive as a married couple with a child can vary significantly based on your combined income and tax credits. Generally, families may receive more through various deductions and credits like the Child Tax Credit. For an accurate estimate, consider using tax calculators or consulting a tax professional.

If your marital status is married with one child, it's often advisable to claim one allowance for yourself and one for your child, totalling two. However, if you want to have more taxes withheld for a larger refund, you might consider claiming zero. Evaluate your financial goals to determine the best choice for you.