Transfer On Death For Bank Accounts

Description

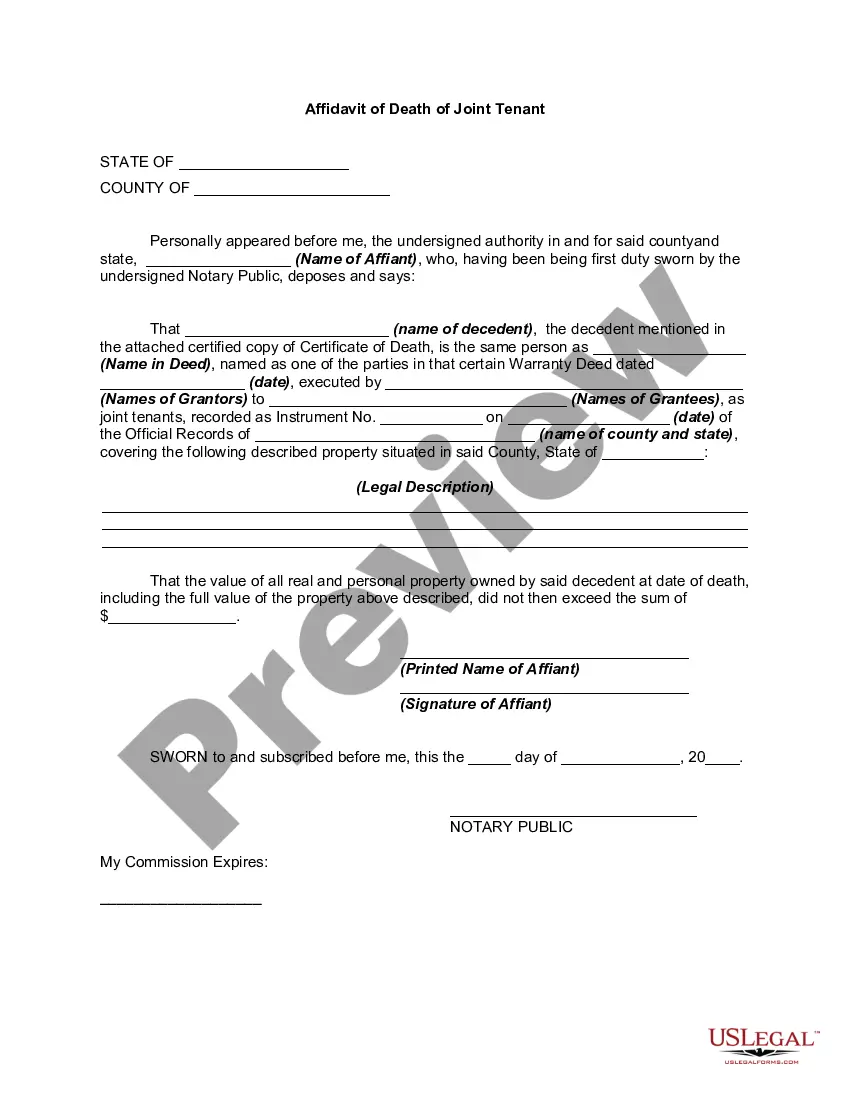

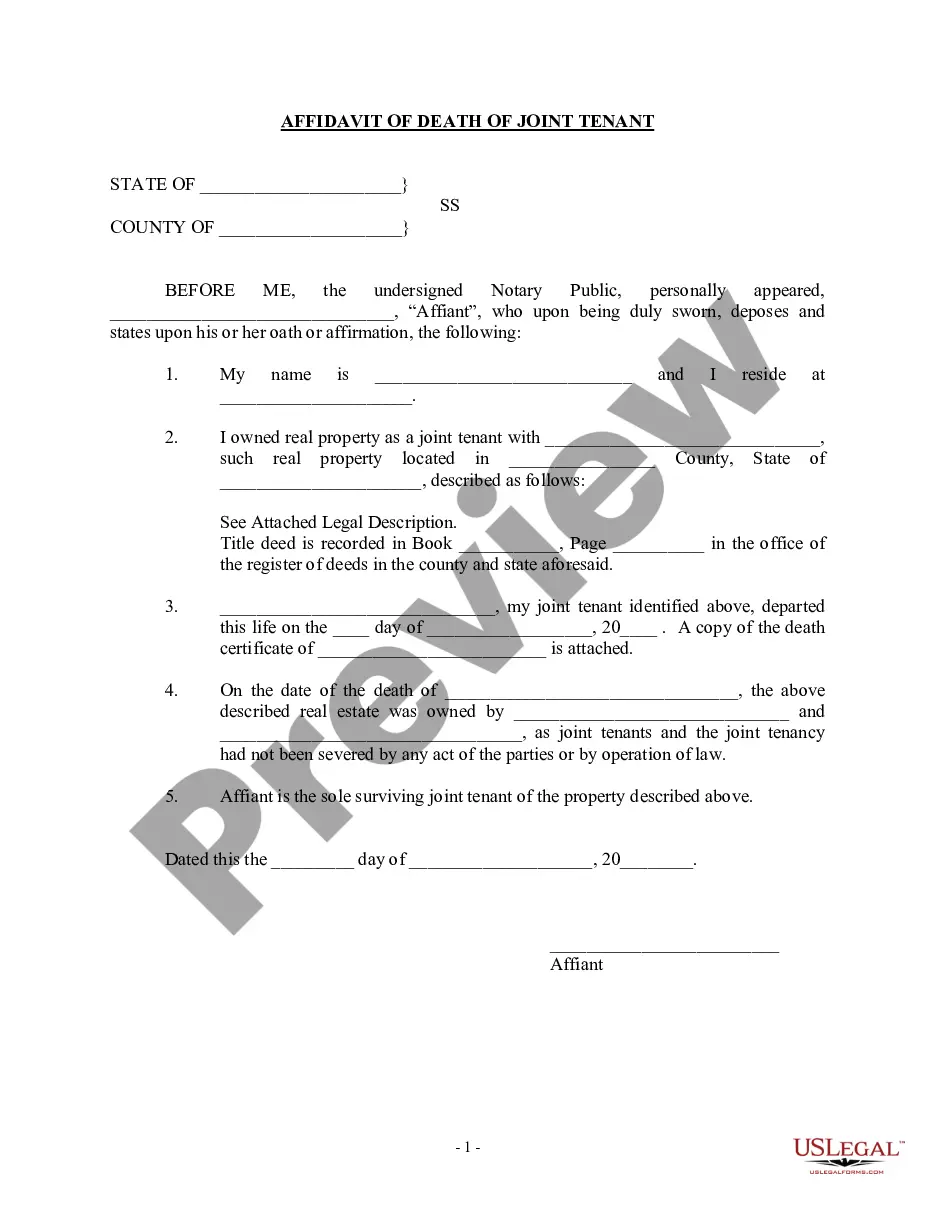

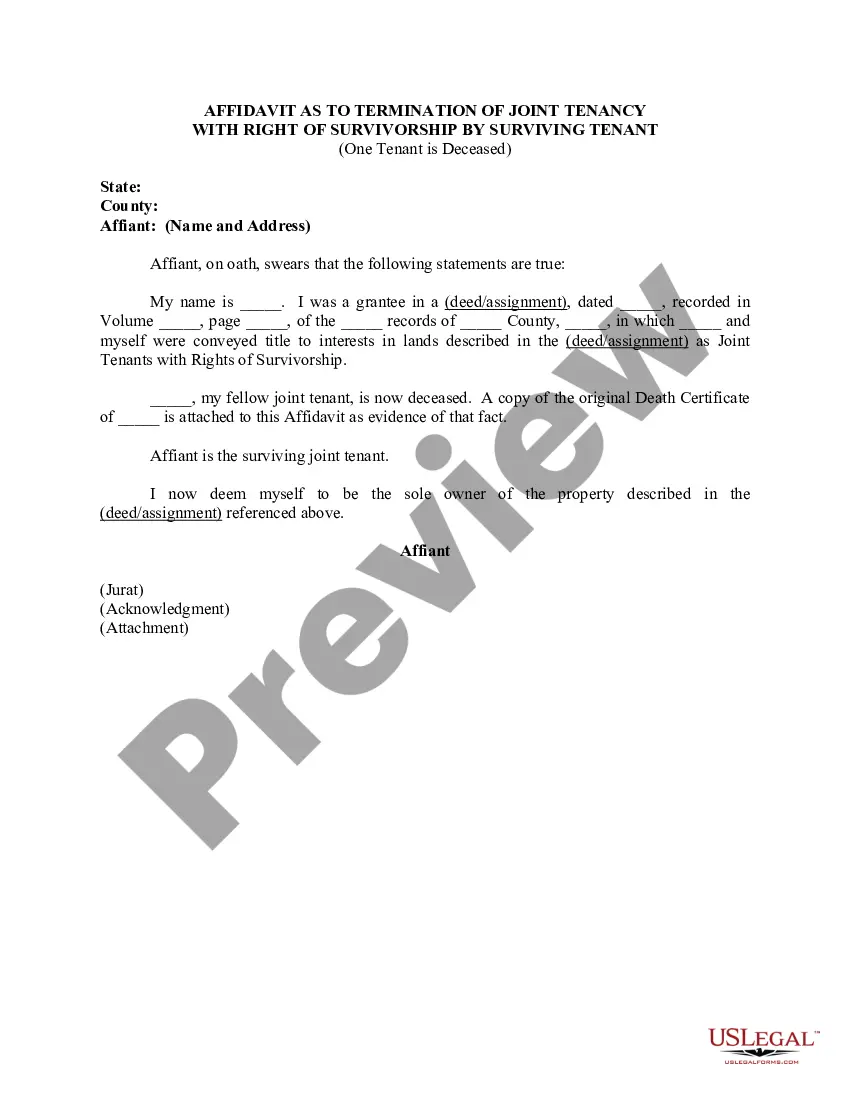

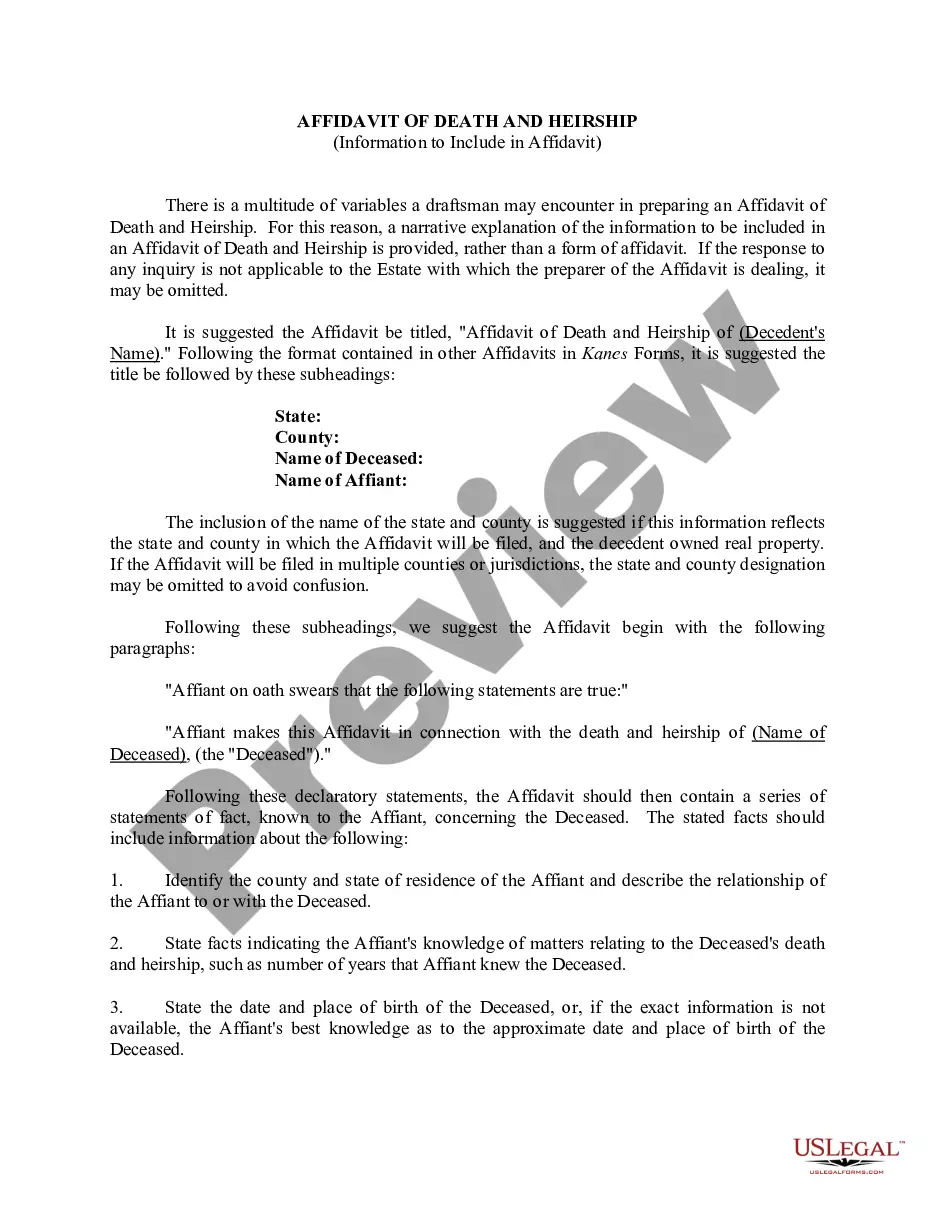

How to fill out Affidavit For Transferring Property After Death In Joint Tenancy With Right Of Survivorship By Surviving Tenant When One Tenant Is Deceased?

It’s well-known that you cannot transform into a legal expert instantly, nor can you swiftly learn how to prepare Transfer On Death For Bank Accounts without possessing a specific set of abilities.

Drafting legal documents is a lengthy task that demands specialized education and expertise. So why not entrust the creation of the Transfer On Death For Bank Accounts to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can discover anything ranging from court documents to templates for corporate internal communication.

If you require any additional form, restart your search.

Sign up for a complimentary account and select a subscription plan to purchase the template.

- We recognize how crucial adherence to federal and local regulations is.

- That’s why, on our site, all forms are specifically tailored to locations and regularly updated.

- Begin by visiting our website to acquire the form you require in just a few minutes.

- Locate the document you need using the search bar positioned at the top of the page.

- View it (if this option is available) and examine the accompanying description to determine if Transfer On Death For Bank Accounts meets your requirements.

Form popularity

FAQ

Many banks allow their customers to name a beneficiary, which is sometimes called a payable on death (POD) or transferable on death (TOD) account. If the account holder established someone as a beneficiary, the bank releases the funds to the named person once it learns of the account holder's death.

Setting up a payable-on-death account could make sense if you want to make sure your beneficiaries have a source of ready cash when you pass away. But you may still need a living trust if you have other assets you want to transfer, such as real estate, vehicles, investments or business assets.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

A court must grant you the power to withdraw money from the account if you're neither a joint owner or an account beneficiary. For example, an executor must produce proof of executor status and a certified copy of the death certificate to collect funds and place them in an estate account.

Go to your bank and tell them that you want to make your bank account payable on death. Your bank will ask you to name a beneficiary or beneficiaries (the person or people you want the money to go to) and to sign your name to confirm that this is what you want to do.