Estate Property Transfer Without Probate

Description

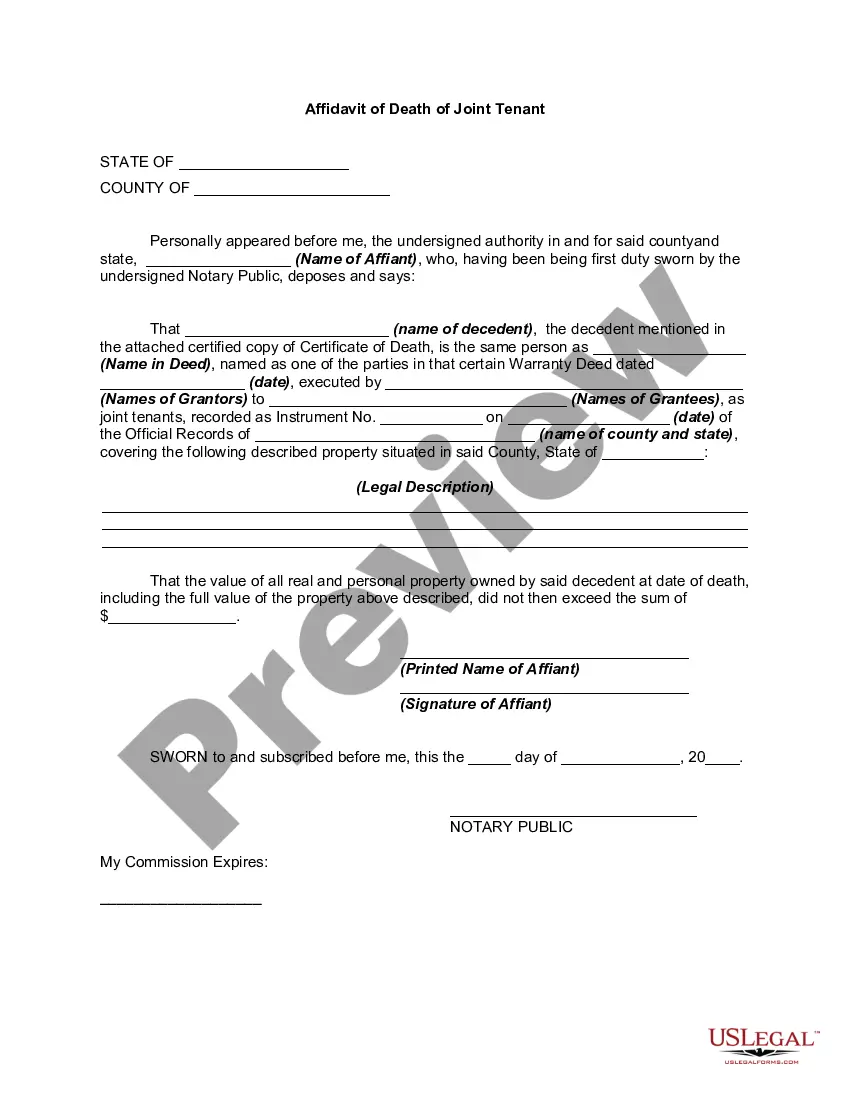

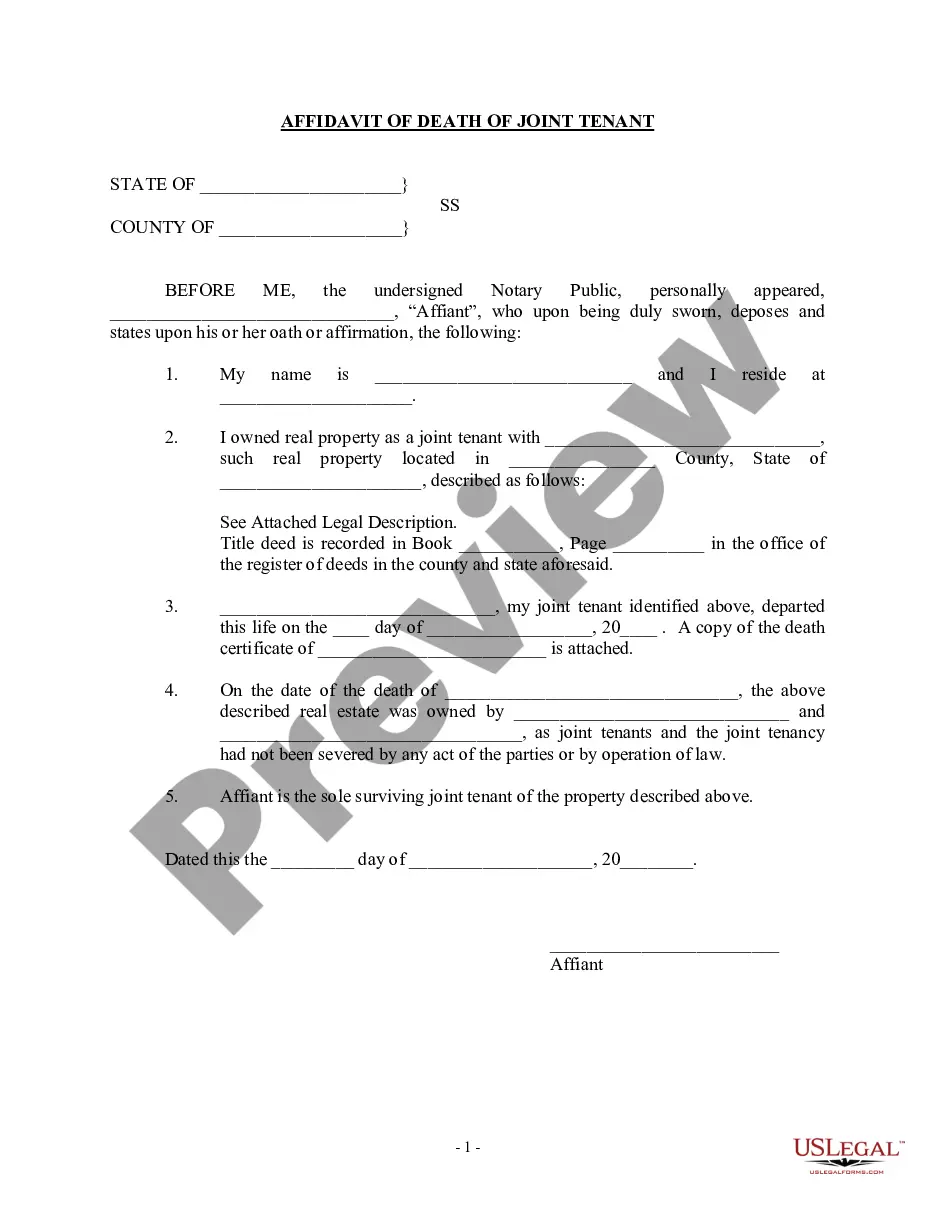

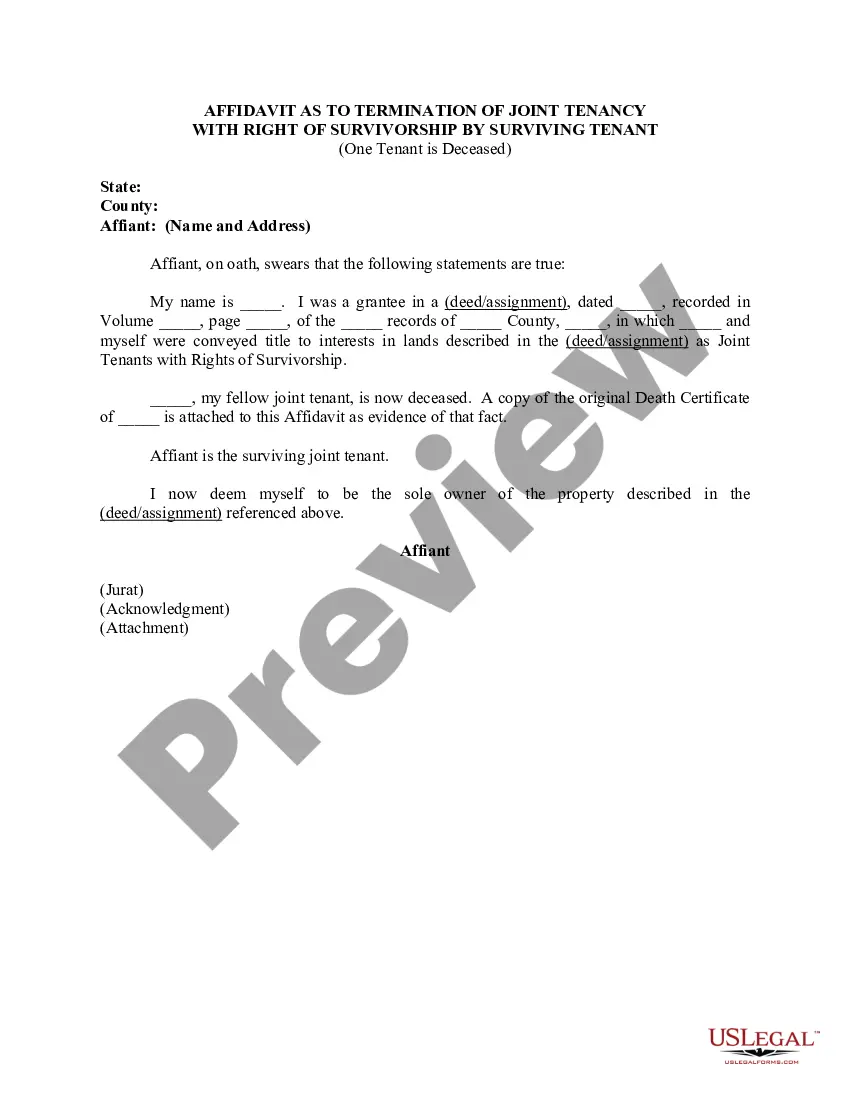

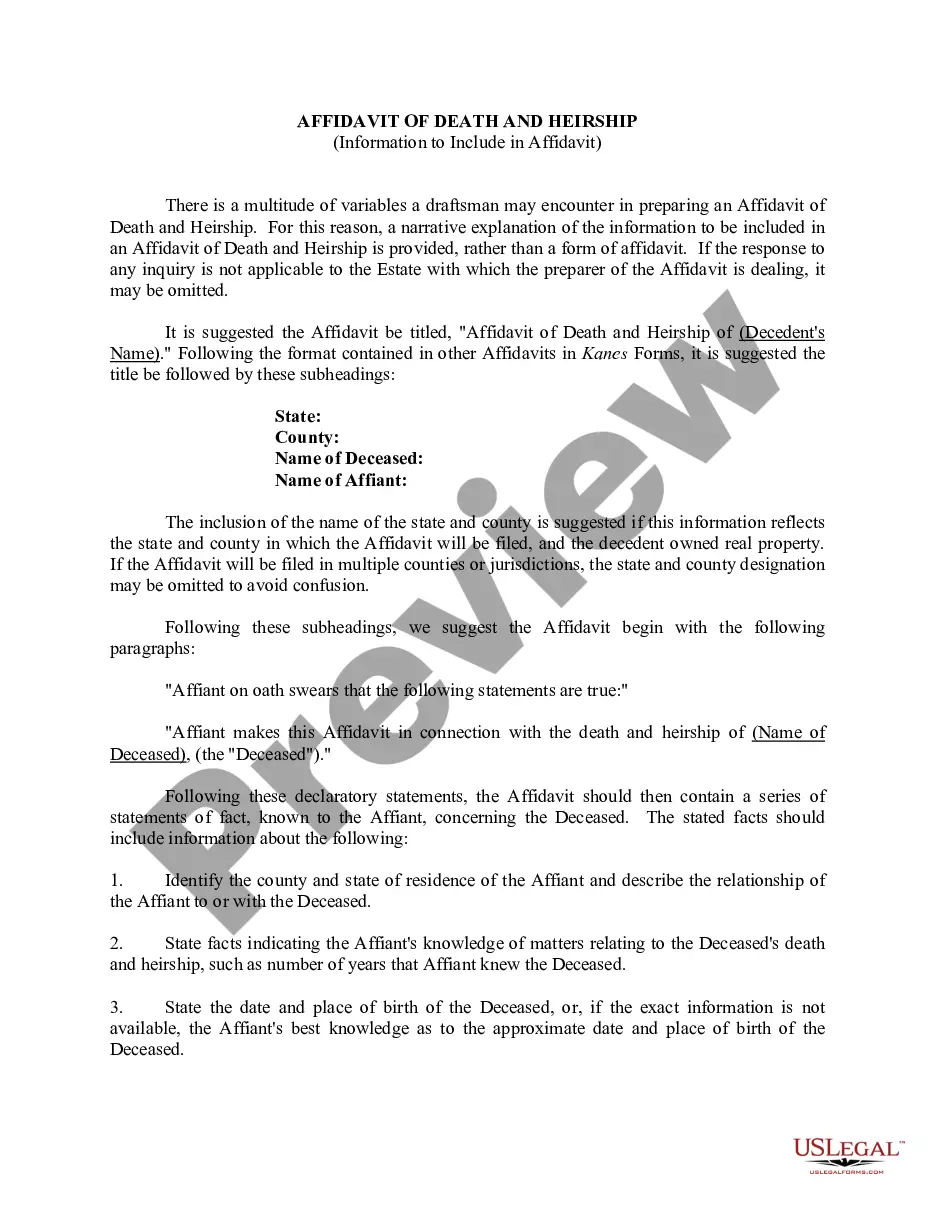

How to fill out Affidavit For Transferring Property After Death In Joint Tenancy With Right Of Survivorship By Surviving Tenant When One Tenant Is Deceased?

Working with legal papers and operations might be a time-consuming addition to your day. Estate Property Transfer Without Probate and forms like it typically need you to search for them and understand the best way to complete them correctly. Consequently, whether you are taking care of financial, legal, or individual matters, having a comprehensive and convenient web catalogue of forms at your fingertips will help a lot.

US Legal Forms is the number one web platform of legal templates, boasting more than 85,000 state-specific forms and a variety of resources to assist you complete your papers quickly. Discover the catalogue of relevant papers available to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Safeguard your papers managing processes with a top-notch services that lets you prepare any form in minutes without any extra or hidden charges. Just log in to your profile, identify Estate Property Transfer Without Probate and acquire it straight away from the My Forms tab. You may also access formerly saved forms.

Is it your first time utilizing US Legal Forms? Register and set up up your account in a few minutes and you’ll get access to the form catalogue and Estate Property Transfer Without Probate. Then, follow the steps below to complete your form:

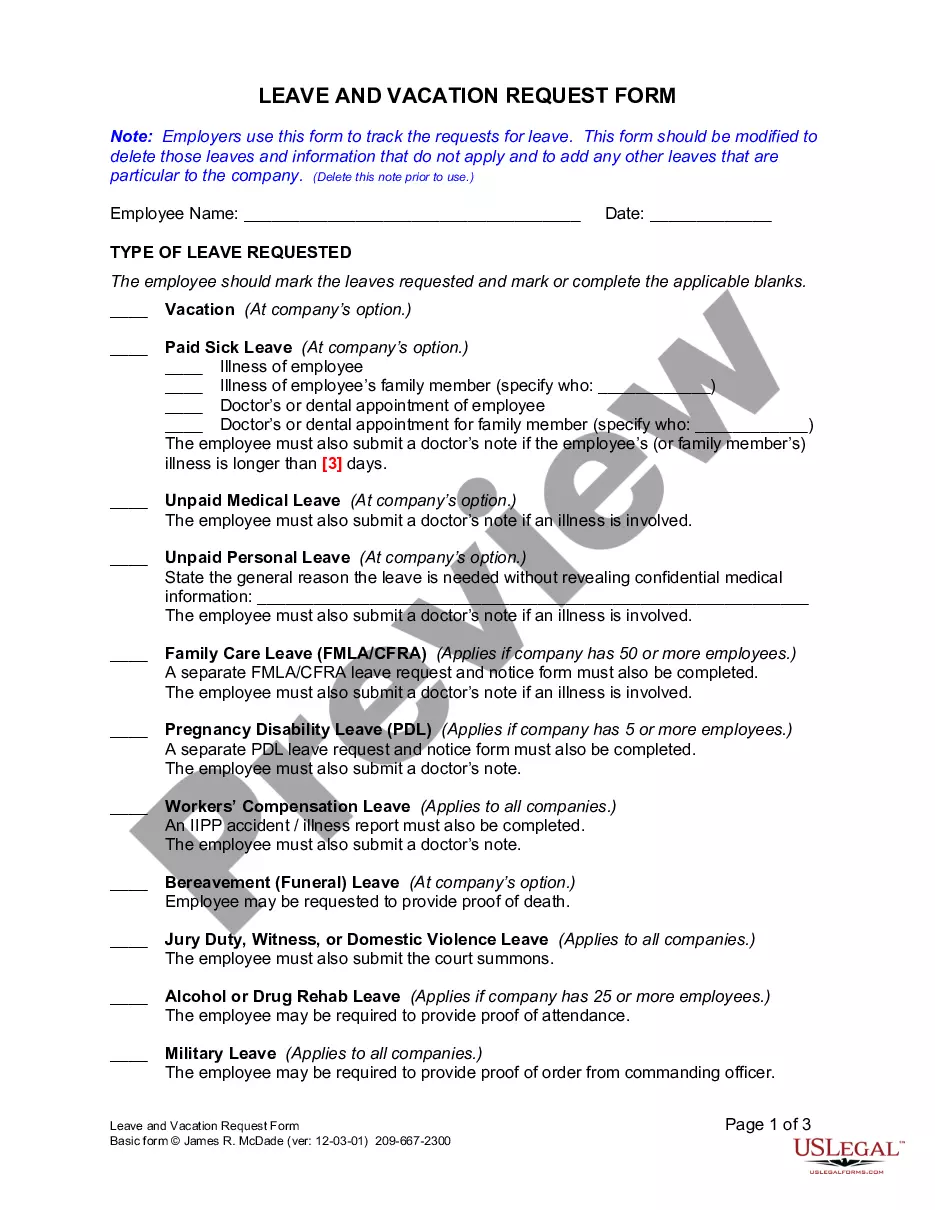

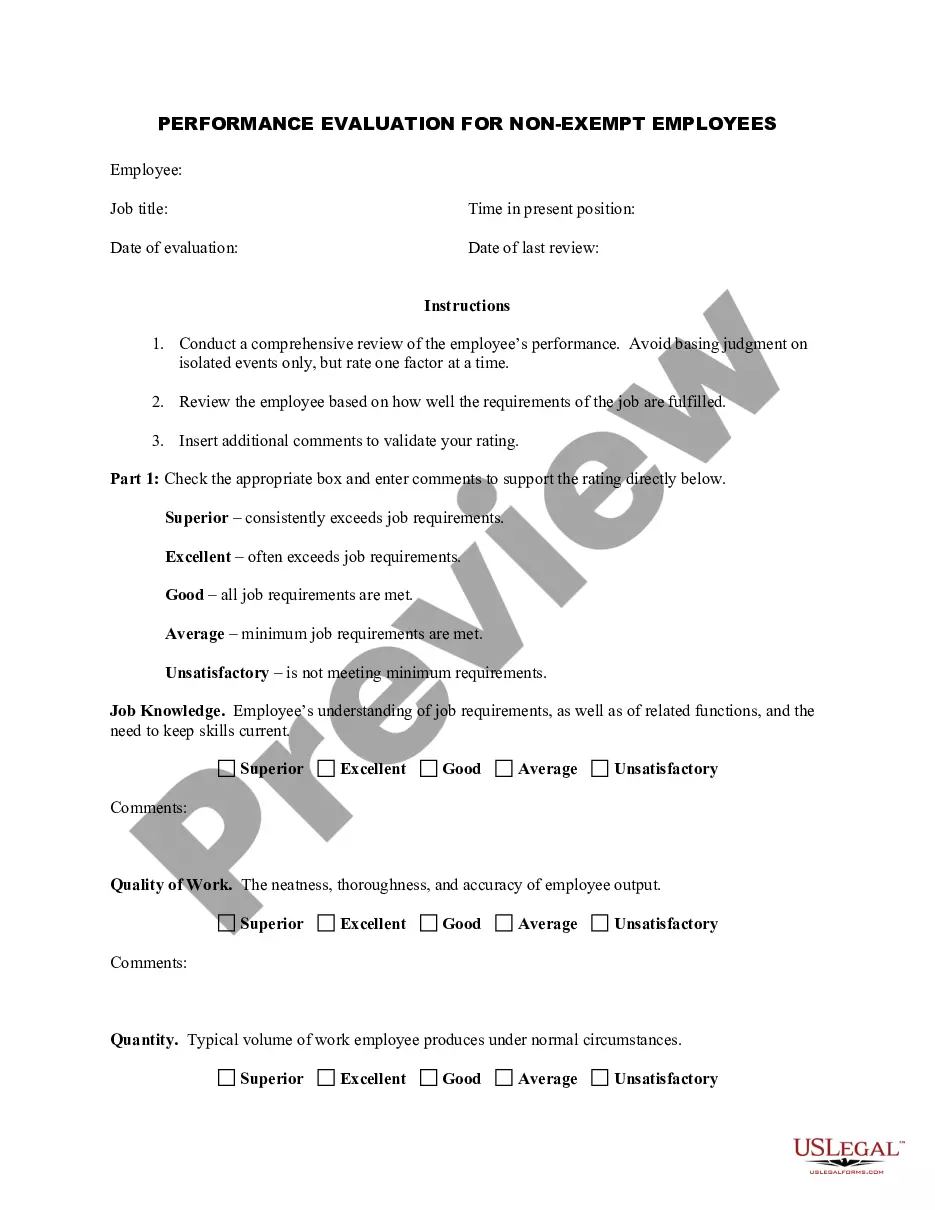

- Make sure you have discovered the correct form using the Preview feature and looking at the form description.

- Pick Buy Now as soon as ready, and choose the monthly subscription plan that suits you.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of expertise assisting users manage their legal papers. Discover the form you need right now and streamline any process without having to break a sweat.

Form popularity

FAQ

The living trust is the most well-known way to avoid probate.

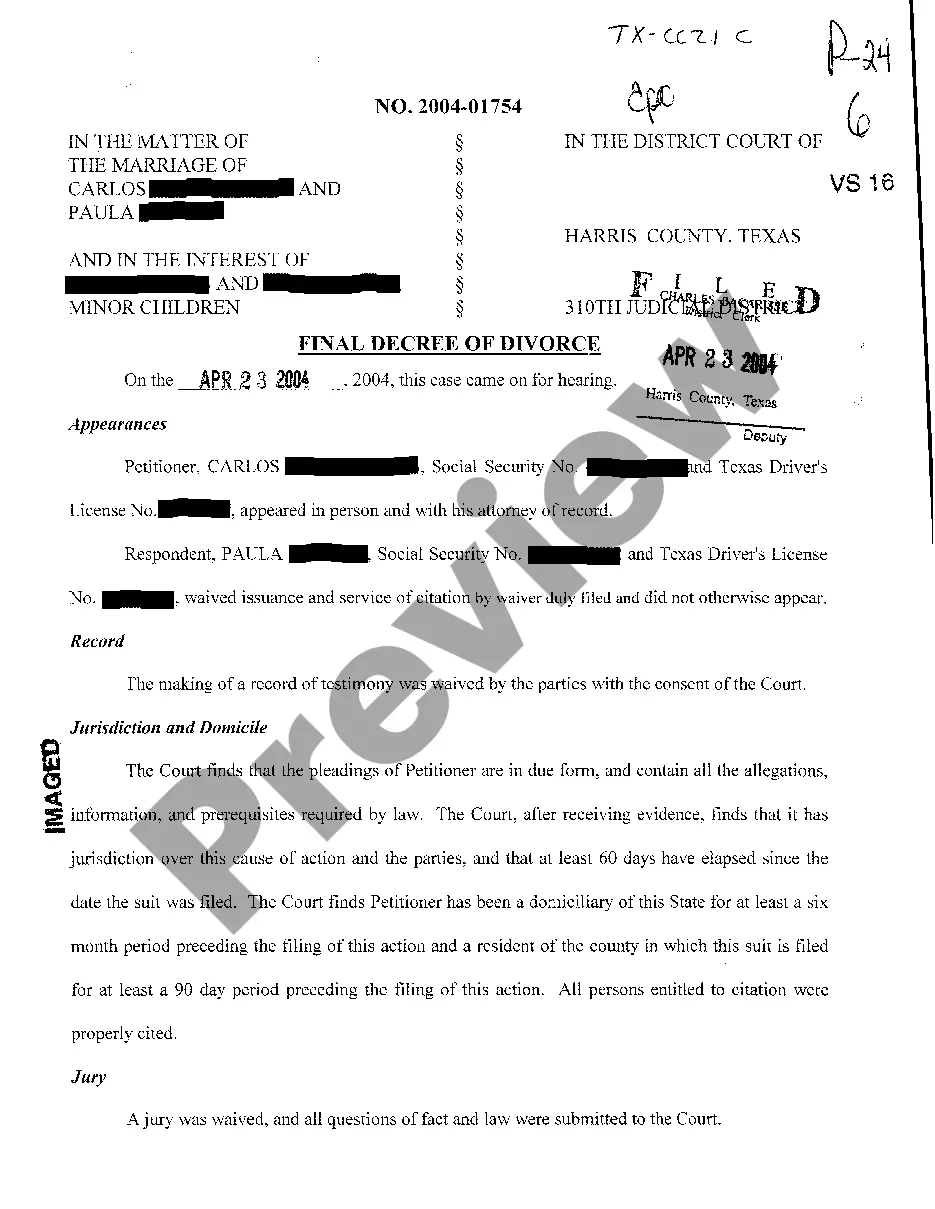

A transfer on death deed (TODD) is a legal document that allows a person to transfer ownership of their property after they die. By using a TODD, a person can transfer the property directly without going through probate.

If assets have a named beneficiary or are jointly held, then they usually go straight to the beneficiary or the surviving owner without needing to be probated. However, the following assets do require probate: Real estate held in the deceased's name only.

Joint accounts and joint title are widely-used ways to avoid probate. Married couples can own real estate or financial accounts through joint tenancy with right of survivorship. Some states also allow tenancy in the entirety for real estate to avoid probate.

How to Avoid Probate Create a Living Trust. A revocable living trust can be used to avoid probate. ... Joint Ownership of Property. Joint tenancy is when two or more people are owners of the property or an asset. ... Name Beneficiaries on Accounts. ... Work with a Knowledgeable Woburn Probate Attorney.