Estate Property Transfer With Beneficiary

Description

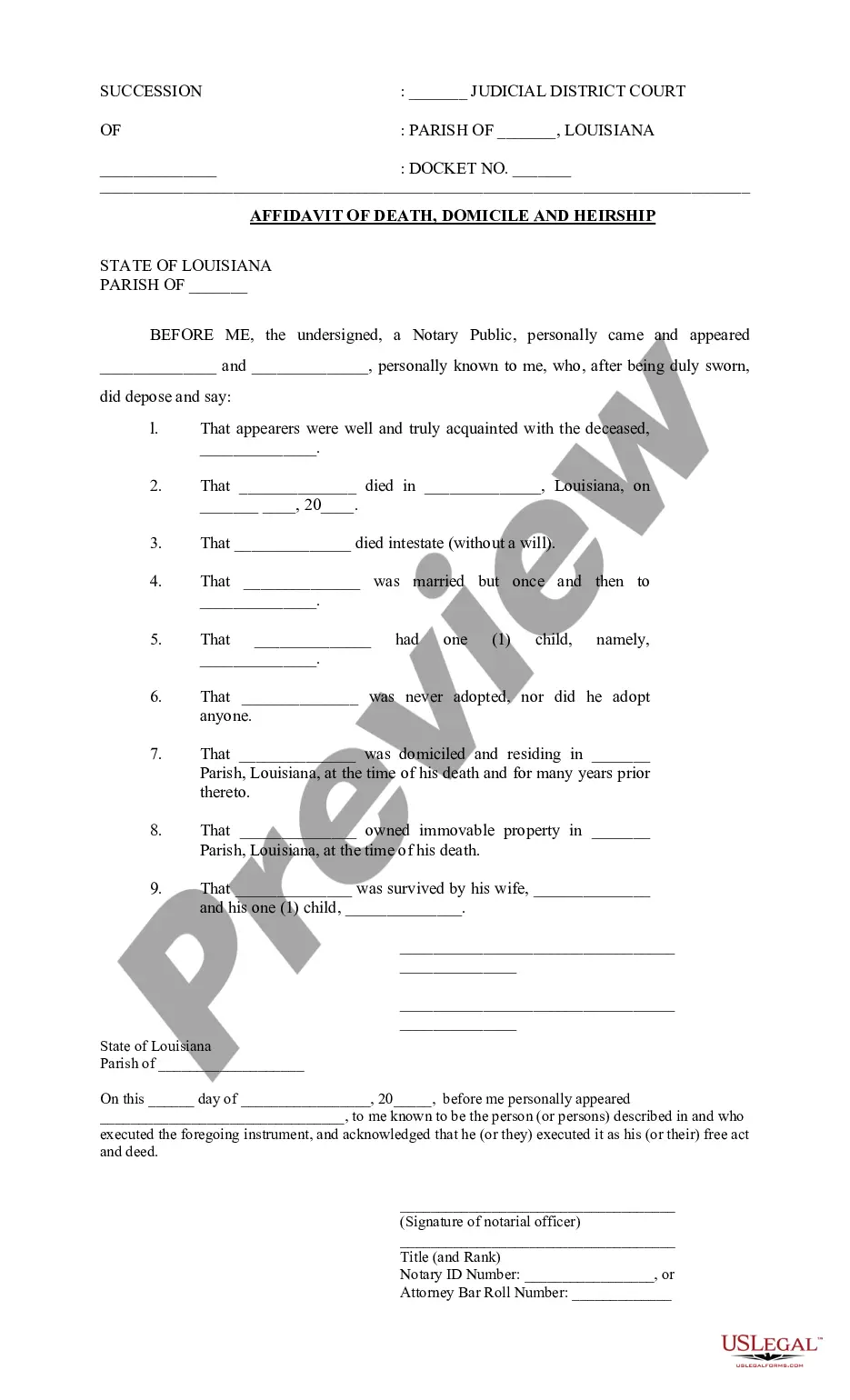

How to fill out Affidavit For Transferring Property After Death In Joint Tenancy With Right Of Survivorship By Surviving Tenant When One Tenant Is Deceased?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a an easier and more cost-effective way of creating Estate Property Transfer With Beneficiary or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of over 85,000 up-to-date legal forms addresses almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-compliant forms carefully prepared for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can quickly find and download the Estate Property Transfer With Beneficiary. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and navigate the catalog. But before jumping straight to downloading Estate Property Transfer With Beneficiary, follow these recommendations:

- Check the form preview and descriptions to ensure that you are on the the form you are searching for.

- Check if form you select complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the Estate Property Transfer With Beneficiary.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and transform form execution into something simple and streamlined!

Form popularity

FAQ

How To Transfer Property of The Deceased in Ontario (step-by-step) Step 1: Gather Documents and Identify the Trustee. ... Step 2: Initiate the Probate Process or Joint Tenancy Survivorship. ... Step 3: Notify Relevant Parties and Assess Financial Obligations. ... Step 4: Transfer Title with the Land Titles Office.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

You can name your estate as a beneficiary. Your executor will be responsible for distributing your estate (including your pension benefit) ing to the instructions in your will. If you name your estate as your beneficiary and die without a will, the court will appoint someone to administer your estate.

Disability: If your beneficiary has a disability or acquires one from an accident or illness before death. In that case, the POD and TOD funds could end up with the government or jeopardize their Medicaid and SSI.

If the beneficiary dies before the will is executed, the gift to the beneficiary is considered void. If the beneficiary dies after the will is executed and is a relative, the estate will go to the heirs, or devisees of the beneficiary, instead of the heirs of the will-maker.