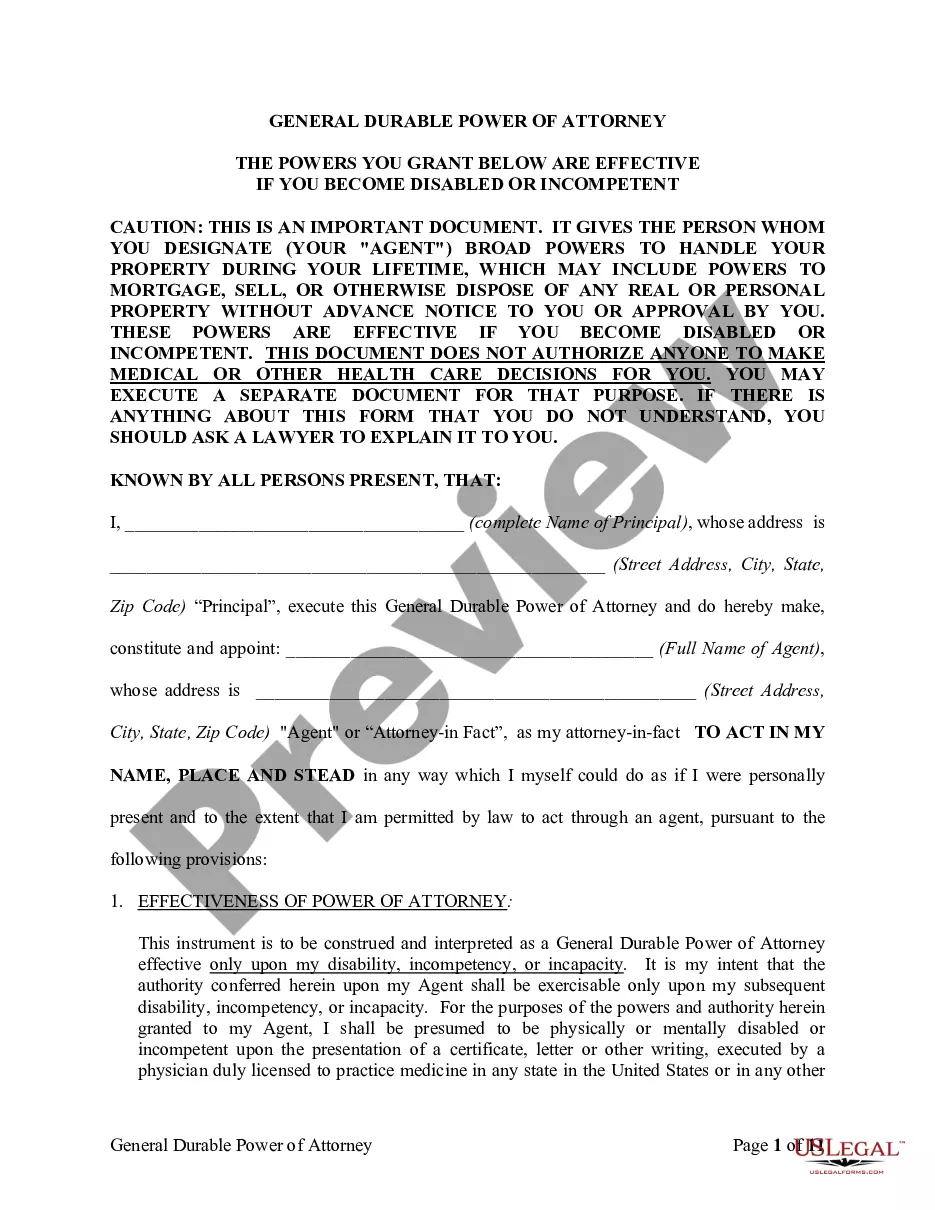

An odometer statement in New York (NY) withholding is an essential document used during the sale or transfer of a motor vehicle. It serves as proof of the vehicle's mileage at the time of transfer, ensuring transparency and preventing odometer fraud. This detailed description will explore what an odometer statement is, its significance in NY withholding, and different types of odometer statements used in the state. In NY withholding, an odometer statement is required to be provided by the seller to the buyer of a used motor vehicle. It is a legal declaration that discloses the accurate mileage recorded on a vehicle's odometer at the time of sale. The purpose of this statement is to protect consumers from unknowingly purchasing vehicles with falsified mileage readings, commonly known as odometer fraud. Odometer fraud involves rolling back or tampering with an odometer to reduce the displayed mileage, falsely inflating the vehicle's value or hiding its true wear and tear. By imposing the requirement of an odometer statement, NY withholding aims to deter such fraudulent activities and ensure fair transactions within the marketplace. There are two main types of odometer statements used in NY withholding: 1. Federal Odometer Statement: As mandated by federal law, the seller of a motor vehicle must provide the buyer with a federal odometer statement, also known as an "Odometer Disclosure Statement" (ODS). This statement must detail the vehicle's mileage at the time of transfer and include the seller's signature. The federal odometer statement serves as documentation for both the buyer and the seller, protecting their rights and interests in the transaction. 2. NY Odometer and Damage Disclosure Statement: In addition to the federal requirement, New York State also imposes its own odometer and damage disclosure statement. This statement expands on the federal ODS and requires sellers to disclose if the vehicle has sustained any material damage or if the odometer reading is not the actual mileage due to its mechanical or electrical failure or replacement. The NY odometer and damage disclosure statement form must be completed accurately and signed by both the seller and the buyer. This form serves as an agreement between the parties involved, establishing the known condition of the vehicle and acknowledging potential discrepancies in mileage or damage. In summary, an odometer statement in NY withholding is a document that provides transparency and safeguards consumers against odometer fraud. It ensures that the mileage of a vehicle being sold is accurately disclosed, benefiting both buyers and sellers in the transaction. The main types of odometer statements used in NY withholding include the federal odometer statement and the NY odometer and damage disclosure statement.

Odometer Statement Ny Withholding

Description

How to fill out Odometer Statement Ny Withholding?

Whether for business purposes or for personal matters, everyone has to handle legal situations at some point in their life. Filling out legal paperwork demands careful attention, beginning from choosing the right form template. For instance, if you select a wrong edition of the Odometer Statement Ny Withholding, it will be rejected once you send it. It is therefore essential to get a dependable source of legal papers like US Legal Forms.

If you have to get a Odometer Statement Ny Withholding template, follow these simple steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Examine the form’s description to make sure it fits your case, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to find the Odometer Statement Ny Withholding sample you need.

- Download the file when it matches your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved files in My Forms.

- In the event you do not have an account yet, you may download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the profile registration form.

- Select your transaction method: use a bank card or PayPal account.

- Pick the document format you want and download the Odometer Statement Ny Withholding.

- When it is saved, you are able to fill out the form with the help of editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time searching for the appropriate template across the web. Take advantage of the library’s easy navigation to find the appropriate form for any occasion.

Form popularity

FAQ

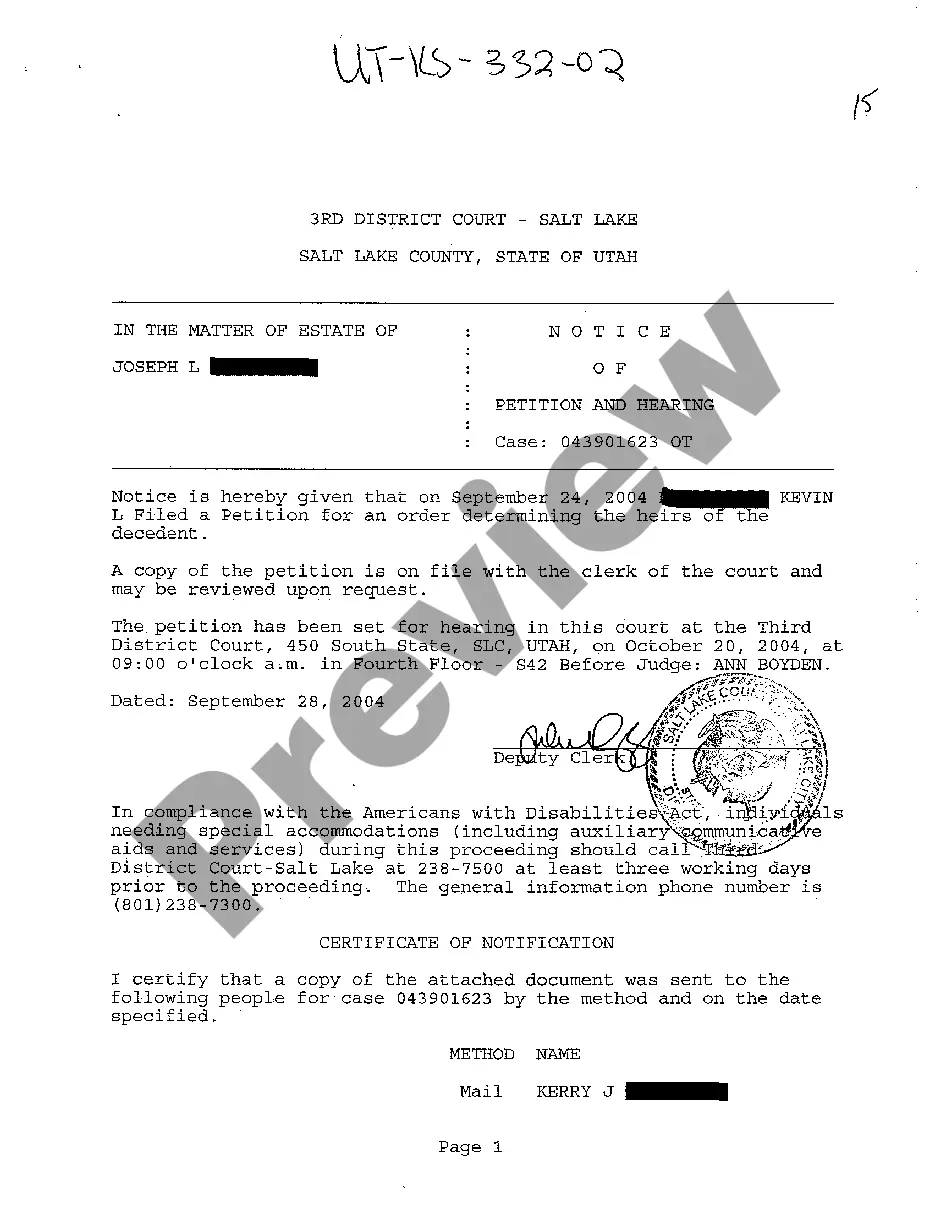

Taking Care of the Important Paperwork If you choose to buy from a private seller, you'll have to bring the title, proof of insurance, identification, and proof of address to the DMV. Remember, you can't drive the car legally until you've had the title and registration transferred.

If you notice an error on your title, you can visit a motor vehicle agency or submit a written request through the mail to request a correction. If you visit a motor vehicle agency: You must provide proof that a correction is needed. There is no charge to correct a title if the error was clearly caused by the MVC.

The Statement of Damages sets out the full particulars of the types of damage claimed including a summary of the Plaintiff's injuries, the treatment received and the prognosis.

The odometer disclosure should contain: The complete vehicle description (make, year model, body type, and vehicle identification number). The date of sale. Reference to federal and state law with the following or similar wording:

Odometer Disclosure Statement. Information. Step 1 ? Vehicle Information. Step 2 ? Buyer Information. Step 3 ? Seller Information. Step 4 ? Odometer Information. ? WARNING ? ODOMETER DISCREPANCY ? I hereby certify that the odometer reading is NOT the. Step 5 ? Statement of Buyer.