Unsecured Payment Rate With Irs

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

It’s common knowledge that you cannot become a legal authority instantly, nor can you swiftly learn how to prepare Unsecured Payment Rate With Irs without possessing a specialized skill set.

Drafting legal documents is an extensive endeavor necessitating specific training and abilities. So why not entrust the development of the Unsecured Payment Rate With Irs to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can discover everything from court forms to templates for internal communication.

You can re-access your documents from the My documents tab at any time. If you’re a returning customer, you can simply Log In and locate and download the template from the same tab.

No matter the objective of your documents—be it financial, legal, or personal—our platform has you covered. Give US Legal Forms a try now!

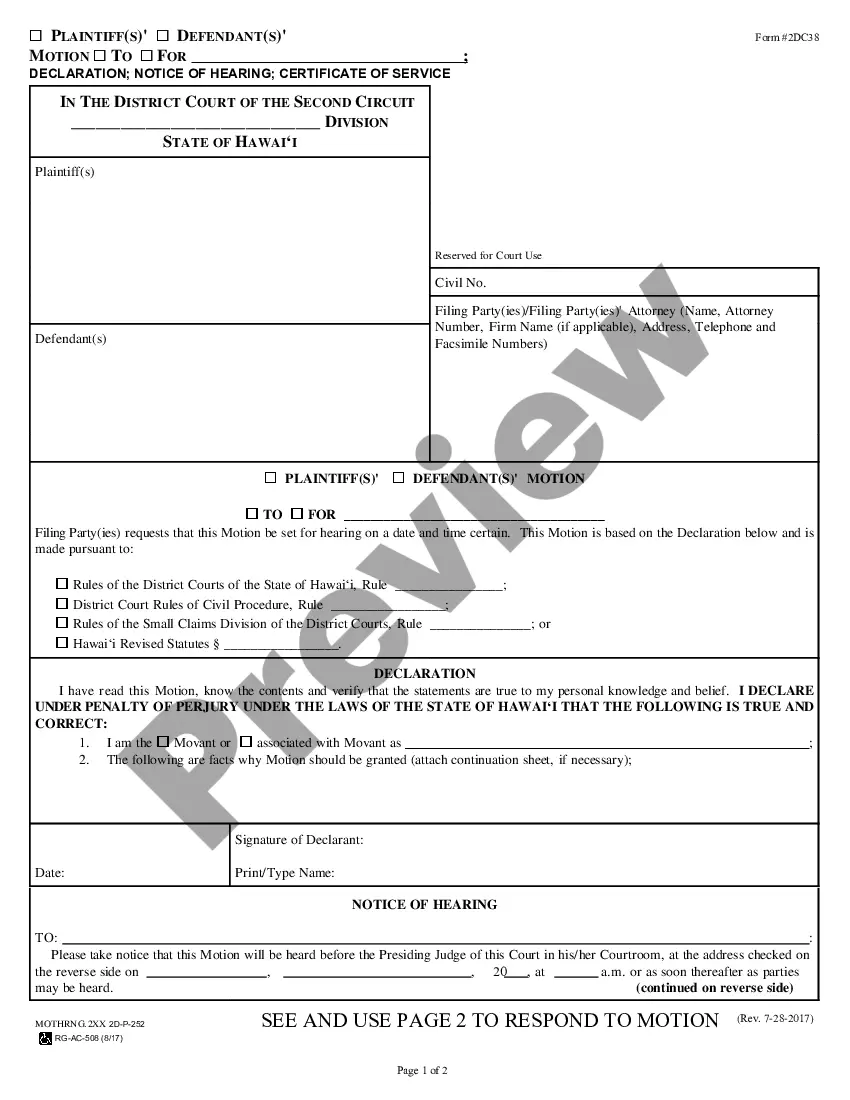

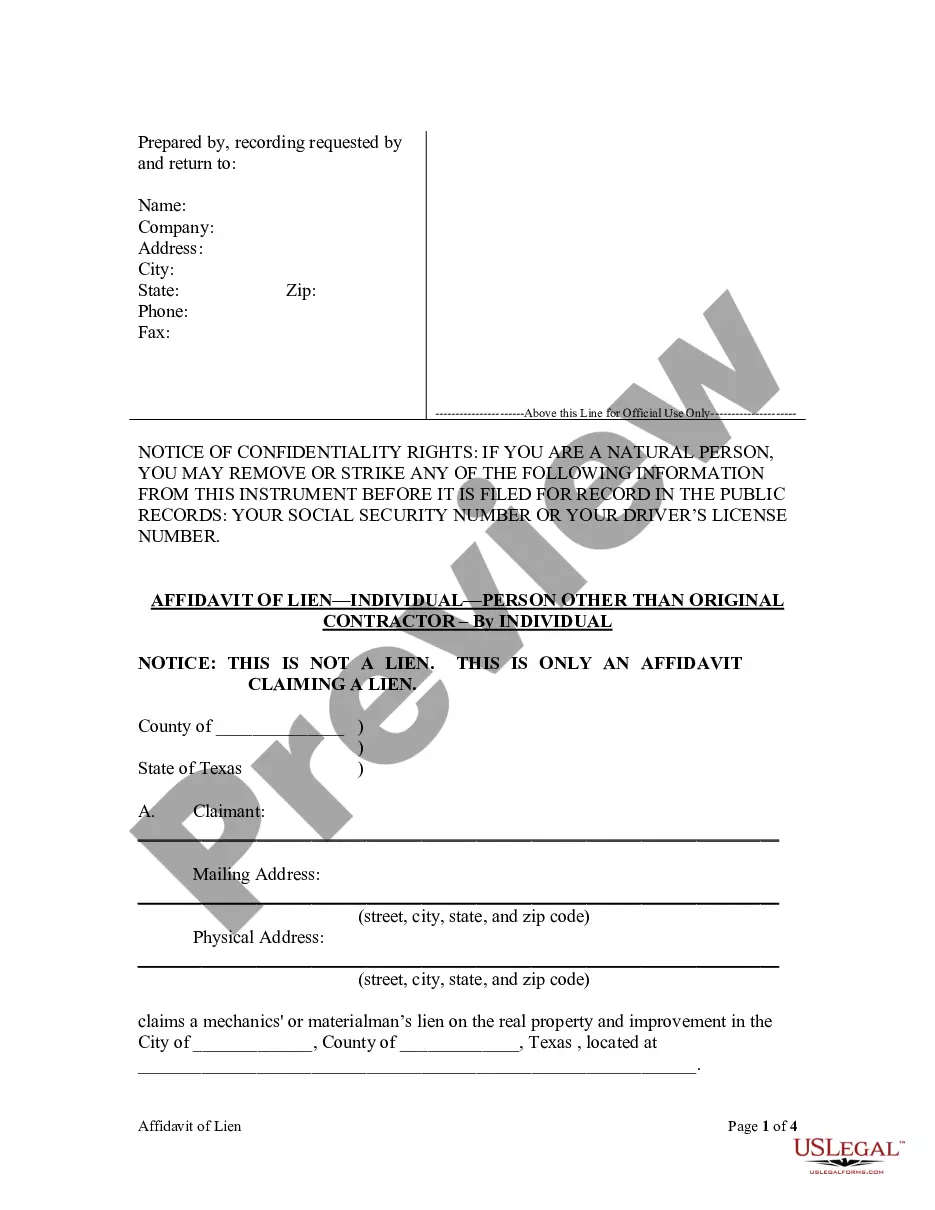

- Identify the document you require by utilizing the search bar situated at the top of the page.

- Preview it (if this option is available) and evaluate the accompanying description to confirm whether Unsecured Payment Rate With Irs is what you seek.

- Commence your search anew if you need any additional template.

- Create a free account and choose a subscription plan to acquire the template.

- Select Buy now. After the transaction is completed, you can download the Unsecured Payment Rate With Irs, fill it out, print it, and send or mail it to the appropriate persons or entities.

Form popularity

FAQ

In the living expenses section of the 433-F form, you will list your expenses, including food, clothing, gas, insurance, utilities, medical bills, child care, and housekeeping supplies. You can also note your estimated tax payments and any monthly payments you make on delinquent state or local taxes.

WASHINGTON ? The Internal Revenue Service today announced that interest rates will remain the same for the calendar quarter beginning July 1, 2023. For individuals, the rate for overpayments and underpayments will be 7% per year, compounded daily.

Electronic Payment Options for Businesses and Individuals Credit or Debit Card. Visit here for the list of service providers, their contact information, and convenience fees. ... Direct Pay. ... Electronic Funds Withdrawal. ... Electronic Federal Tax Payment System® ... Online Payment Agreement. ... Same-Day Wire Federal Tax Payments. ... User Fees.

Unsecured means it can be discharged in a chapter 7 and you have no liability left after the discharge: though, in a chapter 13, you would pay it through the repayment plan. To discharge tax debt in a Chapter 7 bankruptcy following requirements must be met: The taxes are income-based.

Make your check or money order payable to ?United States Treasury.? Don't send cash. If you want to pay in cash, in person, see Pay by cash, later. Make sure your name and address appear on your check or money order. Enter your daytime phone number and your SSN on your check or money order.