Accept Crypto Payments On Website

Description

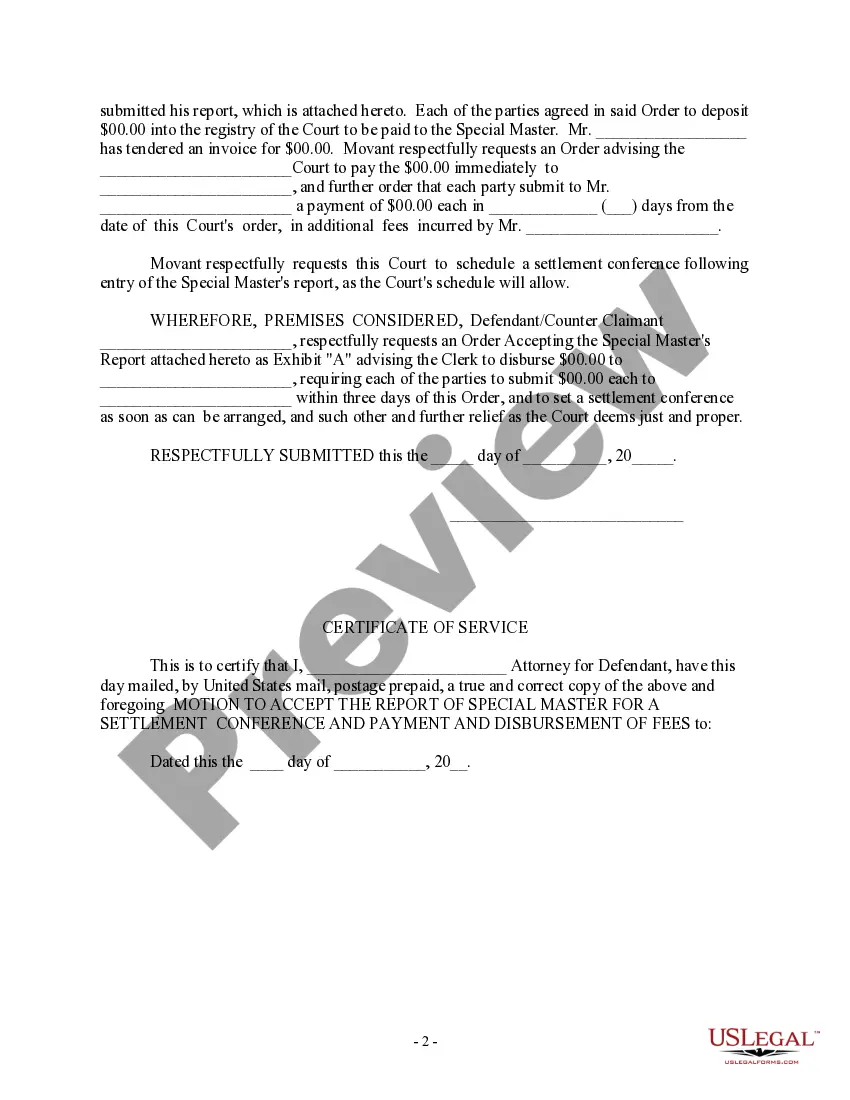

How to fill out Motion To Accept The Report Of Special Master For A Settlement Conference And Payment And Disbursement Of Fees?

- Log in to your US Legal Forms account, or create a new account if you are a first-time user.

- Search for the crypto payment agreement form that fits your business needs. Use the Preview mode to assess its relevance to your local jurisdiction.

- If needed, utilize the Search tab to explore alternative templates until you find one that meets all your requirements.

- Choose the document you wish to purchase by clicking the Buy Now button, and select a suitable subscription plan.

- Complete your purchase by entering your payment details, whether using a credit card or PayPal.

- Download the completed form to your device, ensuring it's accessible from the My Forms menu for future reference.

By following these steps, you can seamlessly integrate crypto payments into your business operations while aligning with legal obligations.

Start today to deliver a modern payment experience for your customers while benefiting from the extensive features that US Legal Forms offers.

Form popularity

FAQ

Yes, you can transfer crypto to a bank account, though the process may involve several steps. First, you need to convert your cryptocurrency into fiat currency, often through a cryptocurrency exchange. Once you have completed that conversion, you can easily withdraw the funds to your bank account. By integrating the right payment solutions, your website will effectively allow you to accept crypto payments and streamline your financial activities.

Choosing the best payment gateway for crypto depends on your business size and requirements. PayPal, Square, and Stripe have integrated features for crypto transactions, but dedicated services like BitPay or CoinGate are also worth considering for specific needs. Each platform offers unique advantages for merchants who want to accept crypto payments on their websites. Ensure you compare transaction fees, supported currencies, and user experience to find your ideal solution.

Yes, it is essential to report cryptocurrency transactions, even if you did not sell your assets. The IRS requires you to report the use of cryptocurrency as payment; thus, if you accept crypto payments on your website, you need to document those transactions. Keeping thorough records helps ensure compliance and simplifies tax filing. Make sure to consult with a tax professional for specific guidance.

There are several excellent platforms for processing crypto payments; however, the best site often depends on your specific business needs. Popular options like Coinbase Commerce and BitPay allow you to easily accept crypto payments on your website. Both platforms offer robust features, user-friendly interfaces, and strong security measures. It’s wise to evaluate them based on fees, ease of integration, and available currencies.

Yes, cryptocurrency can be used as a form of payment. Many businesses increasingly choose to accept crypto payments on their websites to provide customers with more options. By accepting cryptocurrency, you can reach a broader audience and offer a modern payment solution. Plus, it may enhance transaction security and reduce fees associated with traditional payment methods.

To accept crypto for your business, start by choosing a compatible payment processor. Then, follow their instructions to integrate the payment platform into your website. By doing this, you can attract a broader customer base and enhance your service offering when you accept crypto payments on your website.

For businesses dealing in cryptocurrencies, various forms are necessary for tax reporting. Typically, you will need to fill out Form 8949 to report gains and losses from crypto transactions. Keeping track of all your crypto-related transactions will help you comply when you accept crypto payments on your website.

To accept crypto payments on your website, first, choose a reliable payment processor that supports cryptocurrencies. Once you set up an account, integrate their payment gateway into your website. This approach allows you to receive various cryptocurrencies directly from customers, making the process smooth and efficient.

You can write off crypto as a business expense, as long as you document the transaction thoroughly. This process allows you to mitigate losses or gain tax benefits on your business operations. It’s wise to consult a tax professional to ensure compliance while accepting crypto payments on your website.

Yes, you can set up a crypto wallet for your business to facilitate transactions. Choose between a hot wallet for immediate access or a cold wallet for enhanced security. By using a wallet, you can manage your crypto assets efficiently and accept crypto payments on your website seamlessly.