Statement Credit Report With Credit Card Number

Description

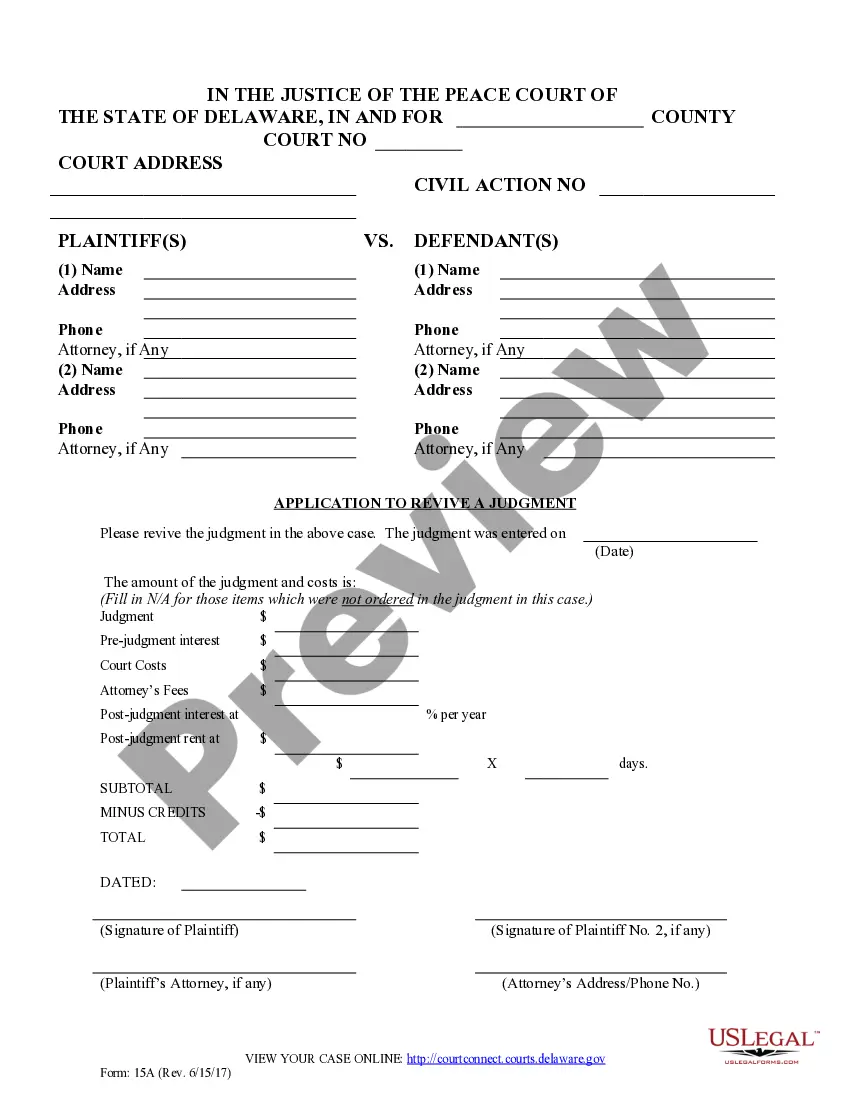

How to fill out Statement To Add To Credit Report?

- Log in to your existing US Legal Forms account. Ensure that your subscription is active; renew if necessary.

- Browse through the available forms in the Preview mode to select the statement credit report that suits your requirements.

- If you can't find the specific report, utilize the Search tab to locate the correct document that meets your jurisdiction's demands.

- Once you've found your desired form, click on the Buy Now button and select your subscription plan to gain access.

- Proceed to finalize your purchase by entering your credit card information or opting for PayPal.

- Download your statement credit report to your device and access it later under the My Forms section in your account.

In conclusion, US Legal Forms stands out with its extensive collection of over 85,000 legal documents that are easily fillable and editable. By following these simple steps, you can ensure that your documentation needs are efficiently met.

Ready to take control of your legal documents? Visit US Legal Forms today!

Form popularity

FAQ

The 2/3/4 rule for credit cards refers to the recommended number of credit cards one should have in relation to their credit utilization and overall credit score. It suggests keeping two accounts for a standard credit history, three for an average credit score, and four or more for robust credit diversity. Following this guideline helps maintain a healthy statement credit report with credit card number, which is crucial for good credit management. Regular monitoring of your credit profile with tools available in platforms like US Legal Forms can also help.

A creditor may choose not to report to credit bureaus for several reasons. They might have a policy of reporting only select accounts or may not report lower-tier products to limit costs. Additionally, they may opt to avoid reporting optional accounts, which can impact your statement credit report with credit card number. It's advisable to ask your creditor if you are uncertain about their reporting practices.

If your credit card does not show up on your credit report, it may result from your card issuer not reporting it. Some issuers may not report accounts under certain conditions, especially if you have an account in good standing with minimal activity. Regular checks of your statement credit report with credit card number can also reveal any discrepancies or gaps that need addressing. Consider reaching out to your card issuer for clarity.

To put a statement on your credit report, you may need to contact your credit card issuer and request them to include your statement. Some credit bureaus allow consumers to add a personal statement, clarifying any discrepancies. Additionally, maintaining good credit behavior will positively influence your statement credit report with credit card number. Consider using US Legal Forms to draft any necessary documents to communicate with your issuer.

Your credit card may not be reporting to credit bureaus for various reasons. Some credit card issuers do not report smaller accounts, or they may have opted not to report your specific account type. Furthermore, ensure the card issuer has no discrepancies with your personal details, as incorrect information can affect your statement credit report with credit card number. It's always good to follow up with your issuer if you notice issues.

To add a credit card to your credit report, make sure your card issuer reports monthly to the bureau. If your issuer does not, you may request them to report your account. You can also use services that help in reporting your account to the bureau, enhancing your statement credit report with credit card number. Additionally, check your reports regularly to confirm your accounts are correctly listed.

There are several reasons your credit card may not be reporting to the credit bureau. Firstly, some card issuers do not report all accounts, especially for those with limited histories. Moreover, if you have just opened a new credit card, it may take some time before it appears on your statement credit report with credit card number. Lastly, ensure that your card issuer has the correct information to report, as errors can prevent your account from being listed.

There are several reasons your credit card may not appear on your credit report. Your issuer may not have reported it yet, or you could be looking at an outdated report. To resolve this issue, review your statement credit report with credit card number and contact your credit card company directly for clarification.

Once you receive a new credit card, it usually appears on your credit report within one to two billing cycles. This timeframe can vary, depending on the issuer's reporting schedule. To stay informed, regularly check your statement credit report with credit card number to ensure accurate representation.

Adding a credit card can have both positive and negative effects on your credit score. Initially, a new card may decrease your score due to the hard inquiry, but it can improve your credit utilization ratio over time. Keep track of your statement credit report with credit card number to monitor these changes.