Toll Violation Dispute Letter Sample With Payment

Description

How to fill out Letter Of Dispute - Complete Balance?

It's commonly understood that you cannot become a legal authority instantly, nor can you swiftly comprehend how to efficiently formulate a Toll Violation Dispute Letter Sample With Payment without the necessary specialized training.

Assembling legal documentation is a labor-intensive task that demands a certain level of education and expertise. So, why not entrust the creation of the Toll Violation Dispute Letter Sample With Payment to the professionals.

With US Legal Forms, which boasts one of the most comprehensive legal template libraries, you can discover everything from judicial papers to templates for internal business correspondence. We recognize the importance of compliance with both federal and local regulations. That’s why, on our platform, all templates are tailored to specific locations and are current.

Select Buy now. Once the payment is processed, you will receive the Toll Violation Dispute Letter Sample With Payment, which you can fill out, print, and send or deliver to the appropriate individuals or organizations.

You can revisit your files from the My documents section whenever you wish. If you are a returning customer, simply Log In to locate and download the template from that same area.

No matter the intent behind your documentation—whether it is related to financial, legal, or personal matters—our website has you supported. Experience US Legal Forms today!

- Commence by visiting our website to acquire the form you require in just a few moments.

- Utilize the search feature at the top of the page to find the form you need.

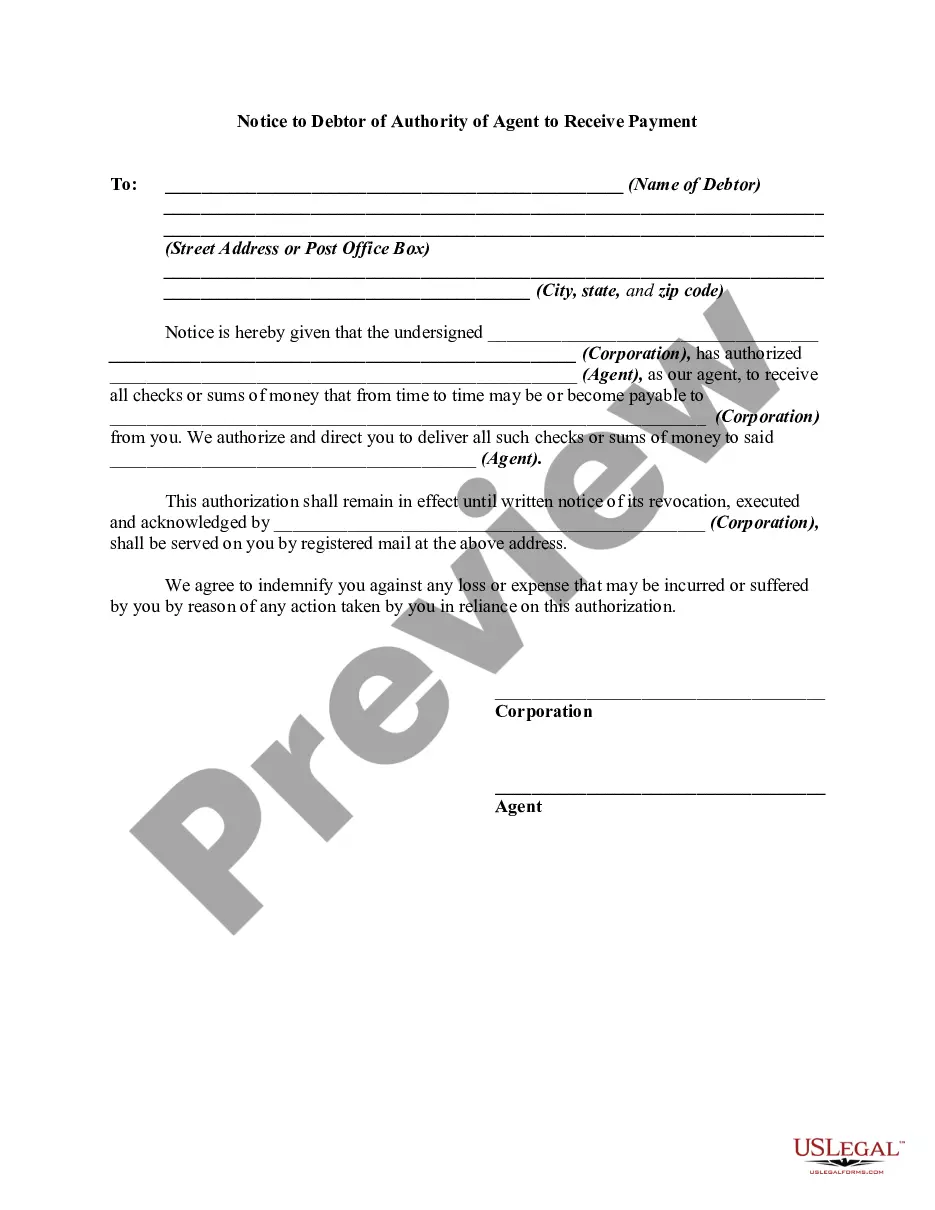

- If available, preview the document and review the accompanying description to ascertain if the Toll Violation Dispute Letter Sample With Payment meets your needs.

- If you require an alternative form, start your search anew.

- Establish a complimentary account and select a subscription plan to obtain the template.

Form popularity

FAQ

Apply for an Employer Identification Number (EIN) online at the Website of the Internal Revenue Service. Note: Only one DBA will print on your license. All other DBAs are recorded as trade names and can be reported using a Schedule DBA.

West Virginia has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.55 percent. West Virginia's tax system ranks 20th overall on our 2023 State Business Tax Climate Index.

What can I do with an EIN number? Open a Bank Account in the USA. Apply for Business Permits. File a Business Tax Return. Hire Employees. Start a Corporation or Partnership. Withhold Employee Taxes. Apply For a Business Credit Card. Apply for Business Loans.

For example, you'll need a Virginia state tax ID number for most state-level tax purposes. You'll need one if you're hiring employees in Virginia, so you can account for state-level employment taxes.

If the business is a sole proprietorship with no employees, the individual's Social Security number will serve as the basis for the State Identification number. To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933.

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

It costs $30 to obtain a business registration certificate. There may be other licensing and permit fees for other licenses you are required to obtain. For example, it may cost as much as $22,650 for a liquor license in the state. Professional licenses vary by profession.

You may check on your refund on our MyTaxes website, or by going to our website at Tax.WV.Gov and clicking on the Where's My Refund? banner. You should receive your amended refund within 10-12 weeks from the date the amended return is filed.