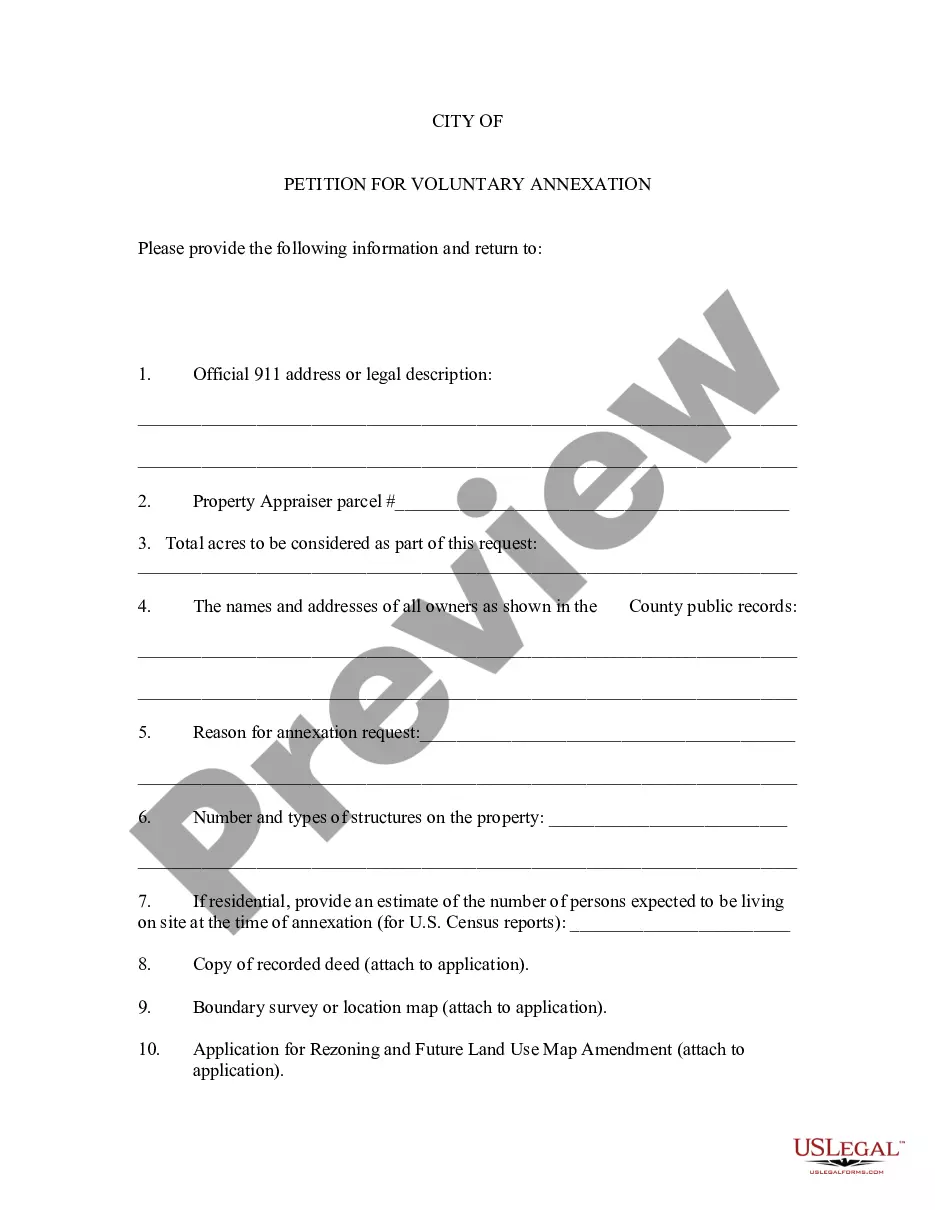

Petition For Voluntary Liquidation

Description

How to fill out Petition For Voluntary Annexation?

It’s clear that you cannot transform into a legal expert instantly, nor can you swiftly master how to draft a Petition For Voluntary Liquidation without possessing a unique collection of expertise.

Compiling legal paperwork is a lengthy endeavor that calls for particular instruction and abilities. So why not entrust the creation of the Petition For Voluntary Liquidation to the experts.

With US Legal Forms, one of the most comprehensive legal document collections, you can locate everything from court documents to templates for office correspondence.

You can access your documents again from the My documents section at any time. If you are a current customer, simply Log In, and find and download the template from the same section.

Regardless of your document’s purpose—whether financial, legal, or personal—our platform has everything you need. Experience US Legal Forms today!

- Find the document you require by utilizing the search field at the top of the webpage.

- Preview it (if this option is available) and review the accompanying description to determine if the Petition For Voluntary Liquidation meets your needs.

- Initiate a new search if you require a different template.

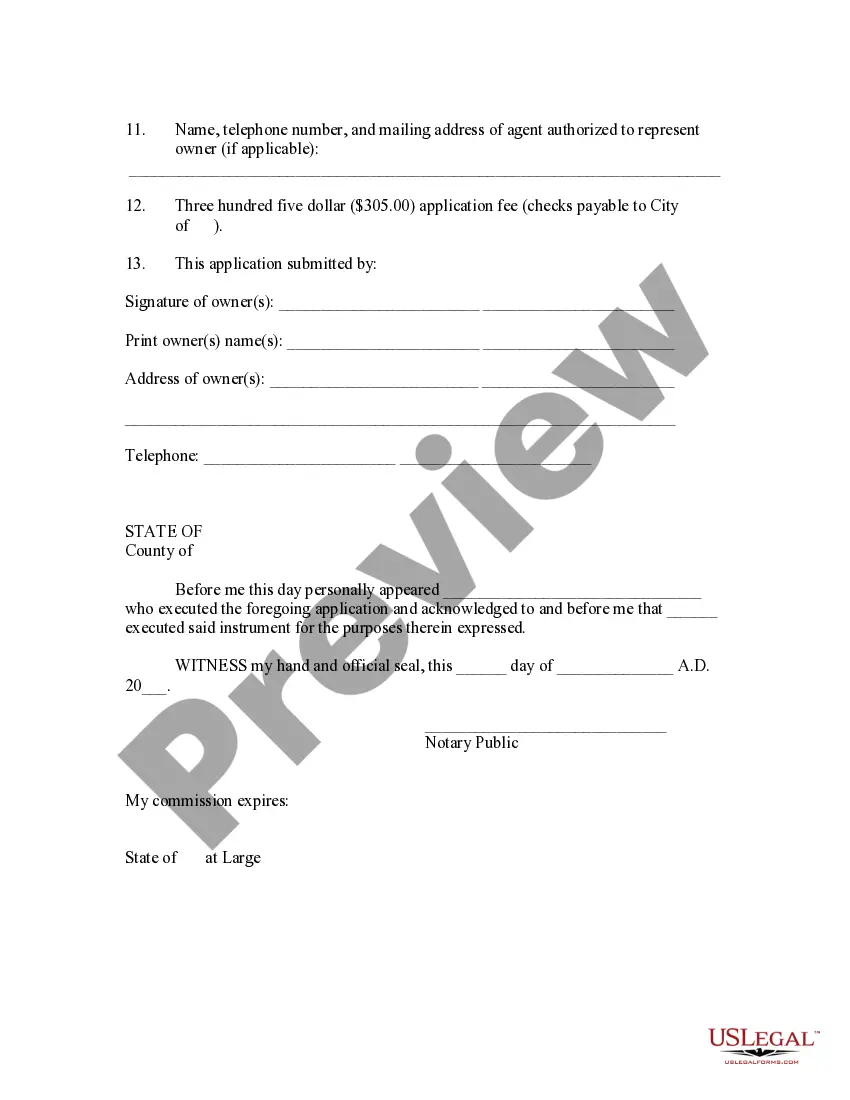

- Create a free account and choose a subscription plan to purchase the document.

- Click Buy now. Once the payment is processed, you can download the Petition For Voluntary Liquidation, complete it, print it, and send or mail it to the appropriate parties.

Form popularity

FAQ

Amending a promissory note is a legal process by which parties can denote changes to the original contract and continue with the terms of the agreement as set forth. Canceling a promissory note is a process that will lead the note to become null and void.

Your lender will typically provide you with a copy of the promissory note, along with several other documents, when you close on your home purchase. The lender will keep the original promissory note until the loan is paid off.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

When a person issues a promissory note, he/ she would have to stamp it as per the Indian Stamp Act and normally a revenue stamp is affixed on the PN signed by the promissory. You can use Re 1/- revenue stamp and get it cross signed by the borrower.

In ance with the common law ?best evidence rule,? a party seeking to prove the disputed contents of the promissory note, such as the amount owed on said note, must produce the original document because it is the ?best evidence? of the terms of the note itself.

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

A promissory note cannot be valid unless it contains details about the nature of credit, the means to repay it along with the duration given for the repayment, the signatures of all parties, the conditions agreed in the sanction of the loan, the rate of interest and all related terms.

But actually, the signed promissory note represents a promise to repay the mortgage or loan, along with the repayment terms. The promissory note describes the debt's amount, interest rate, and late fees. A lender holds the promissory note until the mortgage loan is paid off.