Tenants

Description

How to fill out Multistate Landlord Tenant Handbook - Guide - Laws?

- If you're a returning user, log in to your account, verify your subscription status, and click the Download button to save your required form.

- For first-time users, start by checking the Preview mode to review form descriptions to make sure you select the correct document for your needs.

- If you need a different form, use the Search tab to locate the right template that aligns with your jurisdiction.

- Once you've found the appropriate document, click on the Buy Now button, and select your desired subscription plan, creating an account for access.

- Complete your purchase by entering your credit card information or using a PayPal account for seamless payment.

- Finally, save the downloaded form on your device, and access it anytime through the My Forms section of your profile.

By leveraging US Legal Forms, tenants enjoy the convenience of a robust library filled with trustworthy legal documents. The platform not only saves time but also ensures that all forms are filled out correctly, providing peace of mind.

Start utilizing US Legal Forms today to simplify your legal document needs!

Form popularity

FAQ

The hardest months to find a tenant often coincide with winter and the holiday season, particularly November through January. During these months, many people are less inclined to move due to weather and holiday commitments. By being aware of these trends, landlords can plan their leasing strategies more effectively, either by adjusting rental terms or enhancing property visibility.

To comfortably afford $1,500 in rent, tenants should ideally earn a monthly salary of at least $4,500, which translates to an annual income of approximately $54,000. This figure adheres to the 3X rent rule, ensuring tenants can manage their bills without financial strain. Additionally, sound budgeting practices can help tenants maintain a balanced financial situation while managing rent obligations.

Landlords typically find good tenants by conducting thorough background and credit checks. This process helps in assessing the tenant's rental history, financial responsibility, and overall reliability. Additionally, crafting a comprehensive rental application can provide insights into potential tenants, ensuring that you find individuals who align with your expectations and needs.

The best way to find tenants often involves multiple strategies, including advertising your rental property online and utilizing social media platforms. You can also consider listing your property on rental websites and engaging local real estate agents. Moreover, building a network through referrals from friends or previous tenants can yield excellent results in finding reliable tenants.

The 3X rent rule states that tenants should earn at least three times their monthly rent to qualify for a lease. This guideline helps ensure that tenants can afford their living expenses while paying rent. For example, if your rent is $1,500, tenants should ideally have a monthly income of $4,500. This rule is essential for maintaining a healthy landlord-tenant relationship.

To pass a rental application check, ensure that you present yourself as a reliable tenant by having all your documents in order. This includes proof of income, solid references, and a stable rental history. Be honest about your financial situation, as any misinformation can lead to application denial. Being proactive by checking for any potential red flags beforehand can help you secure a positive outcome.

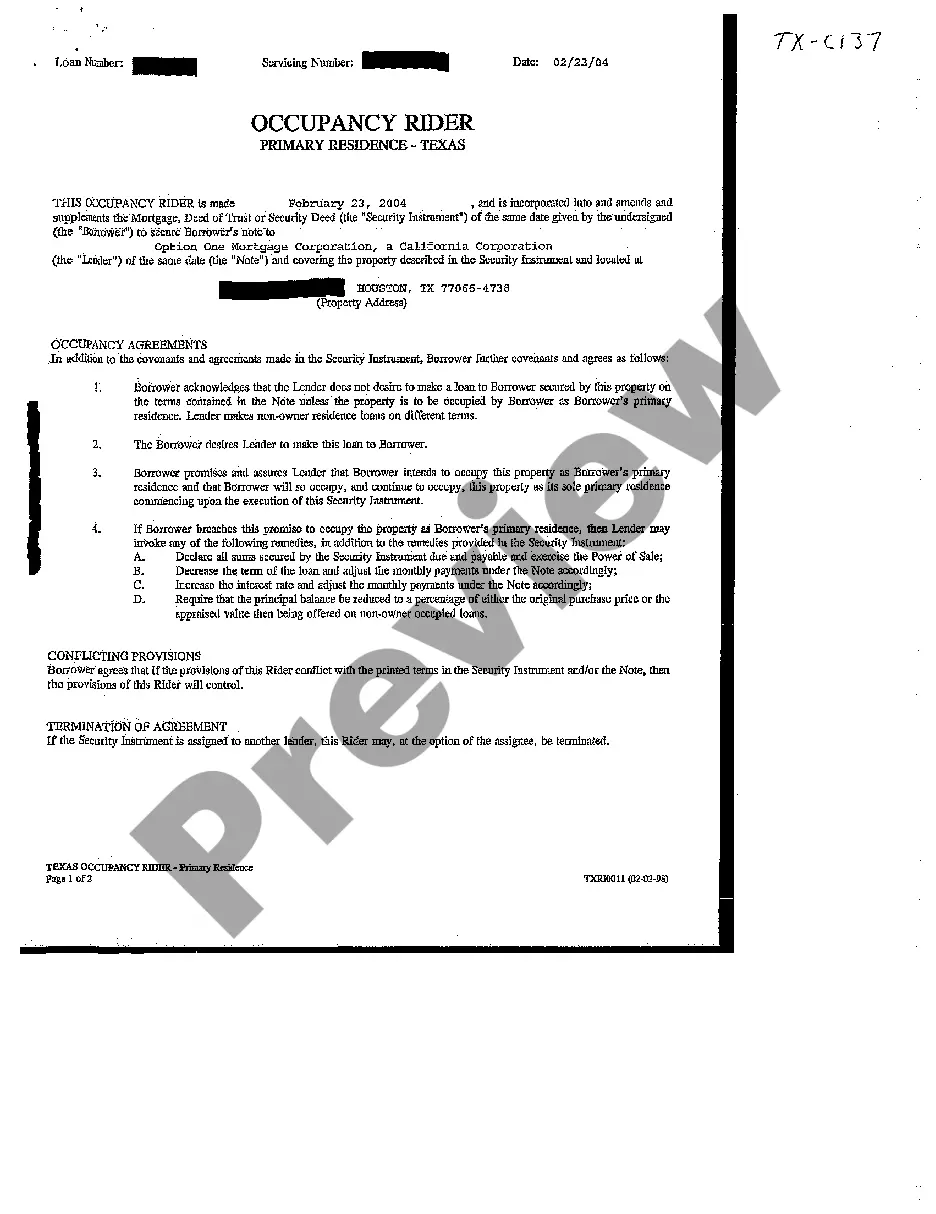

In Texas, a landlord can evict you even if there is no written lease in place; however, they must follow the proper legal procedures. Tenants are usually considered to be on a month-to-month agreement in such cases, and landlords must provide appropriate notice before starting the eviction process. Understanding your rights as a tenant can significantly impact the outcome. Consulting resources like US Legal Forms can provide valuable information on tenant rights and eviction processes.

Filling out a landlord application begins by carefully reading the instructions provided by the landlord or property manager. Ensure you provide all required information, including your identification details and previous rental history. It helps to present yourself positively as a tenant, so consider mentioning your steady income and good payment history. After completion, review the application for any errors or missing information before submitting.

Red flags on a rental application can include inconsistencies in your provided information, such as discrepancies between your income and job details. A lack of rental history or negative references can also raise concerns among landlords. Additionally, if you have a history of late payments or evictions, these can be significant red flags for potential landlords considering you as a tenant. Always ensure that your application is complete and transparent to avoid these issues.

Yes, tenants can typically use their parents as rental references, especially if you have limited rental history. Make sure your parents are aware and willing to provide a positive reference about your responsibility and reliability. Keep in mind that some landlords prefer references from previous landlords or employers, so consider the context of your application. Providing a mix of references can strengthen your position as a tenant.