Agreement Level Sample With Sole Proprietor

Description

How to fill out License Subscription Agreement With Service Level Options?

It’s well known that you cannot become a legal expert instantly, nor can you swiftly learn to draft an Agreement Level Sample With Sole Proprietor without possessing a specialized skill set.

Assembling legal documents is a lengthy undertaking that demands specific education and expertise.

So why not entrust the formulation of the Agreement Level Sample With Sole Proprietor to the professionals.

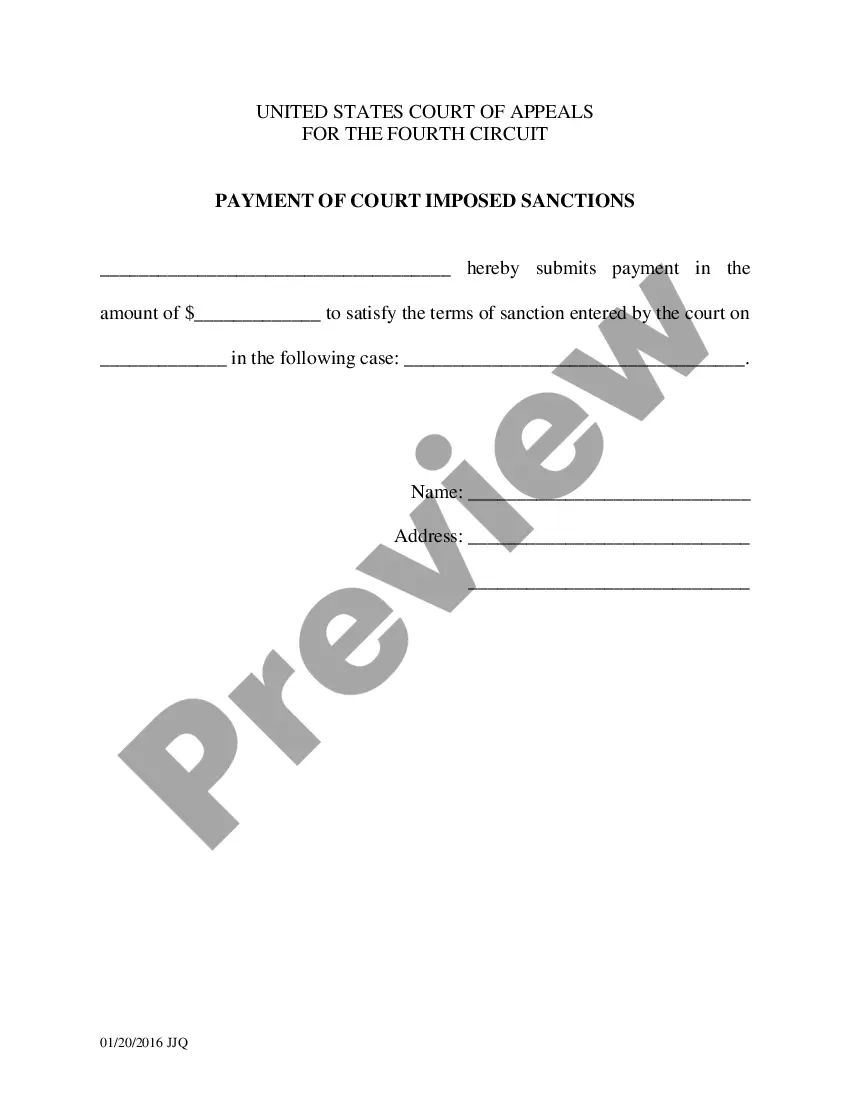

Preview it (if this option is available) and review the accompanying description to ascertain whether the Agreement Level Sample With Sole Proprietor is what you need.

If you require a different template, restart your search. Register for a free account and select a subscription plan to purchase the form. Click Buy now. Once the payment is finalized, you can download the Agreement Level Sample With Sole Proprietor, fill it out, print it, and send or mail it to the appropriate individuals or entities. You can regain access to your forms from the My documents tab at any time. If you’re an existing client, you can simply Log In, and locate and download the template from the same tab. Regardless of the purpose of your documentation—whether it’s financial and legal, or personal—our platform has you covered. Try US Legal Forms today!

- With US Legal Forms, one of the most comprehensive legal document collections, you can discover anything from court papers to templates for internal communication.

- We understand the significance of compliance and adherence to federal and state regulations.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how to get started with our platform and obtain the document you need in just a few minutes.

- Find the document you seek using the search bar at the top of the page.

Form popularity

FAQ

As there is no separate entity under the law for a sole proprietorship business, contracts are normally signed by owner under his or her personal name. Even if the business uses a fictitious name, the owner will usually have his or her name written down in the checks issued by the clients.

A sole proprietorship is a non-registered, unincorporated business run solely by one individual proprietor with no distinction between the business and the owner. The owner of a sole proprietorship is entitled to all profits but is also responsible for the business's debts, losses, and liabilities.

Sole Proprietor Advantages: All profits/losses are passed through to the owner's tax return and you are only responsible for paying personal federal, state, local, and Federal Insurance Contributions Act (FICA) taxes. You are not required to pay any specific business taxes or unemployment taxes.

However, the business owner is personally liable for all debts incurred by the business." Examples of sole proprietors include small businesses such as, a local grocery store, a local clothes store, an artist, freelance writer, IT consultant, freelance graphic designer, etc.

A sole proprietorship is a business that can be owned and controlled by an individual, a company or a limited liability partnership. There are no partners in the business. The legal status of a sole proprietorship can be defined as follows: It is not a separate legal entity from the business owner.