Self Employed Contractors Without A Business

Description

How to fill out Self-Employed Part Time Employee Contract?

Whether for business purposes or for individual matters, everyone has to deal with legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with choosing the proper form template. For example, if you pick a wrong edition of a Self Employed Contractors Without A Business, it will be rejected when you submit it. It is therefore crucial to have a trustworthy source of legal papers like US Legal Forms.

If you need to get a Self Employed Contractors Without A Business template, follow these simple steps:

- Get the template you need using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your situation, state, and county.

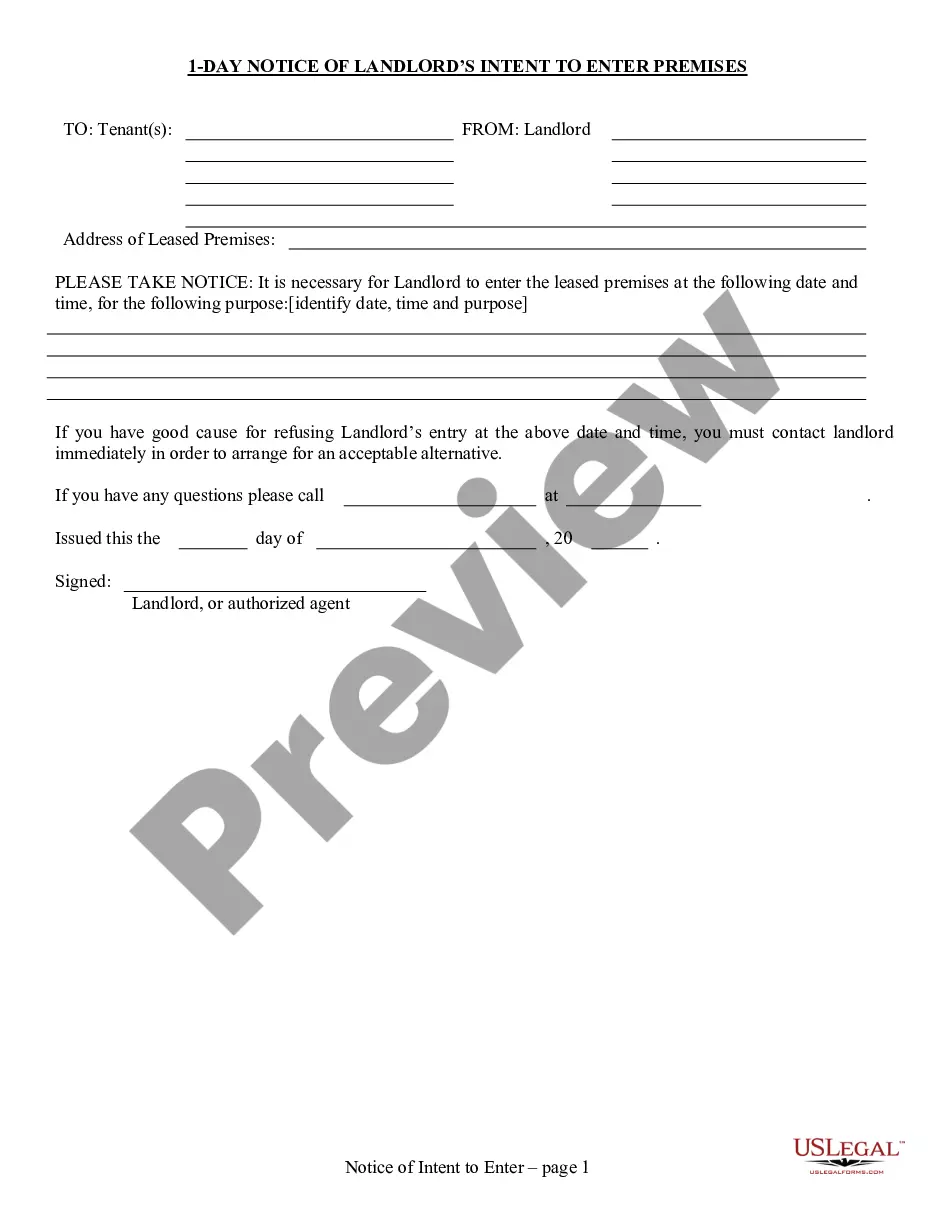

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search function to locate the Self Employed Contractors Without A Business sample you need.

- Download the file if it matches your requirements.

- If you already have a US Legal Forms account, just click Log in to gain access to previously saved files in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Finish the account registration form.

- Choose your transaction method: use a bank card or PayPal account.

- Pick the document format you want and download the Self Employed Contractors Without A Business.

- After it is saved, you are able to fill out the form by using editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time seeking for the right template across the web. Take advantage of the library’s simple navigation to get the appropriate template for any occasion.

Form popularity

FAQ

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

By definition, a contractor is an individual who works for someone else (individual or company) as a non-employee. It's also a way of being self-employed. However, while a contractor may be self-employed, a self-employed person might not be an independent contractor.

Self-employed individuals are considered to be running a business as an independent contractor, a sole proprietor, or a member of a partnership.

In India, independent contractors are not required to register themselves as a separate business entity if they are working as individuals or sole proprietors. As an independent contractor, you can provide services to clients under your own name or a trade name without the need for formal business registration.

However, in practice, you are generally considered an independent contractor if you: Determine your own work schedule and location. Work without direction or supervision. Supply and use your own tools, materials, and equipment. Are able to perform work for other companies simultaneously. Set your own pay rate.