Payment Schedule Form Sample With Tax

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

Legal documentation management may be daunting, even for seasoned experts.

When you are in need of a Payment Schedule Form Sample With Tax and lack the time to dedicate to locating the right and current version, the process can be anxiety-inducing.

Tap into a wealth of articles, guides, and resources related to your circumstances and requirements.

Save time and effort sourcing the documents you require, and utilize US Legal Forms’ advanced search and Review tool to find Payment Schedule Form Sample With Tax and download it.

Leverage the US Legal Forms online repository, backed by 25 years of experience and trustworthiness. Transform your daily document management into a simple and user-friendly process today.

- If you hold a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to access the documents you have previously saved and to manage your folders as desired.

- If this is your initial experience with US Legal Forms, create a free account for unlimited access to all the features of the library.

- Follow these simple steps after downloading the form you need.

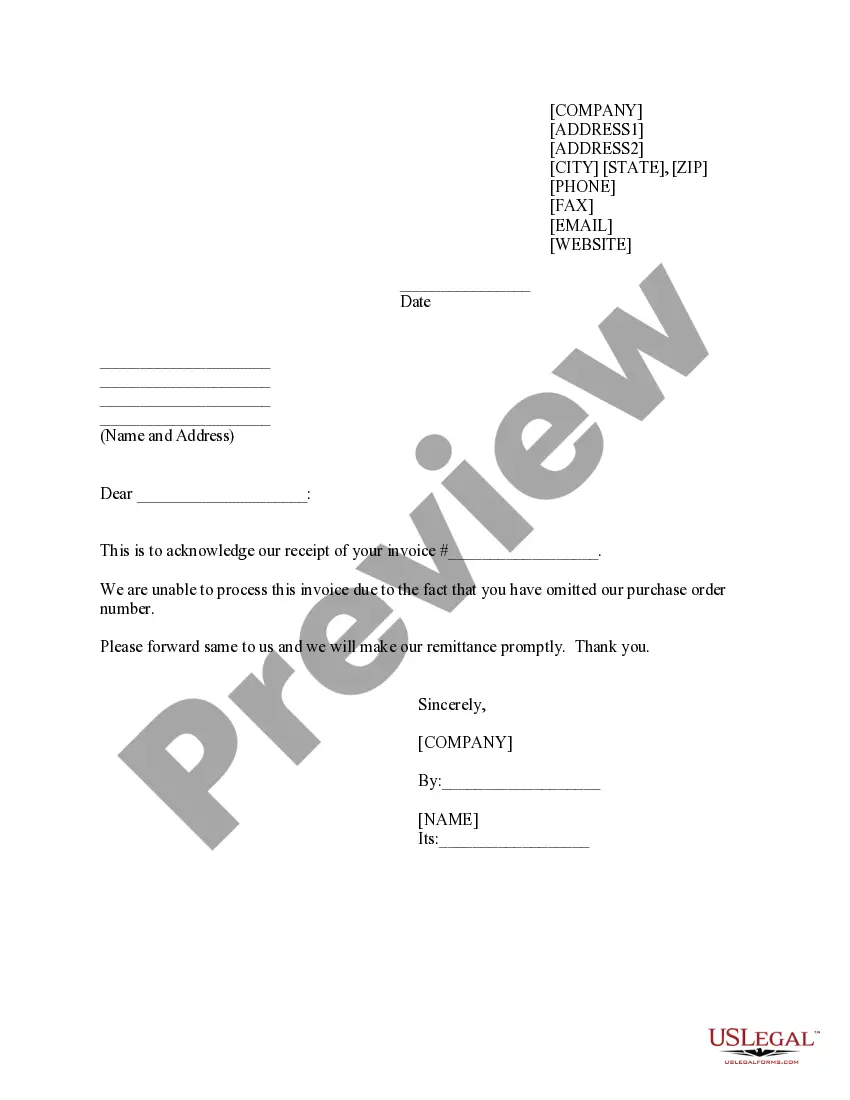

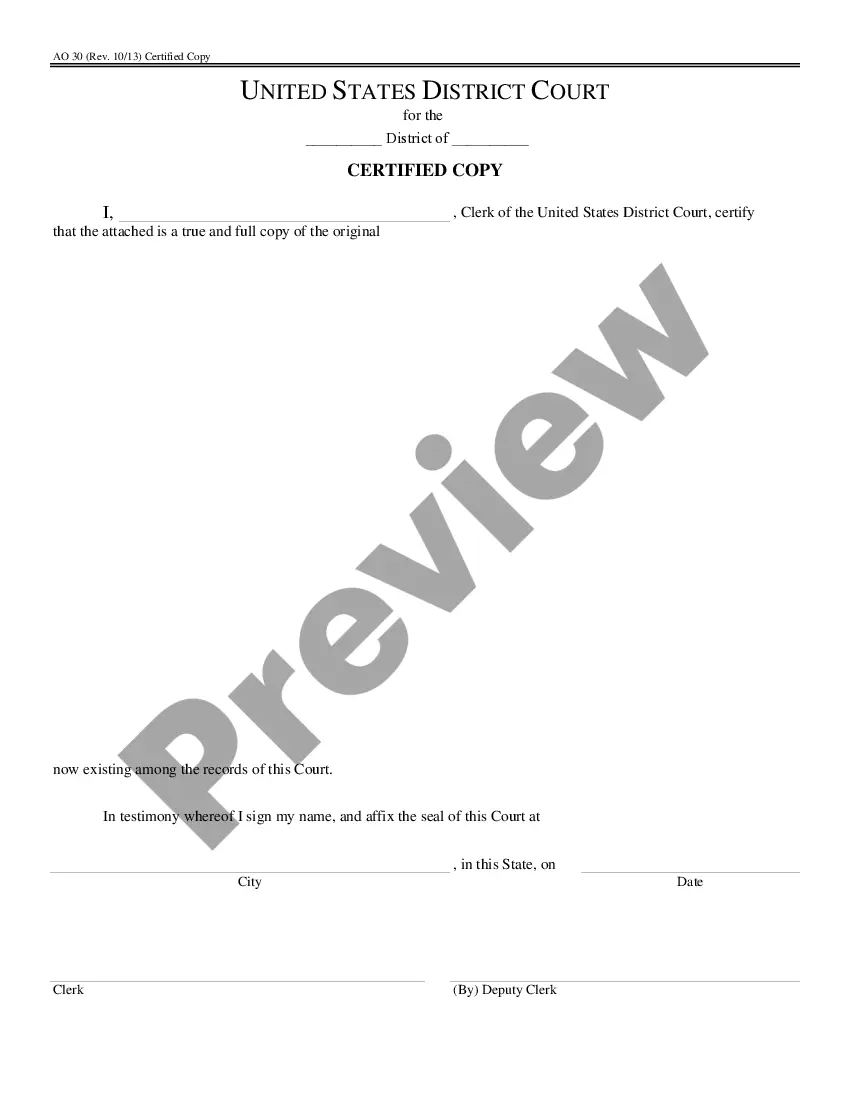

- Confirm that this is the correct form by previewing it and checking its details.

- Ensure that the sample is valid in your state or jurisdiction.

- Select Buy Now once you are ready.

- Choose a subscription plan.

- Select the file format you require, then Download, fill out, eSign, print, and send your documents.

- Access region- or jurisdiction-specific legal and business documents.

- US Legal Forms addresses any requirements you may have, ranging from personal to business paperwork, all in one location.

- Utilize state-of-the-art tools to complete and manage your Payment Schedule Form Sample With Tax.

Form popularity

FAQ

The form for monthly tax payment typically includes essential information such as your tax identification number, payment amount, and due date. A payment schedule form sample with tax can assist in organizing these details effectively. By using resources from US Legal Forms, you can find the appropriate forms and ensure you meet all regulatory requirements for timely tax payments.

To make a scheduled payment, first verify the amount and due date on your payment schedule. Ensure you have the necessary funds available in your account. Utilizing a payment schedule form sample with tax can streamline this process, as it provides a clear overview of your obligations. US Legal Forms allows users to create and track these payments easily, ensuring you never miss a due date.

Creating a payment schedule involves determining the frequency and amount of payments. Begin by listing all due dates and the total amount owed. Incorporating a payment schedule form sample with tax can help you organize this information effectively. US Legal Forms offers various samples that can simplify this process, allowing you to create a clear and structured payment plan.

To create a payment plan template, start by outlining the key elements you need. Include the payment amount, due dates, and any applicable fees. By using a payment schedule form sample with tax, you can ensure accuracy and compliance with tax regulations. Consider utilizing online platforms like US Legal Forms, where you can find customizable templates that suit your specific needs.

Yes, including the appropriate schedules with your tax return is crucial for accurate reporting. These schedules provide detailed information about your income, deductions, and credits, which may affect your tax liability. By using a payment schedule form sample with tax, you can ensure that all relevant schedules are included, thereby supporting your tax filings and avoiding potential issues with the IRS.

To create a payment schedule, start by identifying the total amount owed and the frequency of payments, such as weekly or monthly. Next, determine the due dates and any interest or fees that may apply. It's essential to document this information in a clear format, which can be facilitated by a payment schedule form sample with tax available on platforms like uslegalforms. This structured approach helps you stay organized and compliant.

A payment schedule outlines the timing and amounts of payments due under a contract or agreement. It provides clarity on when payments are expected and helps both parties manage their finances effectively. Having a clear payment schedule can prevent misunderstandings and promote timely payments. Utilizing a payment schedule form sample with tax can ensure you meet your tax obligations accurately.

Schedules A, B, C, D, E, F, and H refer to different forms used by the IRS to report specific types of income, expenses, and deductions. Each schedule serves a unique purpose in detailing your financial activities. For instance, Schedule A is commonly used for itemized deductions, while Schedule C is for business income. Understanding these schedules can enhance your financial reporting and streamline your payment schedule form sample with tax.

Writing up a payment schedule requires clear organization and understanding of your financial obligations. Start by listing the total amount owed, then break it down into manageable payments over a set period. A payment schedule form sample with tax can simplify this process by providing a template to follow. This helps you visualize your payment timeline and ensures you meet your obligations.

Setting up a payment arrangement for taxes involves contacting the IRS directly or using their online services. You will need to provide your financial information to determine a suitable payment amount. After that, you can draft a payment schedule form sample with tax to outline your payment plan. This structured approach helps ensure you stay on track with your payments.