Payroll Independent Contractor With Amazon

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

Whether for commercial intentions or for personal issues, everyone encounters legal circumstances eventually in their lifetime.

Completing legal documents requires meticulous care, beginning with choosing the right form template.

Once downloaded, you can fill out the form using editing software or print it and complete it by hand. With a vast US Legal Forms catalog available, there is no need to waste time searching for the right template online. Use the library's user-friendly navigation to find the correct form for any situation.

- For instance, if you select the incorrect version of the Payroll Independent Contractor With Amazon, it will be rejected once you submit it.

- Thus, it is essential to have a reliable provider of legal documents like US Legal Forms.

- If you need to acquire a Payroll Independent Contractor With Amazon template, follow these straightforward steps.

- Locate the sample you require by utilizing the search bar or browsing the catalog.

- Review the description of the form to ensure it is appropriate for your case, jurisdiction, and county.

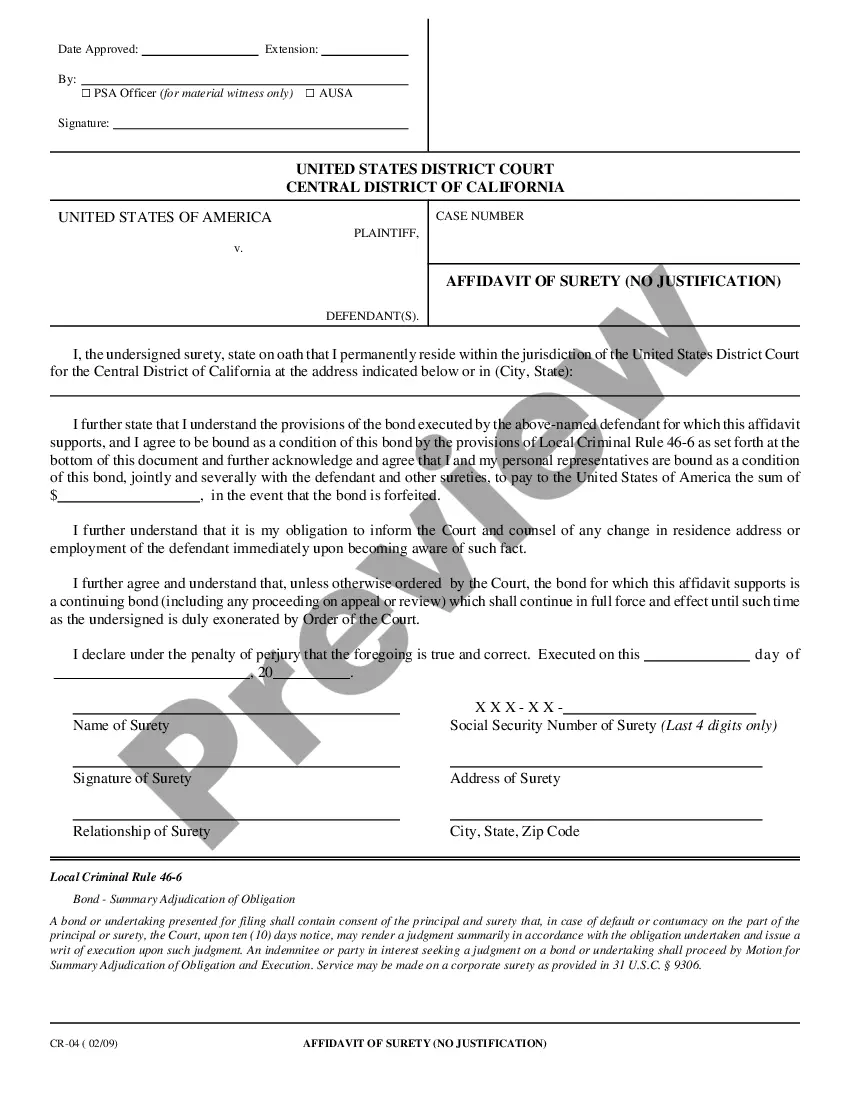

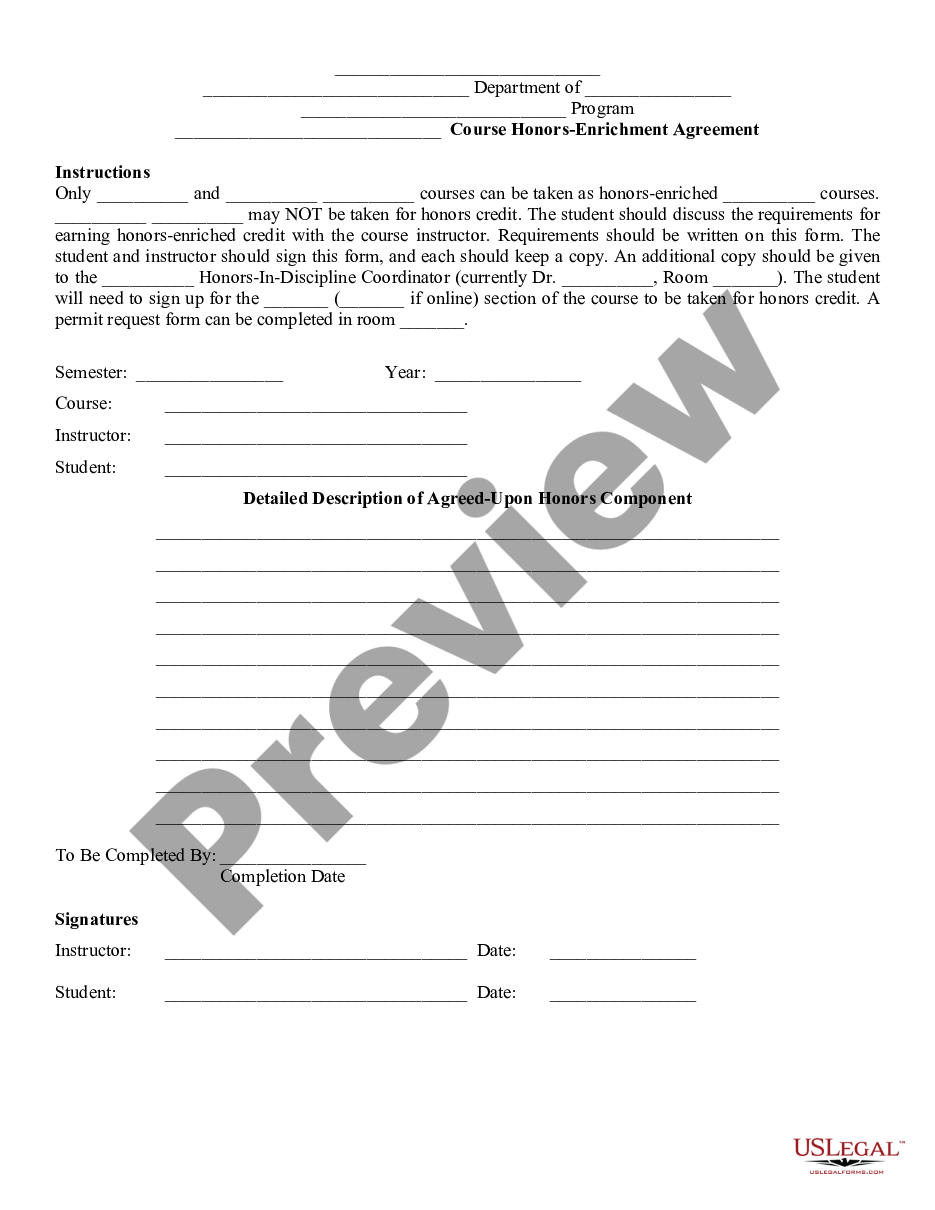

- Click on the preview of the form to examine it.

- If it is not the correct document, return to the search feature to find the Payroll Independent Contractor With Amazon sample you need.

- Download the file if it aligns with your needs.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: a credit card or PayPal account.

- Select the file format you desire and download the Payroll Independent Contractor With Amazon.

Form popularity

FAQ

Common forms Amazon Flex Delivery Drivers for 2023 tax season are: 1099-NEC: If you earn more than $600 with Amazon Flex, expect to get the ?non-employee compensation? 1099 form. However, if it's under $600, you will not receive the form. But, you must still report the income to avoid penalties.

It's simple: you're an independent contractor.

If you are an Amazon Flex delivery driver, you may be asked to provide proof of income or employment to a third party, such as a landlord, loan provider, or government agency. In these situations, Amazon Flex earnings can be used as proof of income.

Amazon considers Flex drivers self-employed independent contractors.

U.S. Tax Identification Number (TIN) If you select ? Individual? as the type of beneficial owner, your U.S. TIN can take the form of a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). You may not enter an Employer Identification Number (EIN).