Independent Contractor Geologsit Form

Description

How to fill out Geologist Agreement - Self-Employed Independent Contractor?

There's no longer any need to squander time looking for legal documents to adhere to your local state legislation.

US Legal Forms has gathered all of them in a single location and enhanced their accessibility.

Our website offers over 85k templates for any business and personal legal situations categorized by state and area of application. All forms are properly drafted and confirmed for validity, so you can feel confident in obtaining an updated Independent Contractor Geologsit Form.

Click Buy Now next to the template name once you identify the correct one. Choose the most appropriate subscription plan and register for an account or Log In. Proceed to pay for your subscription using a credit card or PayPal. Select the file format for your Independent Contractor Geologsit Form and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to edit it online. Preparing formal documents under federal and state regulations is quick and easy with our platform. Try US Legal Forms today to maintain your documentation organized!

- If you are acquainted with our service and already possess an account, you must ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documentation at any time by accessing the My documents tab in your profile.

- If you have never used our service before, the process will require additional steps to complete.

- Here's how new users can find the Independent Contractor Geologsit Form in our catalog.

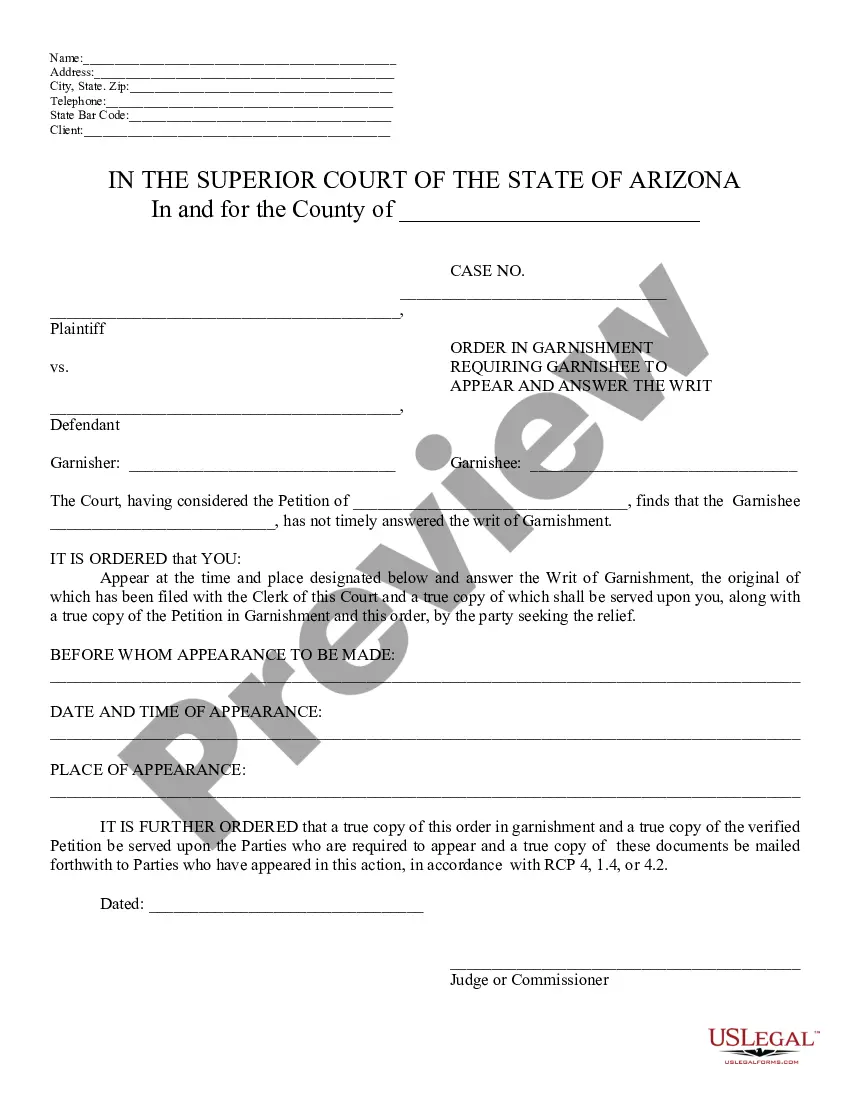

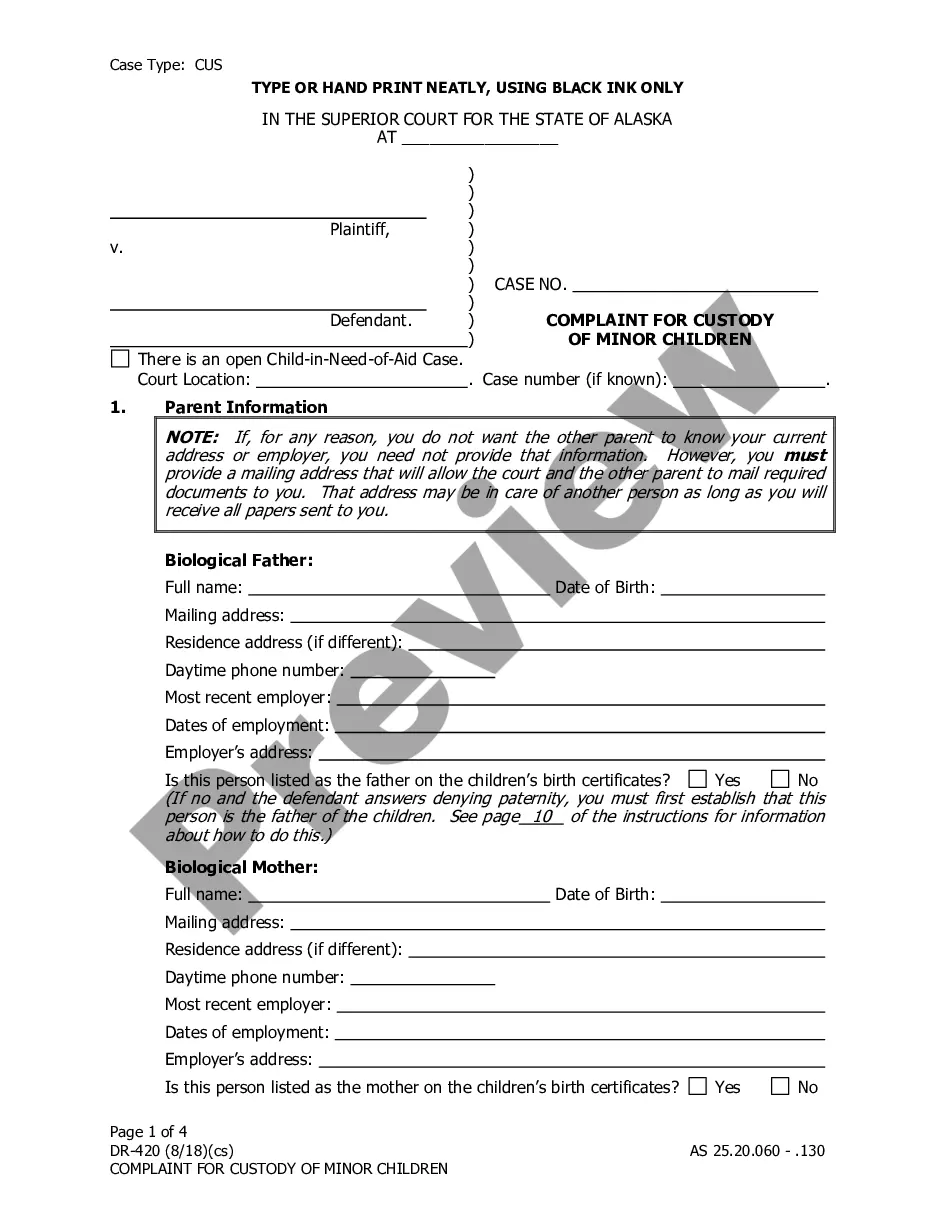

- Examine the page content thoroughly to ensure it includes the sample you need.

- To do this, utilize the form description and preview options if available.

- Employ the Search bar above to find an alternative sample if the current one does not suit you.

Form popularity

FAQ

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

You should have the following on hand to fill out the 1099-MISC form:Payer's (that's you!) name, address, and phone number.Your TIN (Taxpayer Identification Number)Recipient's TIN.Recipient's name and address.Your account number, if applicable.Amount you paid the recipient in the tax year.

Payers use Form 1099-MISC, Miscellaneous Information or Form 1099-NEC, Nonemployee Compensation to: Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099-NEC).

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship).Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.You may need to make estimated tax payments.

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...