Self Employed Independent Worker For Short

Description

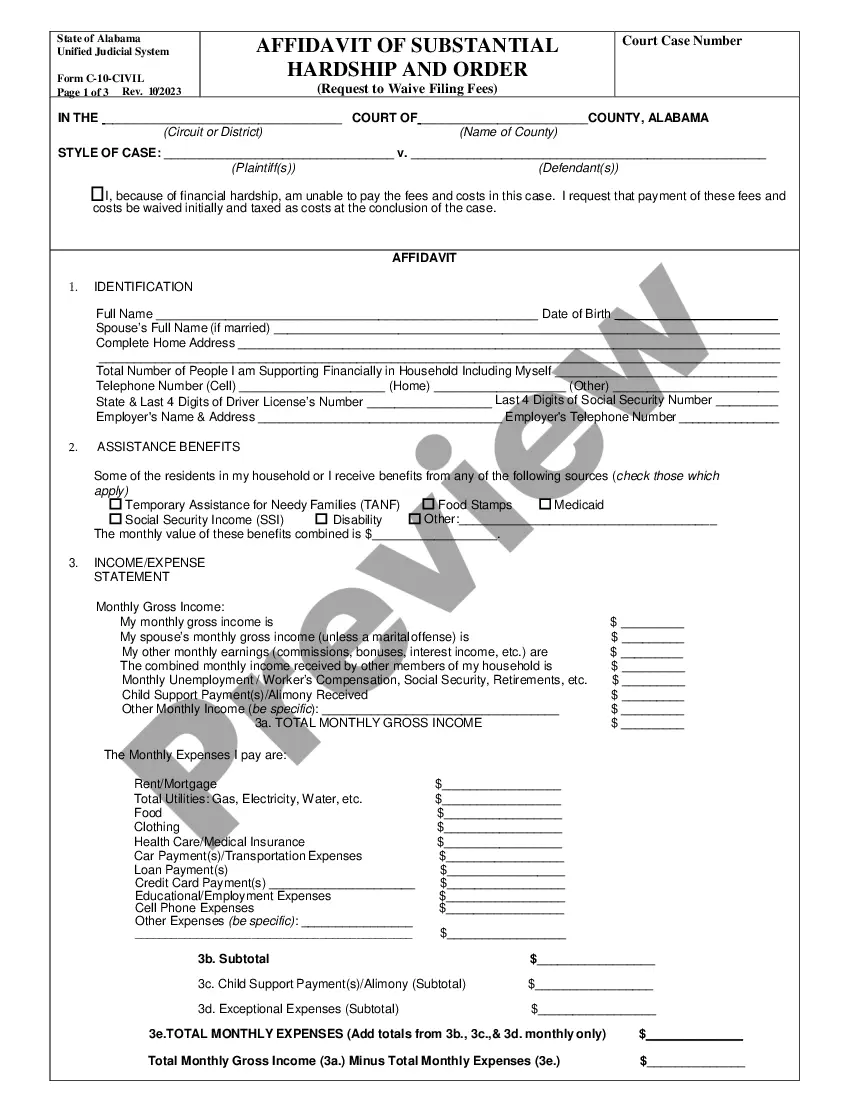

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

Regardless of whether for corporate objectives or personal matters, everyone must confront legal circumstances eventually in their lifetime.

Completing legal paperwork necessitates meticulous attention, beginning with choosing the appropriate form template.

Pick the format of the document you desire and download the Self Employed Independent Worker For Short.

- For example, if you select an incorrect version of a Self Employed Independent Worker For Short, it will be rejected when you submit it.

- Thus, it is vital to have a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain a Self Employed Independent Worker For Short template, follow these straightforward steps.

- Locate the template you require by using the search box or browsing the catalog.

- Review the form’s description to ensure it pertains to your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search function to find the Self Employed Independent Worker For Short template you need.

- Download the template if it satisfies your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: either via credit card or PayPal account.

Form popularity

FAQ

CRIMINAL cases are available, unless sealed, on the UJS system from 1989 to present. CIVIL cases, unless confidential or sealed, are available from 2003 to present. Active money judgments are available for the past 20 years and inactive money judgments from April 19, 2004 to present.

South Dakota generates the bulk of its tax revenue by levying a general sales tax and select sales taxes (otherwise known as excise taxes). The state derives its constitutional authority to tax from Article XI of the state constitution. Tax policy can vary from state to state.

Certain gross receipts resulting from the sale of tangible personal property by civic and nonprofit associations are exempt from the state and local sales taxes. Sales to these associations are generally subject to the state and municipal sales tax.

You must be 65 years old or older OR disabled (as defined by the Social Security Act). You must own the property. Un-remarried widow/widowers of persons previously qualified may still qualify. Income limits apply.

Some customers are exempt from paying sales tax under South Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered electronically) into South Dakota.

Sales and Use Tax A church is not exempt from paying sales tax on purchases even though it may have a 501(c)(3) or other exempt status with the IRS. A church is not required to have a sales tax license for most activities, but it may be required to obtain a license if it sells taxable products or services.

For civil record searches and questions regarding criminal and civil record searches, you can send an e-mail to: USJPARupport@ujs.state.sd.us. Criminal and protection order searches are available on the Public Access System or PARS at: . There is a $20 fee for each submitted search.