Agreement Contractor Form Contract For Borrowing Money

Description

How to fill out Attorney Agreement - Self-Employed Independent Contractor?

Individuals often link legal documentation with a notion of intricacy that only an expert can handle.

In some respects, this is accurate, as creating the Agreement Contractor Form Contract For Borrowing Money necessitates a thorough comprehension of subject matter criteria, including state and local statutes.

However, with US Legal Forms, everything has become more straightforward: pre-prepared legal templates for any life and business event tailored to state legislation are compiled in a unified online library and are now accessible to everyone.

Complete your payment via PayPal or with your credit card. Select the format for your sample and click Download. You can print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once bought, they remain stored in your profile. You can access them at any time through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and area of application, making the search for the Agreement Contractor Form Contract For Borrowing Money or any other specific template only a matter of minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to acquire the form.

- New users to the service will need to create an account and subscribe before they can download any documentation.

- Follow this step-by-step guide to acquire the Agreement Contractor Form Contract For Borrowing Money.

- Examine the page content meticulously to ensure it fulfills your requirements.

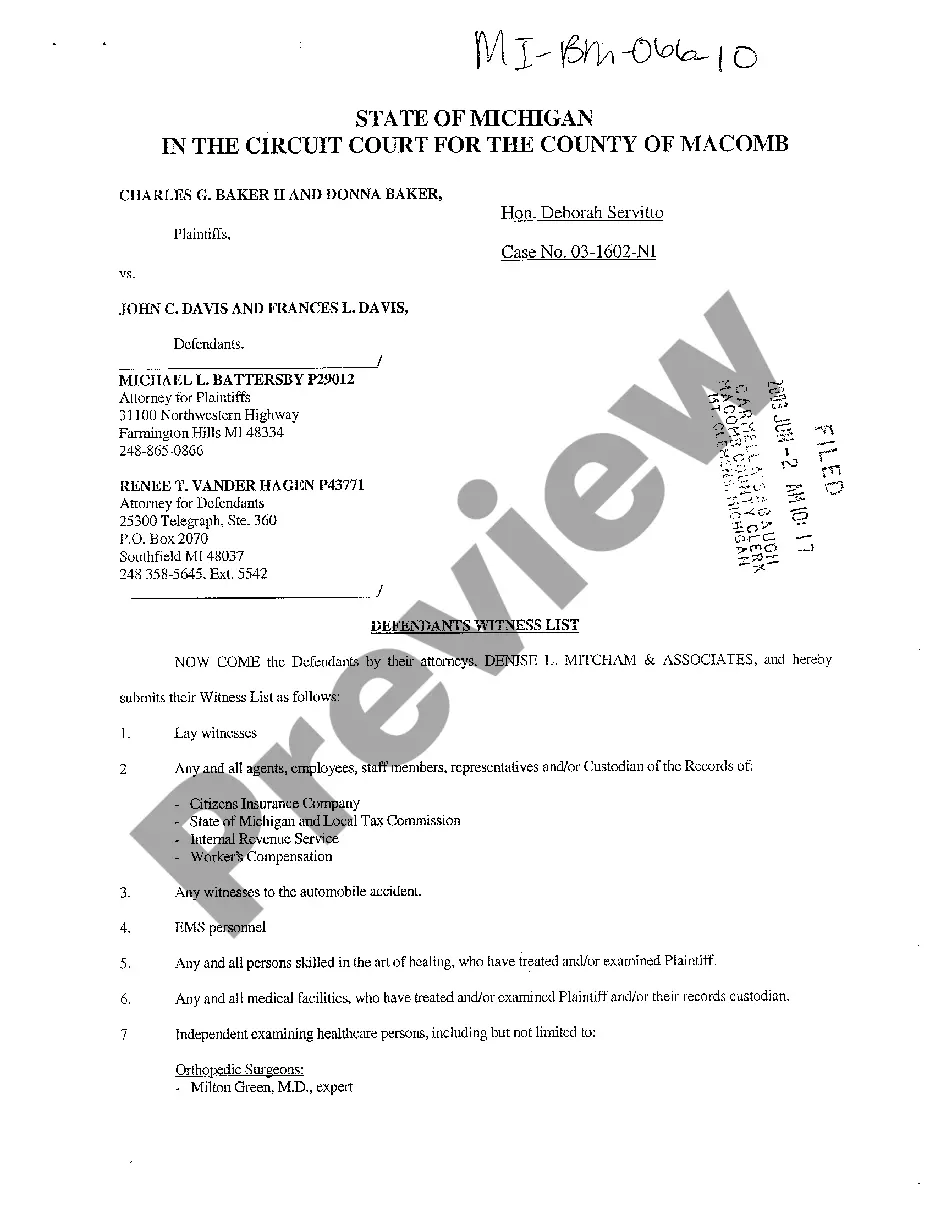

- Review the form description or confirm it via the Preview option.

- If the previous choice does not fit you, seek another sample using the Search bar in the header.

- When you discover the correct Agreement Contractor Form Contract For Borrowing Money, click Buy Now.

- Choose a pricing plan that aligns with your needs and financial capability.

- Sign up for an account or Log In to advance to the payment page.

Form popularity

FAQ

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

Loan agreements are beneficial for borrowers and lenders for many reasons. Namely, this legally binding agreement protects both of their interests if one party fails to honor the agreement. Aside from that, a loan agreement helps a lender because it: Legally enforces a borrower's promise to pay back the money owed.