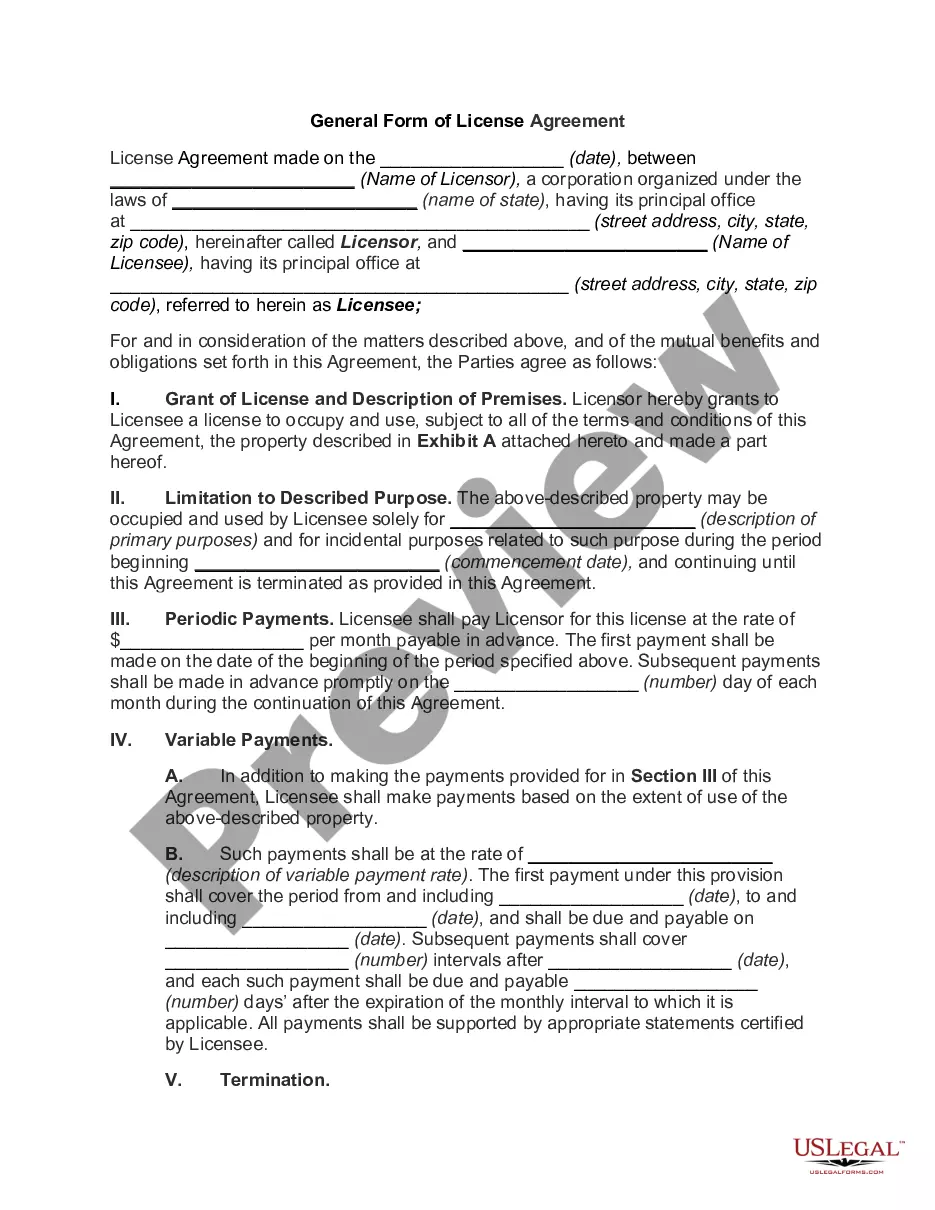

Agreement Self Employed Forgiveness Ppp

Description

How to fill out Agreement Self Employed Forgiveness Ppp?

Maneuvering through the red tape of official documents and templates can be challenging, particularly when one does not engage in that professionally.

Even selecting the appropriate template for the Agreement Self Employed Forgiveness Ppp will be labor-intensive, as it has to be valid and precise to the very last detail.

However, you will need to invest significantly less time locating a suitable template if it originates from a source you can trust.

Obtain the correct form in a few straightforward steps: Enter the title of the document in the search bar. Select the appropriate Agreement Self Employed Forgiveness Ppp from the results. Review the description of the sample or view its preview. If the template meets your needs, click Buy Now. Choose your subscription plan. Utilize your email and create a secure password to register for an account at US Legal Forms. Pick a credit card or PayPal payment option. Save the template document to your device in your preferred format. US Legal Forms will save you time and energy verifying whether the form you found online suits your needs. Set up an account and gain unrestricted access to all the templates you require.

- US Legal Forms is a service that eases the process of locating the appropriate forms online.

- US Legal Forms is a single point where one can obtain the latest templates of documents, verify their usage, and download these templates to complete them.

- It is a repository with over 85,000 forms that are relevant in various fields.

- When searching for an Agreement Self Employed Forgiveness Ppp, you won't have to doubt its relevance as all of the forms are validated.

- Having an account at US Legal Forms guarantees you have all the necessary templates within your reach.

- Store them in your history or add them to the My documents collection.

- You can access your saved forms from any device by clicking Log In at the library website.

- If you still don’t possess an account, you can always search again for the template you require.

Form popularity

FAQ

Self-employed workers can now receive up to 100% forgiveness on PPP loans.

Any amount forgiven is recorded as gain from extinguishment/forgiveness of debt once legally released from being the primary obligor. Gain from forgiveness is presented on its own line in the income statement as other income or operating income (since location is not specified by US GAAP).

Federal payroll tax filings (IRS Form 941) Income, payroll, and unemployment insurance filings from your state. Receipts for employer contributions to group benefit plans. Receipts for any retirement plan contributions.

PPP borrowers are eligible for forgiveness in an amount equal to the sum of their eligible expenses during their chosen 8-week to 24-week Covered Period. To be considered for full forgiveness, borrowers must use at least 60% of their loan proceeds on payroll costs.

Federal payroll tax filings (IRS Form 941) Income, payroll, and unemployment insurance filings from your state. Receipts for employer contributions to group benefit plans. Receipts for any retirement plan contributions.