Garnishment Can Wage With W2

Description

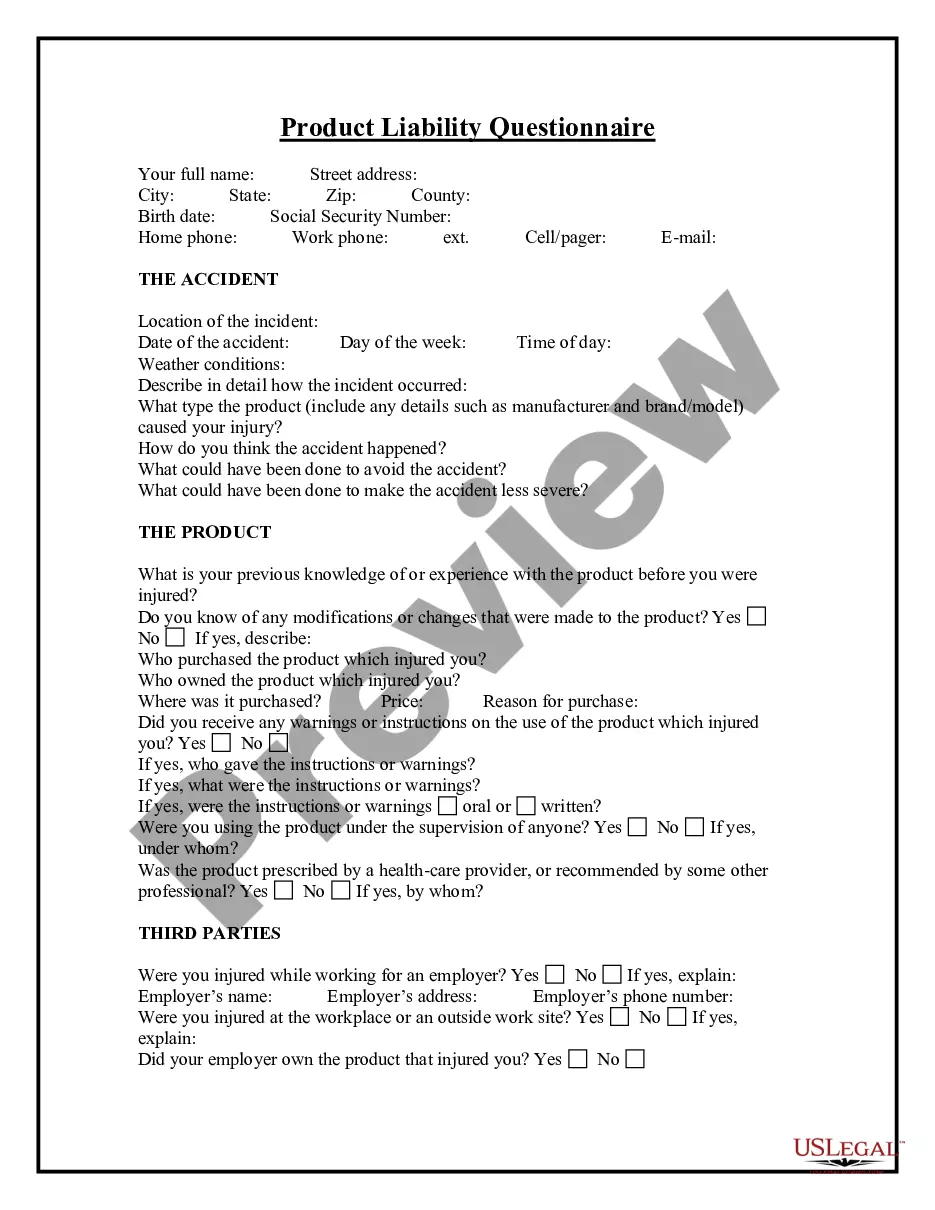

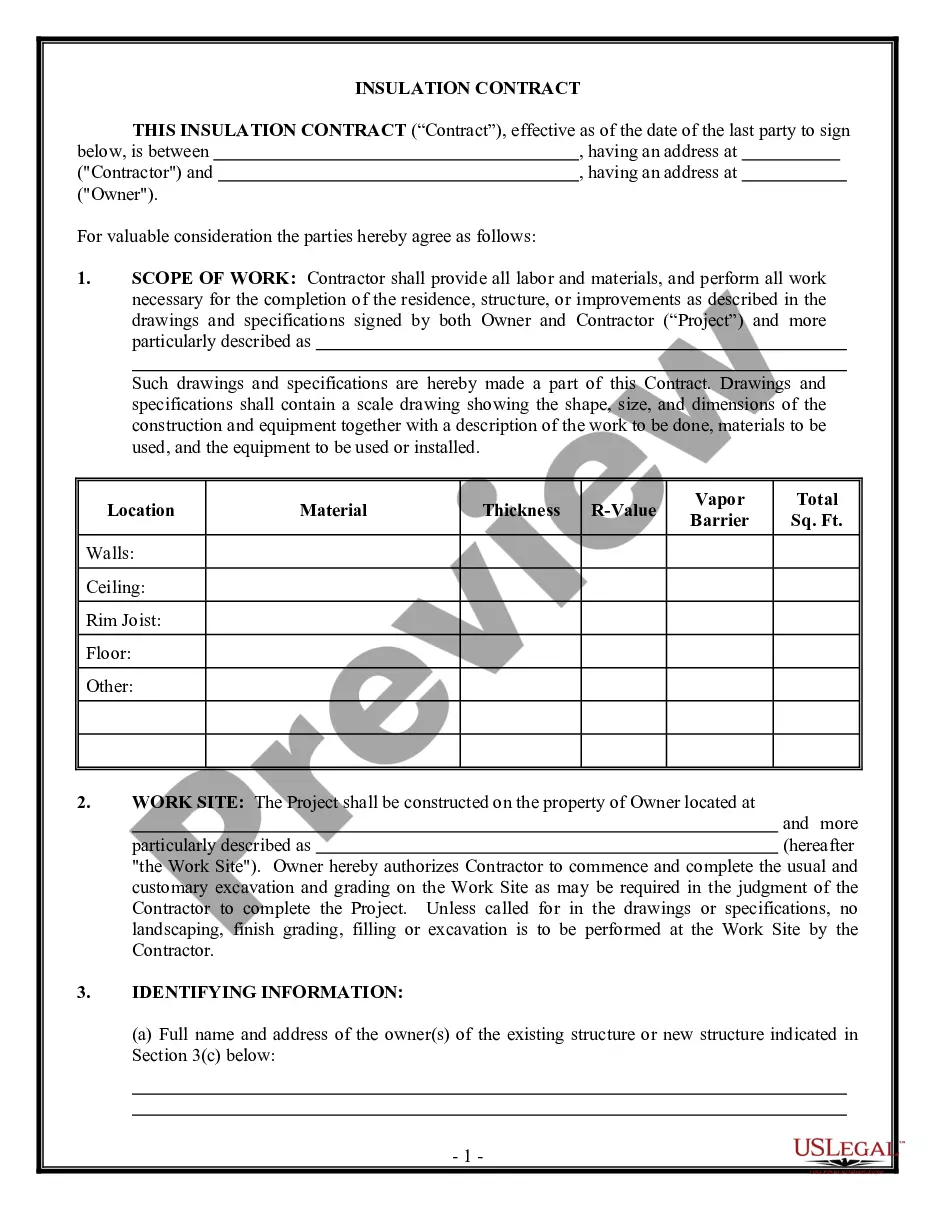

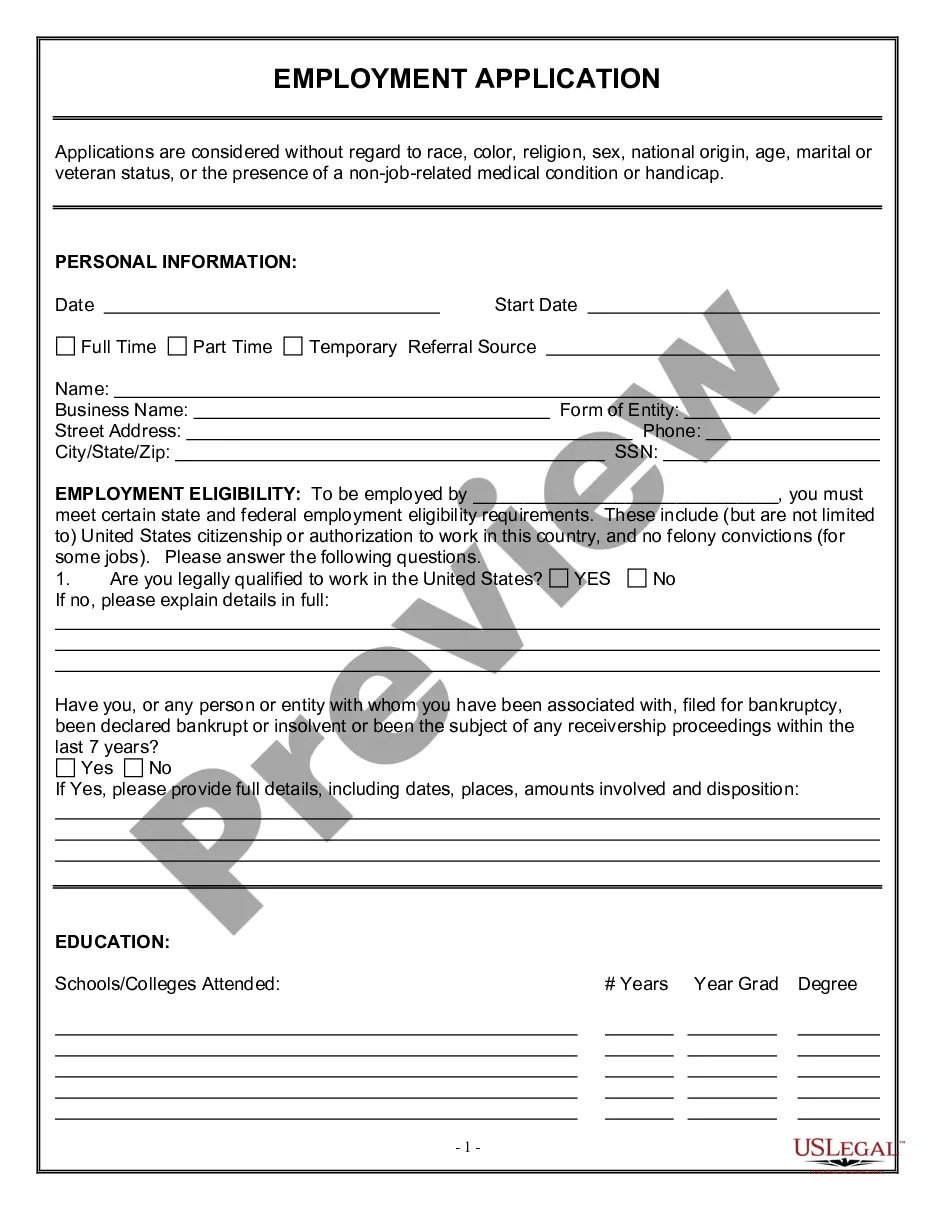

How to fill out USLegal Guide On How To Stop Garnishment?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations might require extensive investigation and significant expenses.

If you’re seeking a simpler and more cost-effective way of drafting Garnishment Can Wage With W2 or any other paperwork without the hassle of navigating through obstacles, US Legal Forms is readily available for you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-specific forms meticulously prepared for you by our legal experts.

Examine the document preview and descriptions to ensure you are viewing the form you seek. Verify that the form you select complies with your state and county requirements. Choose the most appropriate subscription option to purchase the Garnishment Can Wage With W2. Download the document. Then fill it out, sign it, and print it. US Legal Forms has an excellent reputation and over 25 years of experience. Join us today and make form completion an easy and efficient process!

- Utilize our website whenever you need a dependable and trustworthy service through which you can rapidly locate and download the Garnishment Can Wage With W2.

- If you’re familiar with our services and have already established an account with us, simply sign in to your account, choose the form, and download it or re-download it anytime later in the My documents section.

- Not registered yet? No problem. It takes just a few minutes to set it up and browse the catalog.

- But before diving straight into downloading Garnishment Can Wage With W2, adhere to these suggestions.

Form popularity

FAQ

You do not need to separately report wage garnishment on your tax return, as it is already accounted for in your W-2 income. The net income shown after garnishment deductions will reflect your actual earnings. Keep in mind that while garnishments do not require separate reporting, they do influence your overall financial situation. Familiarizing yourself with how garnishment can wage with W-2 will assist you in staying organized during tax season.

Wage garnishments can have an indirect effect on your taxes. Since your gross income decreases due to garnishments, this may influence your overall taxable income. Therefore, it is important to factor in these deductions when assessing your tax liability. Understanding the relationship between garnishment can wage with W-2 can help you manage your finances and prepare for tax season effectively.

The amount required for wage garnishment to take effect varies depending on state laws and the type of debt involved. Generally, if you earn above a certain threshold, a creditor may seek to garnish your wages. It's crucial to know your rights and the specifics of your situation, as garnishment can wage with W-2 and influence how much you actually take home. For tailored guidance, consider using platforms like UsLegalForms.

Yes, wage garnishments can appear on your W-2 form if they affect your wages during the tax year. Specifically, when your employer deducts amounts for garnishment, it may reflect in the total wages reported. Therefore, you should keep track of any garnishment amounts throughout the year, as they can impact your overall financial picture. Understanding how garnishment can wage with W-2 will help you prepare your taxes more accurately.

Handling garnishments in payroll requires precise record-keeping and communication with affected employees. Make sure to keep updated records on the amount to be garnished, and adjust employee paychecks accordingly. Utilizing platforms like uslegalforms can simplify compliance with garnishment laws, ensuring that all deductions are calculated correctly and in a timely manner.

Yes, the IRS does inform you if your wages are being garnished due to unpaid taxes. They will send you a Notice of Intent to Levy, allowing you some time to address the tax issue before garnishment begins. It is important to act quickly, as failure to respond could lead to automatic deductions from your wages.

When filling out a W-2 wage and tax statement, you will need to enter your employer's information, including their name, address, and Employer Identification Number. Next, include your personal information, such as your name, address, and Social Security number. It is important to report your total wages earned and the federal and state taxes withheld accurately, as this information can impact eventual garnishment of wages.

You will typically notice a reduction in your paycheck if your wages are being garnished. Check your paystub for any deductions labeled as garnishments and review the amounts carefully. If you see an unexpected decrease, investigate further by contacting your employer or the creditor involved. Using platforms like US Legal Forms can also clarify your situation and provide you with helpful information.

Unfortunately, yes, wages can be garnished without your prior knowledge, particularly if a creditor obtains a court order. You might receive little to no notice before the garnishment takes effect. It’s crucial to stay informed about any debts or legal issues, as this can help you anticipate potential wage garnishments. If you suspect an issue, consider using resources like US Legal Forms to understand your rights.

Yes, employers are informed when wages are garnished because they are legally required to comply with the court order. When your wages are subject to garnishment, your employer processes the necessary deductions from your paycheck. Although they manage the garnishment, they may not disclose the reasons for it to others, maintaining your privacy in the matter.