Garnished Wages Earnings Without Notification

Description

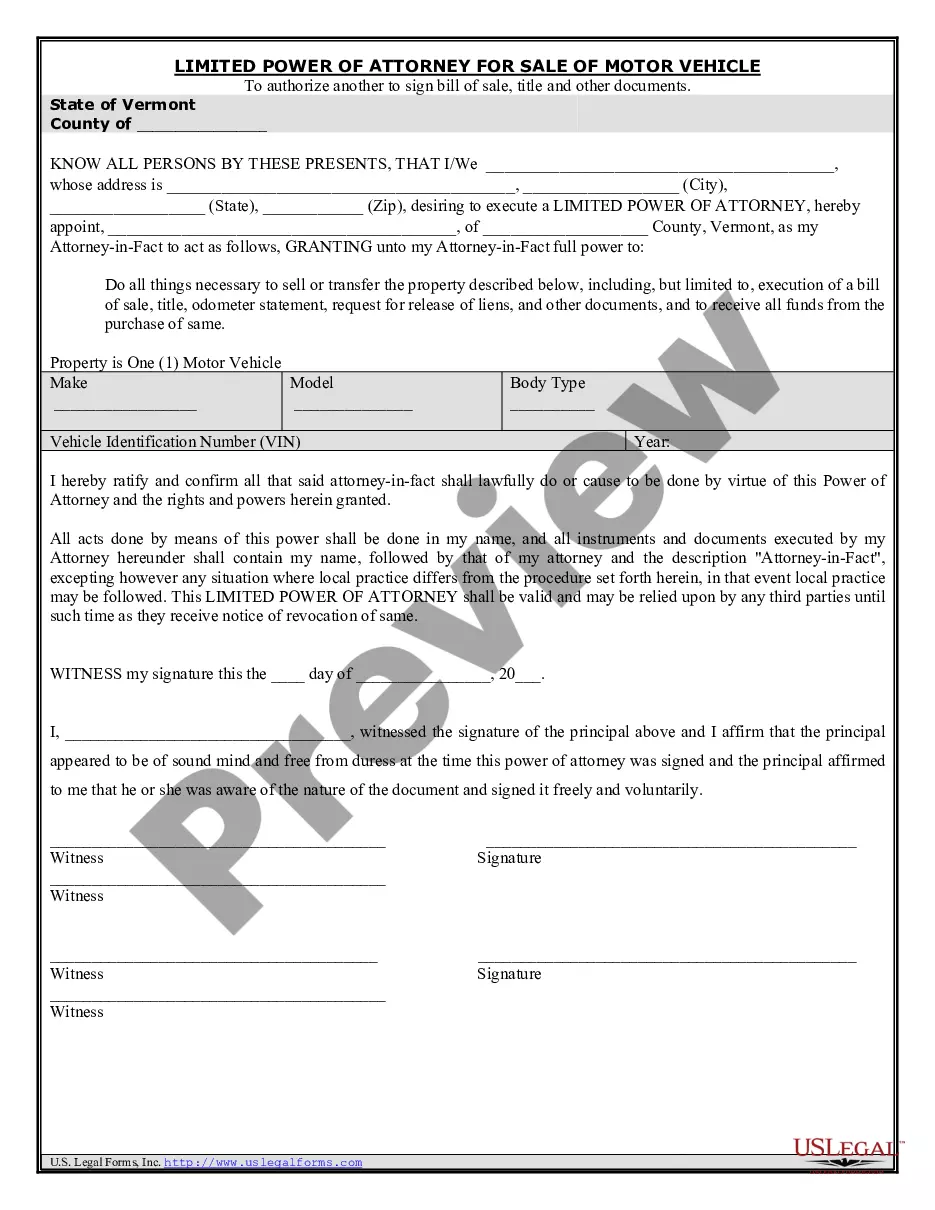

How to fill out USLegal Guide On How To Stop Garnishment?

The Garnished Wages Earnings Without Notification displayed on this page is a reusable legal document created by experienced attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 verified, state-specific templates for any business and personal occasion. It’s the quickest, simplest, and most reliable method to obtain the documents you require, as the service ensures bank-level data security and anti-malware safeguards.

Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any forms you have purchased earlier. Subscribe to US Legal Forms to have verified legal templates for all of life’s situations available at your convenience.

- Search for the document you require and review it.

- Go through the file you looked up and preview it or read the form description to confirm it meets your needs. If it doesn’t, use the search feature to find the correct one. Click Buy Now when you have located your desired template.

- Choose a pricing plan that fits your requirements and create an account. Make a swift payment using PayPal or a credit card. If you already possess an account, Log In and check your subscription to proceed.

- Select the format you want for your Garnished Wages Earnings Without Notification (PDF, DOCX, RTF) and save the template on your device.

- Print the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with an eSignature.

Form popularity

FAQ

The IRS has the authority to garnish your wages without notifying you in advance, especially if you owe back taxes. They usually send a notice after the garnishment is in place, but many people find this out too late. Understanding how these processes work can help you protect your income. US Legal Forms can assist you in exploring your options regarding garnished wages earnings without notification, ensuring you take informed steps.

The government can, indeed, garnish your wages without notice, particularly in cases involving tax debts. While they typically send notifications through the mail, the actual garnishment can happen before you receive these notifications. Being proactive in managing your financial obligations can help prevent sudden wage garnishments. If you're facing uncertainties regarding garnished wages earnings without notification, US Legal Forms provides resources to help you respond effectively.

Yes, employers can initiate wage garnishment without prior notification to you in some circumstances. This process often occurs when creditors secure a court order due to unpaid debts. If your wages get garnished without notification, you may not be immediately aware of it. To navigate these complex situations, consider utilizing services like US Legal Forms to understand your rights better regarding garnished wages earnings without notification.

Yes, your employer will know if your wages are garnished due to the legal obligations imposed on them. Once the garnishment order is received, they must process the deductions according to the court's decision. Understanding this can help you prepare for potential conversations with your employer.

In most cases, your employer will be notified if your wages are garnished. Once a court order is in place, your employer is legally obligated to comply by withholding the designated amount from your paycheck. While this can feel uncomfortable, knowledge about garnished wages earnings without notification can empower you.

To calculate disposable earnings for garnishment, you first need to determine your total income and subtract mandatory deductions like federal taxes, Social Security, and retirement contributions. The remaining sum is typically considered disposable earnings and can be subject to garnishment. It's important to know these figures, especially if you want to challenge garnishments.

Writing a letter of garnishment for wages requires several key details. You need to specify the amount to be garnished, include your creditor's information, and outline the basis of the debt. Ensuring all relevant information is present will help avoid delays or disputes.

A wage garnishment may not directly affect your job performance, but it could affect your relationship with your employer. Some employees feel stressed or embarrassed about their financial situation. It's crucial to know your rights regarding garnished wages earnings without notification and how to navigate the situation.

Wage garnishments can show up in a background check, particularly if they are reported to credit bureaus. While not directly listed, the presence of a judgment can indicate financial issues. This could indirectly affect future job opportunities, so it's wise to be aware of your financial standing.

Yes, wages can be garnished without prior notification under certain circumstances. If a creditor obtains a court order, they may proceed with the garnishment without informing you beforehand. This situation often arises from legal debts where you were unable to respond to a summons.