Letter Short Sale With A Va Loan

Description

How to fill out Sample Letter For Short Sale Request To Lender?

Obtaining legal templates that meet the federal and regional laws is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the correctly drafted Letter Short Sale With A Va Loan sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are simple to browse with all documents arranged by state and purpose of use. Our experts keep up with legislative changes, so you can always be sure your paperwork is up to date and compliant when acquiring a Letter Short Sale With A Va Loan from our website.

Obtaining a Letter Short Sale With A Va Loan is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the guidelines below:

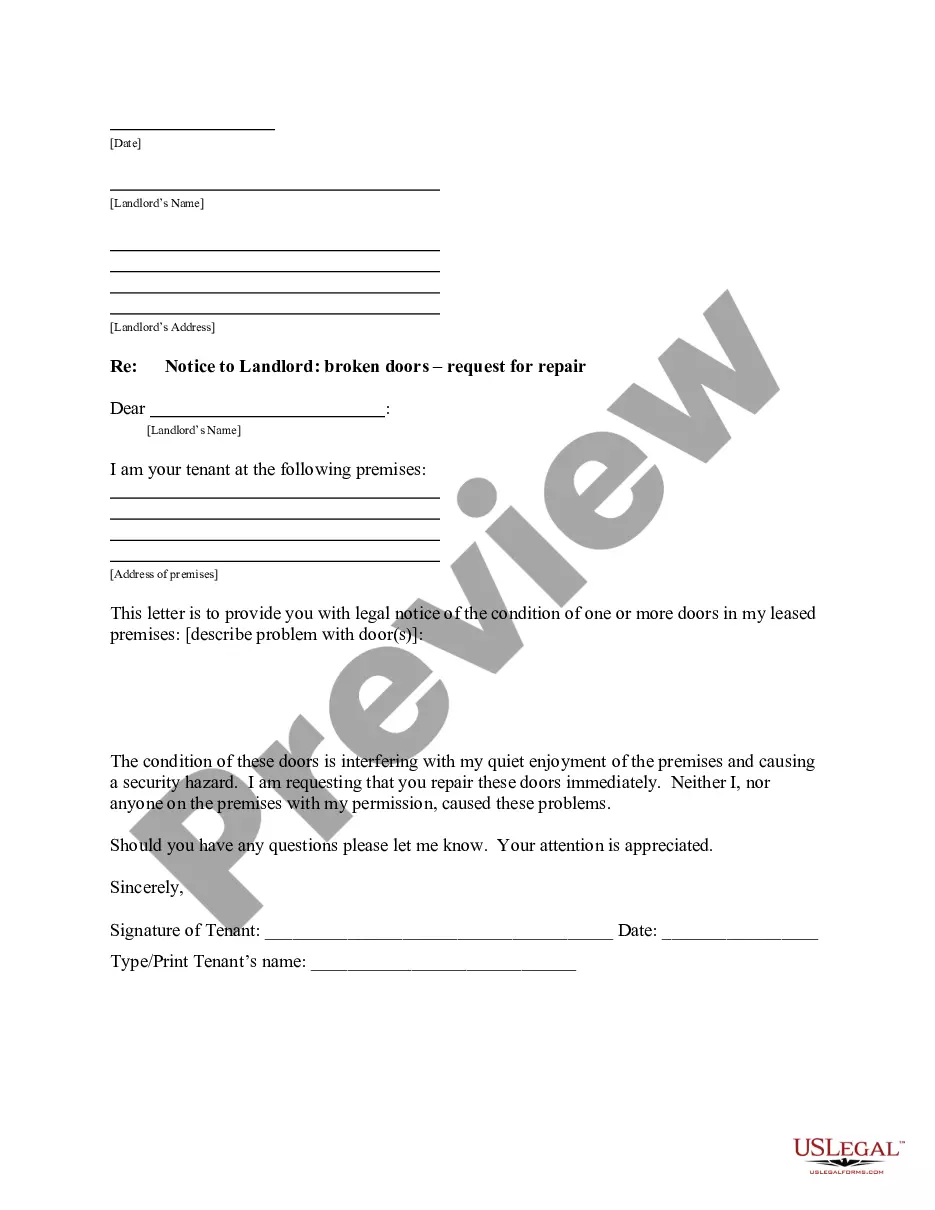

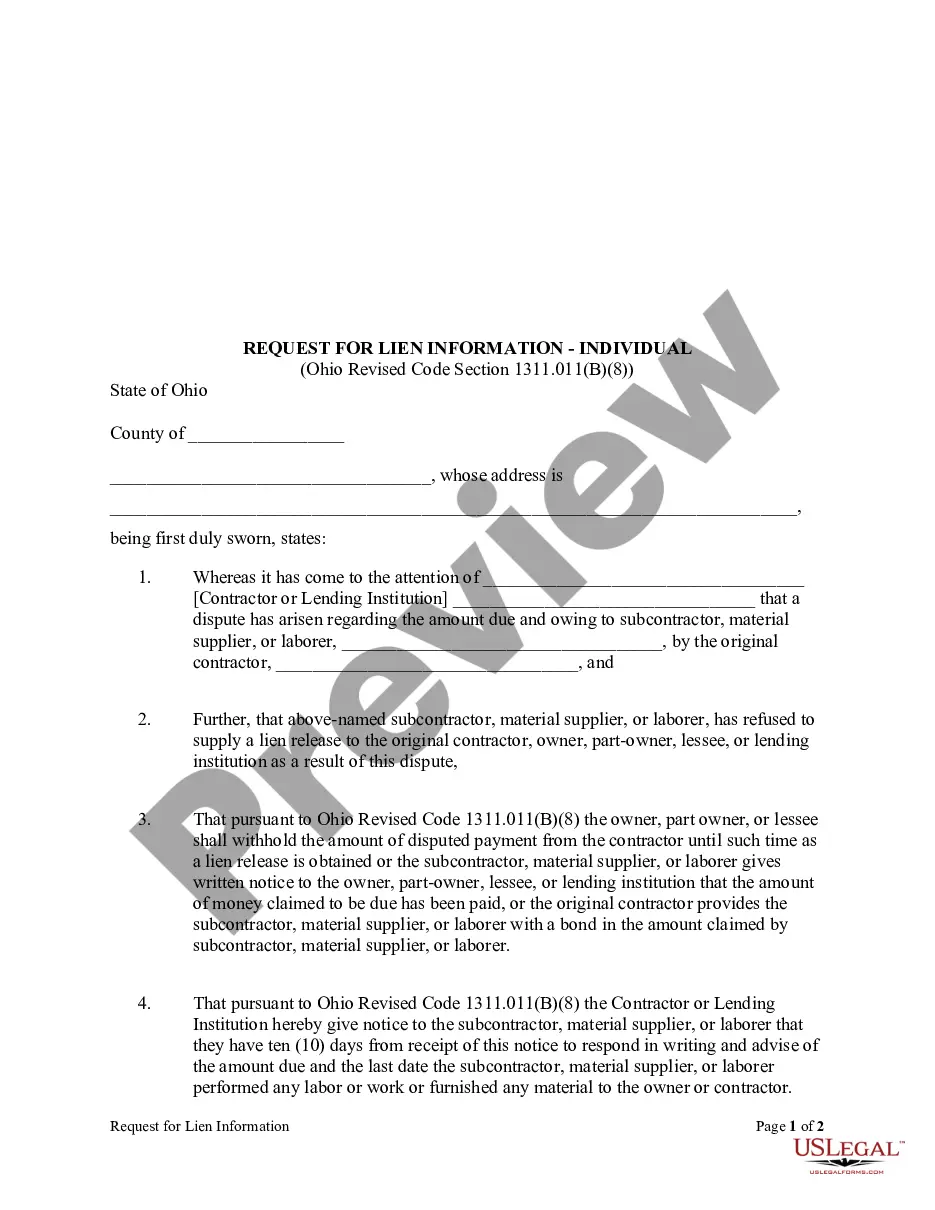

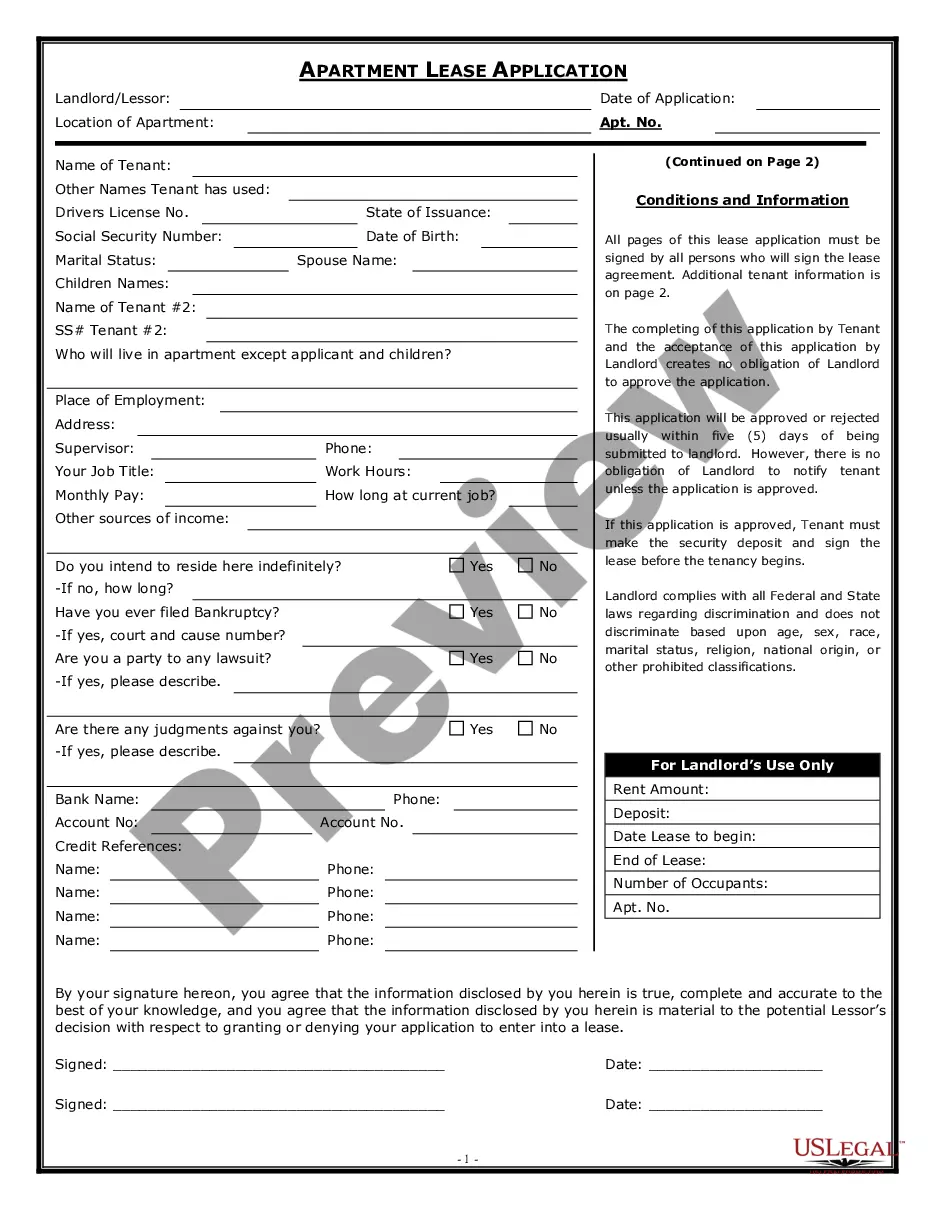

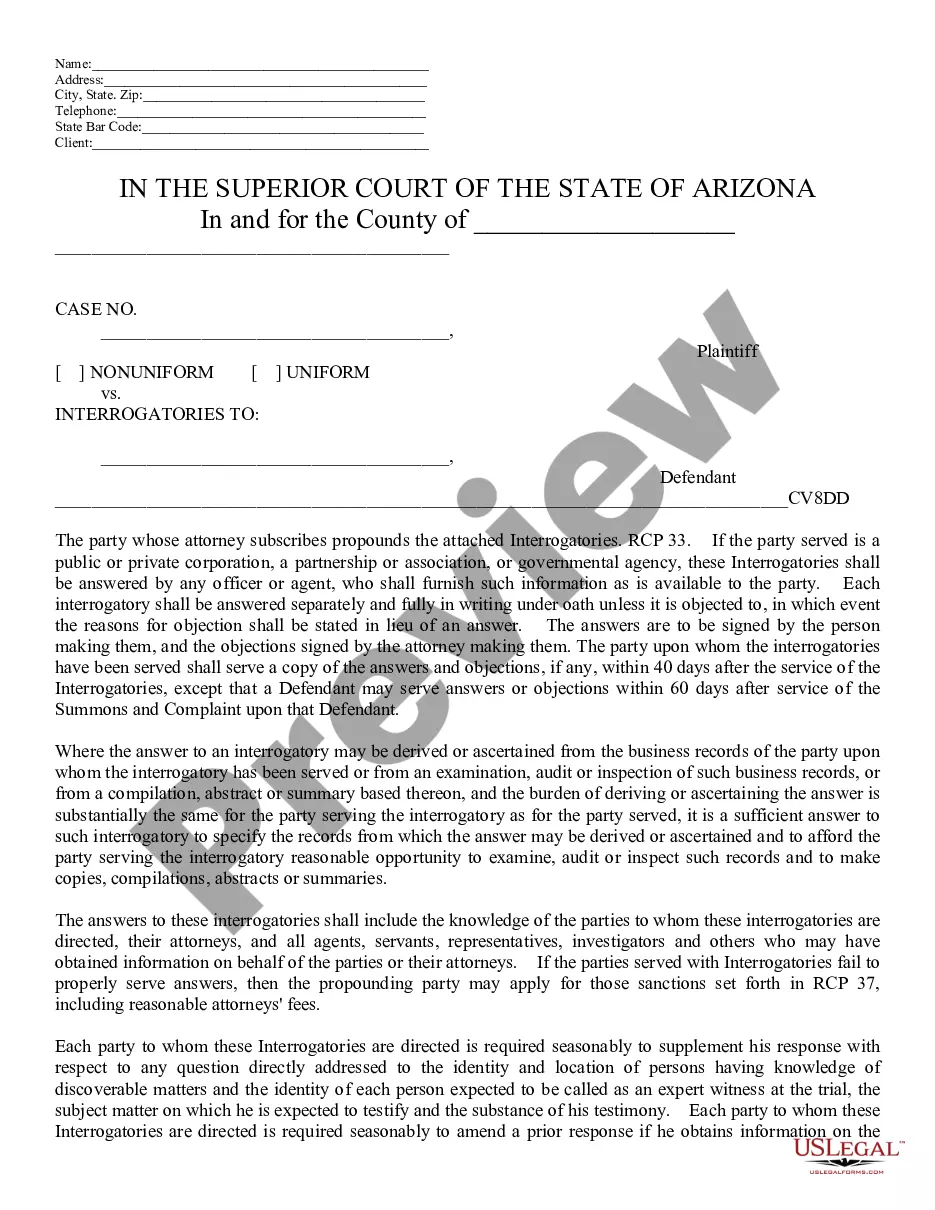

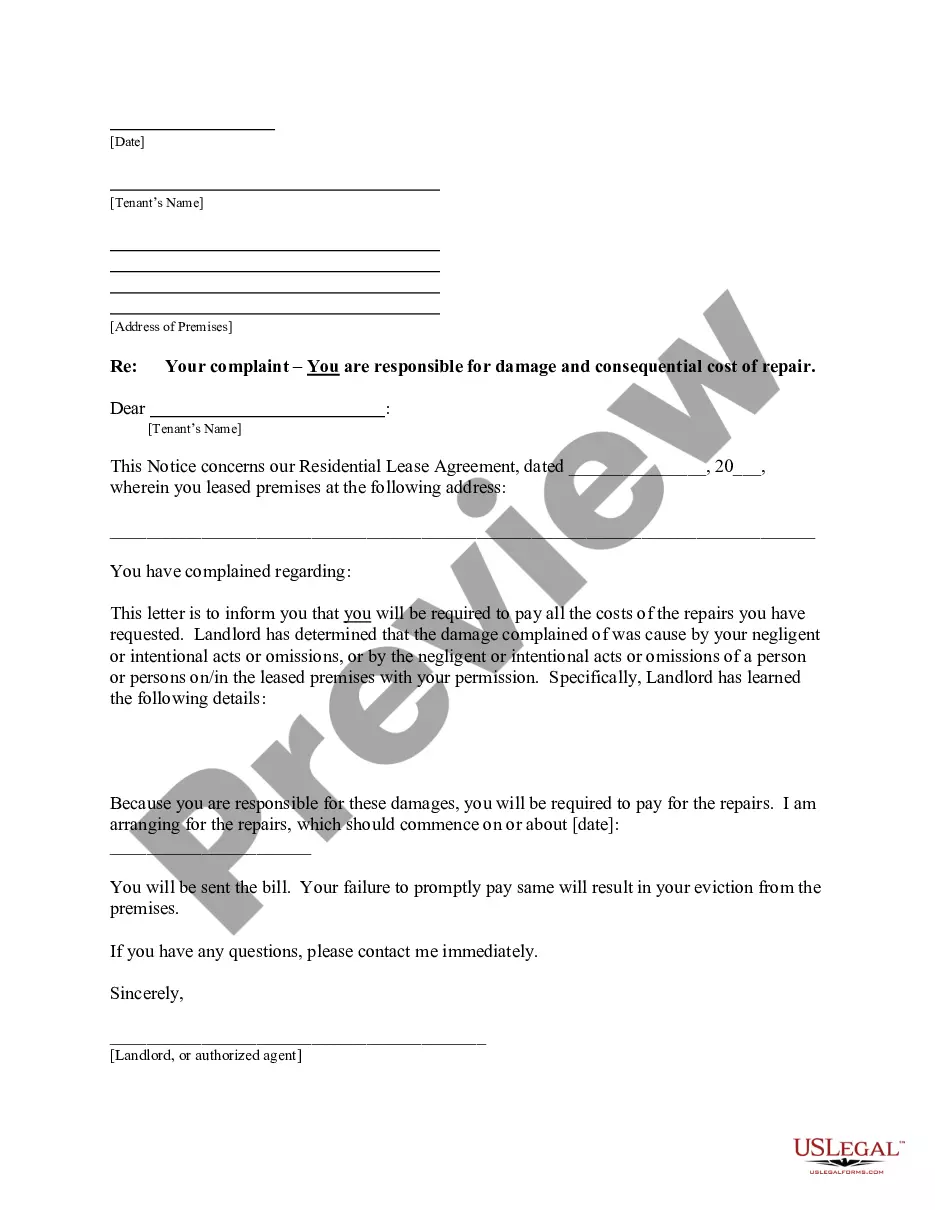

- Take a look at the template using the Preview option or through the text outline to ensure it meets your needs.

- Look for a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Letter Short Sale With A Va Loan and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

A Short Sale in Virginia is the process through which your mortgage company agrees to settle for less than what is owed to them. They do this as an alternative to the expensive and time consuming process of foreclosure.

Loan Seasoning In order to qualify for a VA IRRRL, a VA loan must be seasoned for at 210 days and you must have made your mortgage payment for at least 6 consecutive months. The 210 day countdown begins from the due date of your first mortgage payment.

Short sale process: the seller's side Submit a hardship letter to your lender. ... Hire a real estate agent. ... List your property for sale. ... Submit offer to lender. ... Finalize the sale.

Hear this out loud PauseHow Soon Can You Refinance A VA Loan? To refinance with a VA home loan, you'll have to meet the required waiting period of 212 days or 6 payments' worth of time ? whichever period is longer. You can expect this required waiting period regardless of which VA refinancing option you choose.

The VA requires you to wait 7 months (210 days) from your last loan closing before using the VA Streamline Refinance. However, some VA lenders impose their own waiting period of up to 12 months.