Special Meeting Minutes For Bank Account

Description

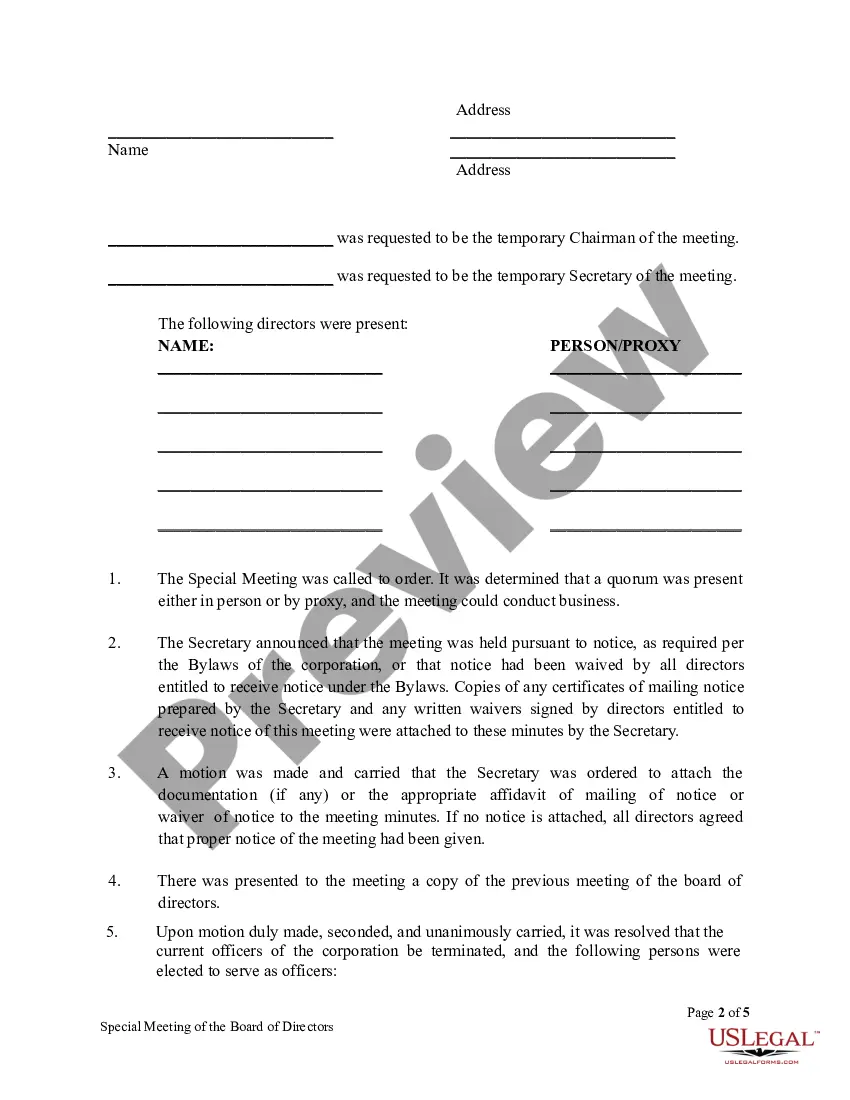

How to fill out Special Meeting Minutes Of Directors?

Creating legal documents from the ground up can occasionally be somewhat daunting.

Certain cases may require extensive research and significant financial investment.

If you're seeking a simpler and more cost-effective method for generating Special Meeting Minutes For Bank Account or any other document without unnecessary hurdles, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

But before you rush to download the Special Meeting Minutes For Bank Account, keep these tips in mind: Review the form preview and descriptions to ensure that you’ve located the document you need. Verify that the template you select adheres to the regulations and laws of your state and county. Choose the correct subscription plan to obtain the Special Meeting Minutes For Bank Account. Download the form, fill it out, sign it, and print it. US Legal Forms enjoys a solid reputation and boasts over 25 years of experience. Join us today and transform document execution into a straightforward and efficient process!

- With only a few clicks, you can swiftly access state- and county-compliant forms meticulously prepared for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can conveniently find and download the Special Meeting Minutes For Bank Account.

- If you’re familiar with our website and already have an account, simply Log In, find the template, and download it or re-download it anytime from the My documents section.

- Not registered yet? No problem. Setting it up takes just a few minutes, allowing you to browse through the catalog.

Form popularity

FAQ

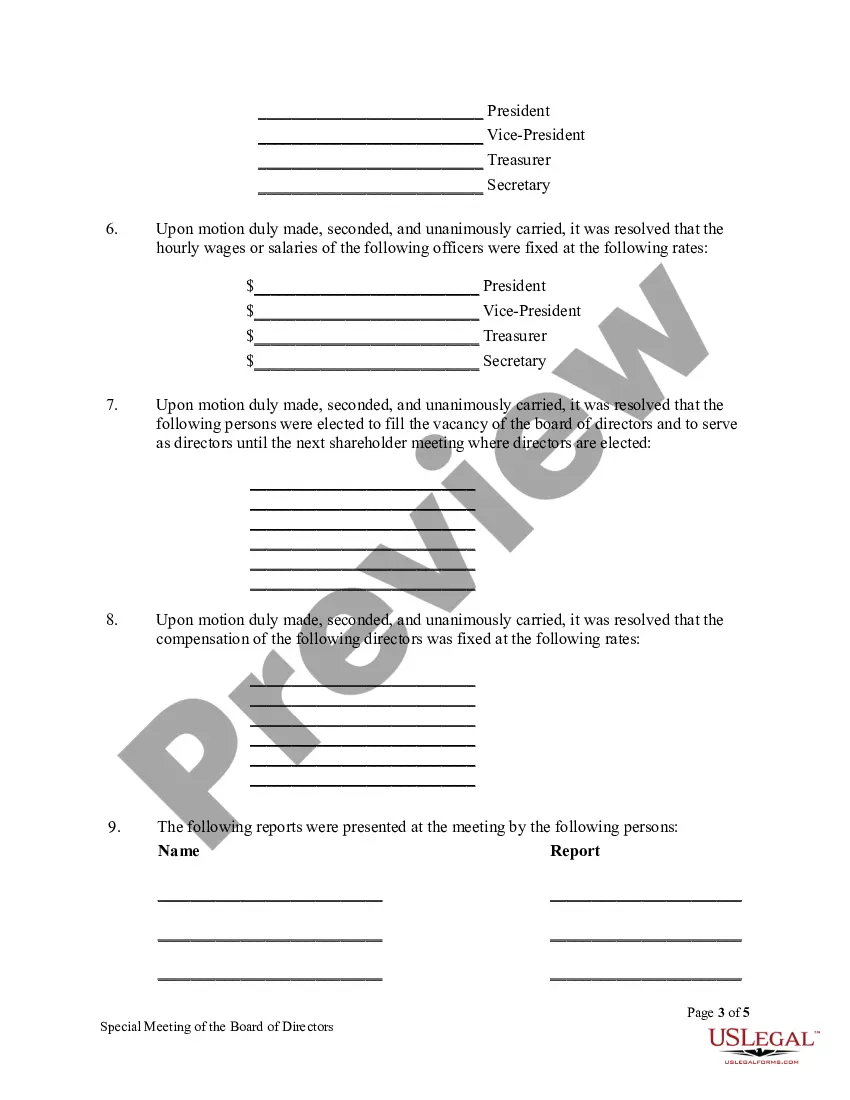

Filling out special meeting minutes for a bank account requires attention to detail and organization. Start by noting the date, time, and location of the meeting. Next, list the names of attendees and specify the purpose of the meeting. Be sure to document the key decisions made and any actions assigned during the meeting to ensure clarity and accountability. Utilizing a reliable platform like US Legal Forms can streamline the process, providing you with templates specifically designed for special meeting minutes for bank account.

Writing perfect special meeting minutes for bank account management starts with a clear structure. Begin by noting the date, time, and location of the meeting, along with attendees and absentees. Capture key discussions and decisions in a concise format, focusing on actions taken and assigned responsibilities. Finally, ensure the minutes are reviewed, approved, and distributed to all relevant parties for transparency and record-keeping.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

A Loan Agreement is a document between a borrower and lender that details a loan repayment schedule.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

It's important to make sure that you have a legally binding contract in place, whether you borrow or lend money. Major lenders will require you to sign an agreement before they disperse funds, but if you're setting up an agreement with friends or family, it makes sense to create your own personal loan contract.

A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be required to pay back the loan in ance with a payment schedule (unless there is a balloon payment).

Loan agreements generally include information about: The location. ... The lender and borrower. ... The loan amount. ... Interest and late fees. ... Repayment method. ... Collateral and insurance.