Option Agreement Contract With A Broker

Description

How to fill out Option Agreement?

- Log in to your US Legal Forms account if you are a returning user, ensuring your subscription is active.

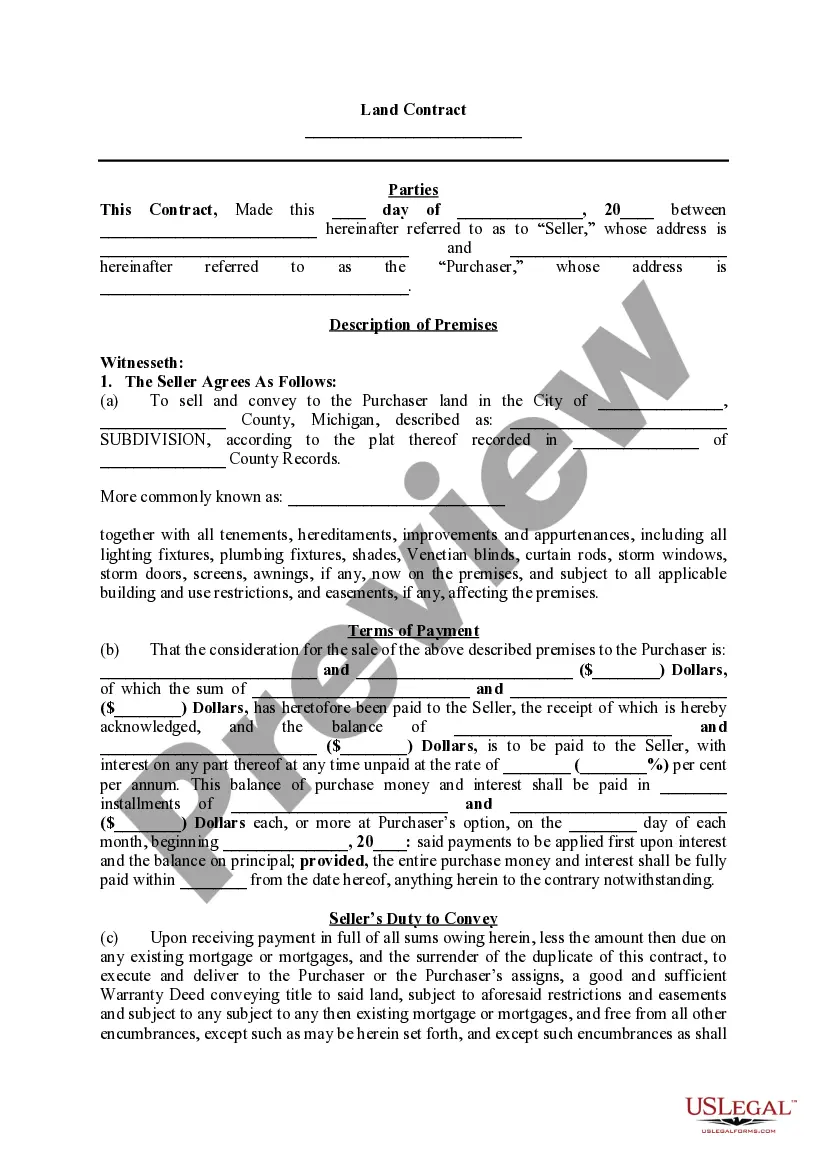

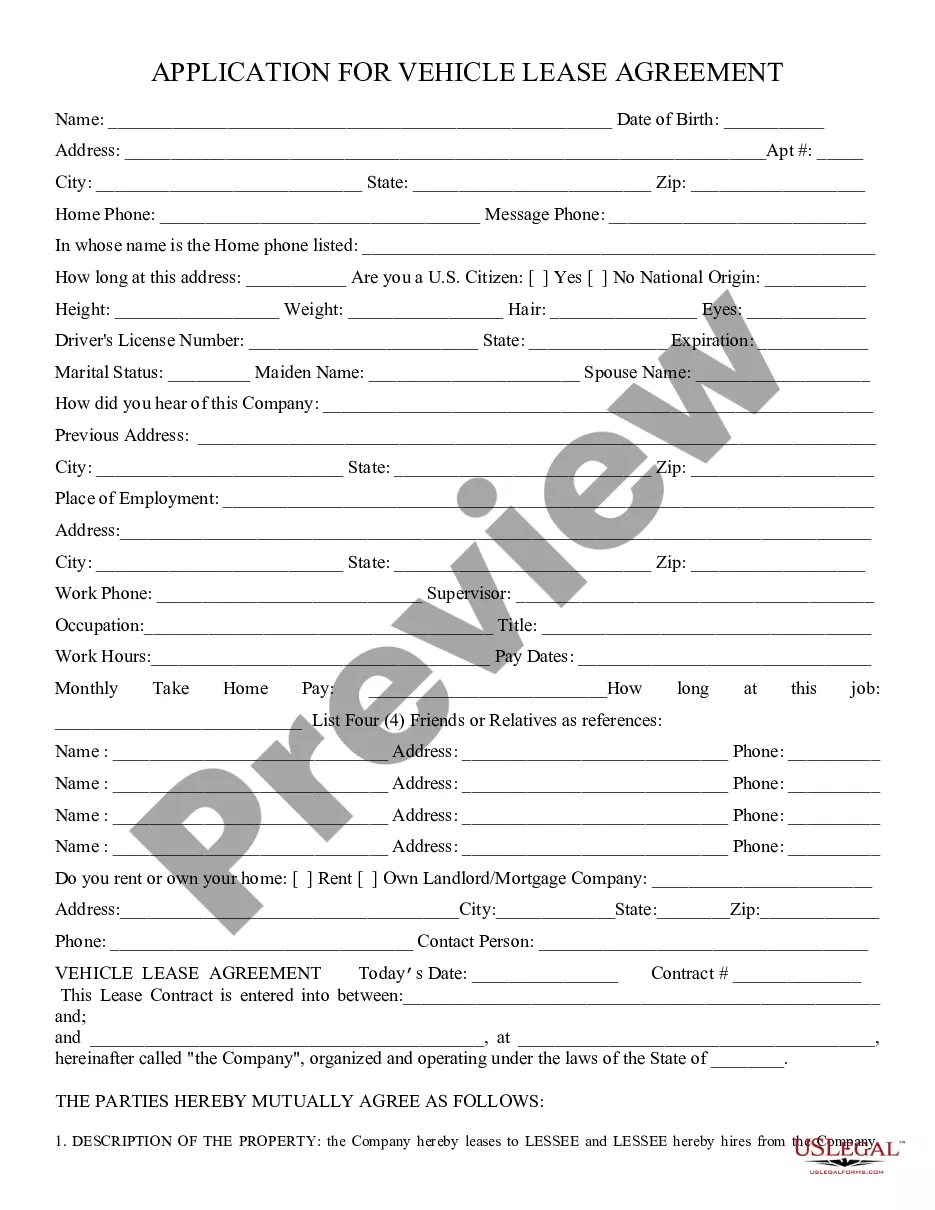

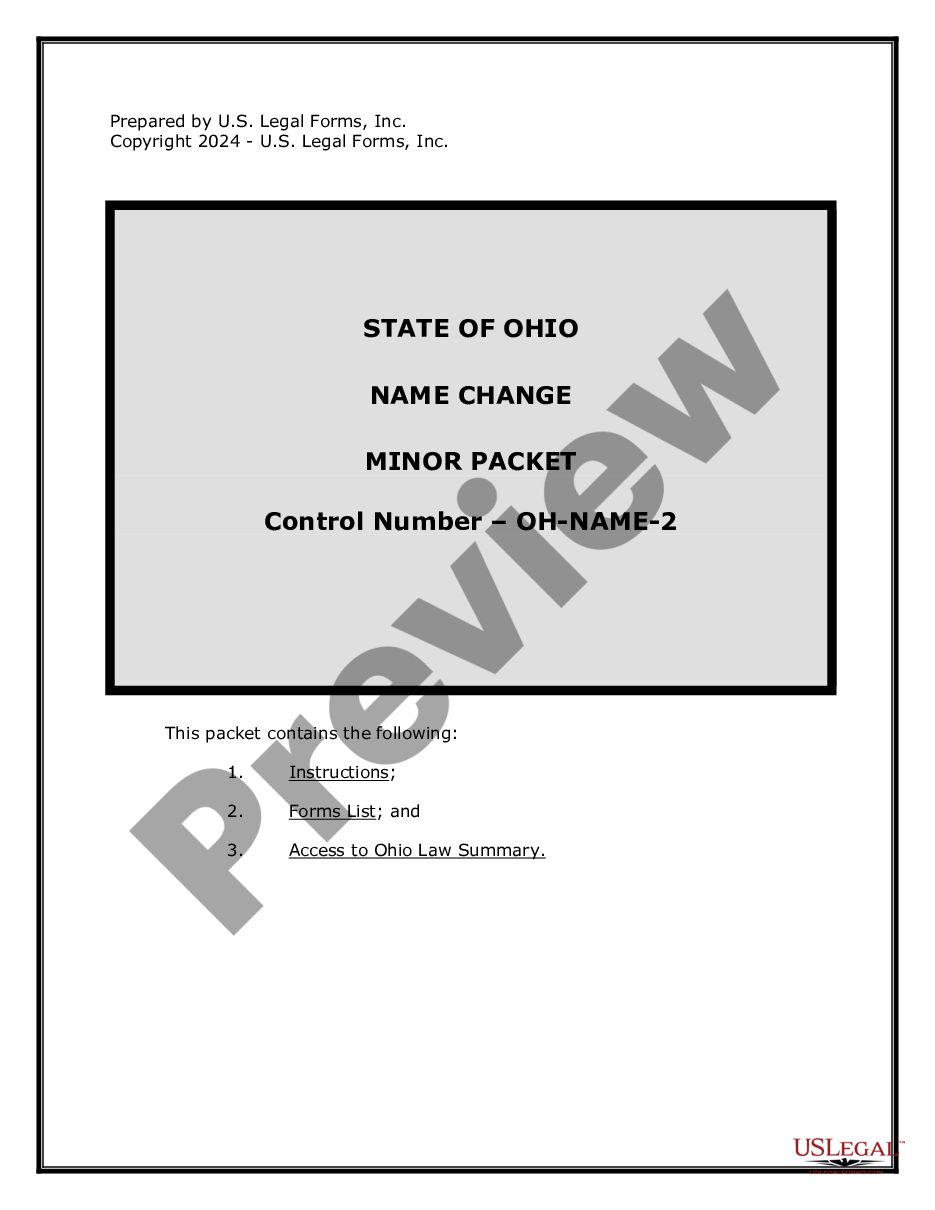

- If this is your first visit, start by browsing the extensive library. Use the Preview mode to review the form description and confirm it's suitable for your needs and jurisdiction.

- If the current option agreement doesn’t meet your requirements, search the library for alternative templates that do.

- Once you find the appropriate document, click on the Buy Now button and select your desired subscription plan.

- Complete the payment process by entering your credit card details or utilizing your PayPal account.

- After your purchase is confirmed, download your option agreement contract to your device for immediate use, with further access available under the My Forms section.

By following these steps, you ensure that you secure a legally sound option agreement contract tailored to your needs. US Legal Forms makes it simple to navigate through legal documentation.

Don’t hesitate to explore the extensive collection today and streamline your legal document preparation with US Legal Forms!

Form popularity

FAQ

Exercising an option contract involves a specific process that can be efficiently managed through your broker. You will typically need to submit a request and confirm your intention to proceed with the exercise as stated in your option agreement contract with a broker. It's vital to keep track of deadlines and any additional fees during this process.

To exercise an option agreement contract with a broker, first notify your broker of your decision to exercise the option. This typically involves providing your broker with a formal request and fulfilling any necessary paperwork outlined in the contract. Make sure you understand any fees or taxes associated with the exercise process.

The best way to exercise options involves evaluating market conditions and your financial needs. Review your option agreement contract with a broker to understand your rights, then decide whether it’s beneficial to exercise, sell, or let the option expire. Staying informed through your broker can help you make timely decisions.

Once an option is exercised, the seller typically cannot back out without facing legal challenges, as this part solidifies the agreement. It creates a binding commitment, meaning the seller must proceed according to the terms established in the option agreement contract with a broker. Understanding this aspect is crucial for both buyers and sellers to prevent unexpected complications.

In many cases, a seller can terminate during an option period, but the specifics can depend on the negotiated terms in the option agreement. This flexibility can be beneficial, but understanding any potential consequences is essential. Working with a broker who understands these contracts will help clarify your options and ensure a smooth process.

A seller can potentially back out of an option agreement, especially if specific terms allow for such actions. However, doing so may lead to legal repercussions, depending on the circumstances and the details of the agreement. If you're in doubt, it's wise to discuss your situation with professionals familiar with option agreement contracts with brokers.

An option agreement is generally enforceable as long as it meets the legal requirements, including mutual consent and consideration. When crafted properly, your option agreement contract with a broker can hold significant weight in legal contexts, protecting your interests. Always ensure you understand your rights and obligations within the agreement to avoid potential disputes.

Yes, it is possible to exit an option contract, but it typically involves certain conditions and may result in financial implications. It is crucial to review the terms outlined in your option agreement contract with a broker, as they often specify any penalties or options available for termination. Consulting a legal professional can provide clarity on your specific situation.

You do not necessarily need $25,000 to trade options. The amount required can vary based on your broker and the specifics of your trading strategy. An option agreement contract with a broker often lays out the terms for your investment, including any minimum deposit requirements. Always check with your broker to understand their policies, as some may allow trading with lower amounts depending on your experience level.

Despite the flexibility of options, there are significant disadvantages to consider. For instance, you may face the risk of losing your entire investment if the market moves unfavorably. Furthermore, an option agreement contract with a broker often involves fees and commissions that can eat into your profits, so it's wise to weigh these risks against potential rewards.