Trust Agreement Form For A Trust

Description

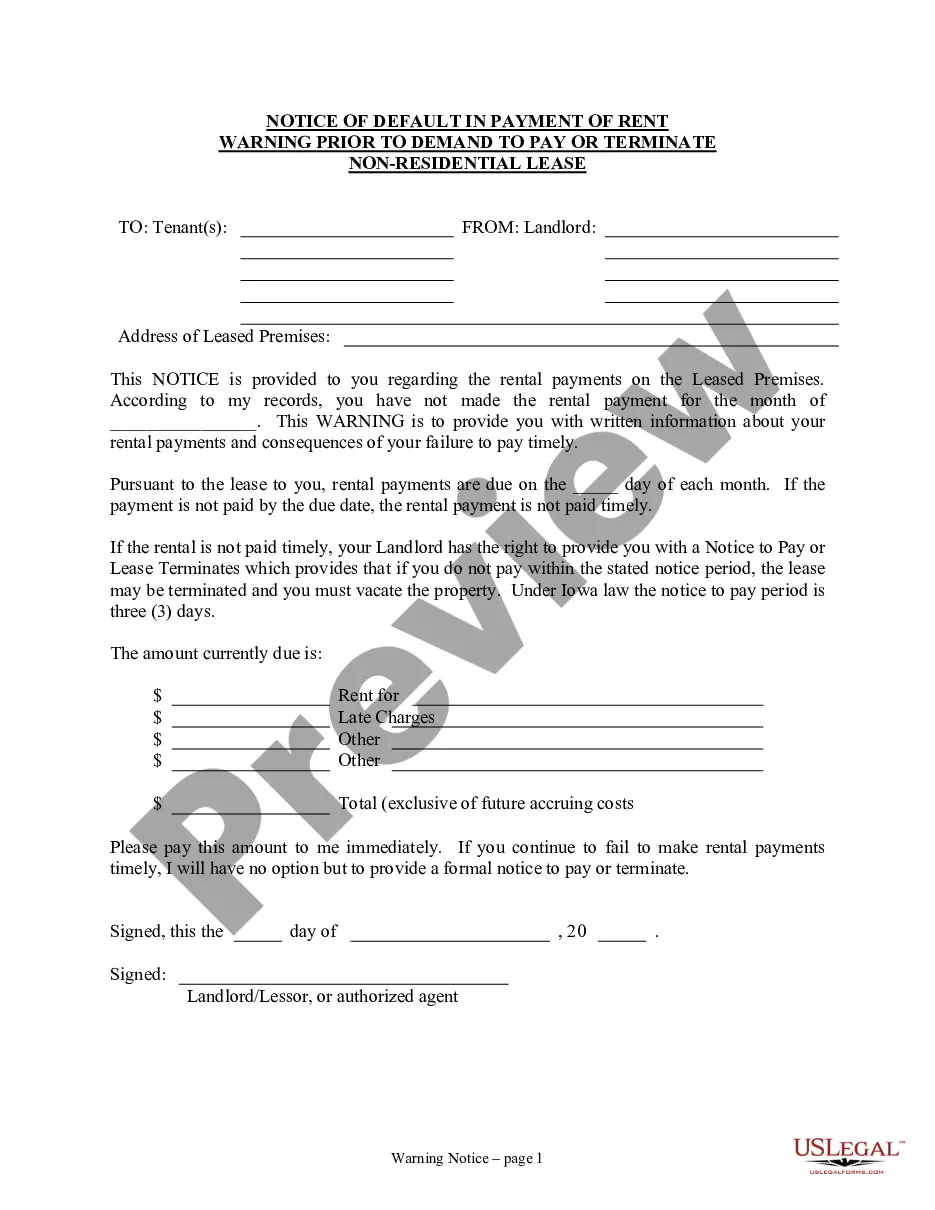

How to fill out Exchange Trust Agreement Between Daleen Technologies, Inc., Daleen CallCo Corp., Daleen Canada Corp., Exchangeable Shares Holders And Montreal Trust Co.?

- If you are a returning user, log in to your account to access the document you need. Ensure that your subscription is active and renew it if necessary.

- For first-time users, start by checking the Preview mode and the form description to ensure you select the correct trust agreement form for your legal needs and jurisdiction.

- If you're unable to find the right document, use the Search tab to explore other available templates that might better suit your requirements.

- Once you locate the appropriate form, click on the Buy Now button, select your preferred subscription plan, and create an account to access additional resources.

- Complete your purchase by providing payment information with your credit card or PayPal account.

- After purchasing, download the trust agreement form to your device. You can also revisit the form anytime in the My Forms section of your profile.

With US Legal Forms, not only do you gain access to a vast collection of over 85,000 legal forms, but you are also empowered with expert assistance that ensures your documents are accurate and compliant with legal standards.

Start using US Legal Forms today to simplify your legal document needs efficiently!

Form popularity

FAQ

To establish a valid trust, you need a clear grantor, a competent trustee, identifiable beneficiaries, trust property, and a lawful purpose. Each requirement ensures the trust operates smoothly and in accordance with the law. Properly addressing these requirements is key to avoiding legal complications. Our Trust agreement form for a trust can guide you through fulfilling each of these essential criteria.

The four essential elements of a trust include the grantor, the trustee, the beneficiaries, and the trust property. The grantor creates the trust, the trustee manages it, the beneficiaries receive the benefits, and the trust property includes the assets involved. Understanding these components is crucial for effective trust management. You can refer to our Trust agreement form for a trust to help clarify these roles.

A common mistake parents make when establishing a trust fund is failing to fund the trust properly. Sometimes, they create the trust but do not transfer assets into it, leaving it ineffective. Additionally, overlooking the importance of clear instructions for the trustee can lead to disputes. Using our Trust agreement form for a trust can help you avoid these pitfalls and ensure proper funding and guidance.

You should avoid placing certain assets into a trust, such as your personal residence if you plan to live there. Assets with designated beneficiaries, like life insurance and IRAs, should also remain outside of a trust. Keeping these in direct ownership can help maintain financial flexibility and control. Downloading our Trust agreement form for a trust can aid you in making informed decisions regarding asset placement.

A trust document typically includes the trust's name, the parties involved, the duty of the trustee, and the rights of the beneficiaries. It also encompasses details about the assets transferred into the trust, the purpose of the trust, and any terms for its operation. Each of these elements plays a significant role in guiding the trust's administration. Using our Trust agreement form for a trust can simplify the creation of this essential document.

A trust agreement consists of various parts including the trust's name, the trustee's responsibilities, and the rights of the beneficiaries. It also outlines how assets are to be managed and distributed, along with any specific conditions for those distributions. Having a well-structured trust agreement is vital for effective management of the trust. Consider our Trust agreement form for a trust as an efficient tool for creating this document.

A trust agreement generally includes several key components such as the name of the trust, the designation of the trustee, and the beneficiaries. It also specifies the assets placed within the trust and outlines how those assets will be managed and distributed. The terms of the trust are detailed to ensure clarity and ease of administration. You can utilize our Trust agreement form for a trust to ensure all necessary details are included.

Typically, you should not place assets like retirement accounts, life insurance policies, or health savings accounts in a trust. These assets often have designated beneficiaries that are best to keep outside of a trust. Additionally, properties that you want to maintain control over during your lifetime should remain out of a trust. Our Trust agreement form for a trust can guide you through proper asset placement.

The person who creates a trust is called the grantor, or sometimes the settlor or trustor. This individual outlines the terms of the trust and decides how assets will be managed. Understanding this role is important when completing a trust agreement form for a trust. If you want to clarify your intentions, consider using a reliable platform like US Legal Forms.

Typically, a lawyer sets up a trust because they have the specialized knowledge required to draft the legal documents. Accountants can offer insights into tax implications and financial planning surrounding the trust. If you're looking for a seamless process, using a trust agreement form for a trust can guide you through. US Legal Forms provides templates that can assist both lawyers and individuals alike.