Trust Administration Companies

Description

How to fill out Administration Agreement Between EQSF Advisors, Inc. And Third Avenue Trust Regarding Retaining EQSF To Render Administrative Services With Respect To Investment?

Securing a reliable location to obtain the most up-to-date and pertinent legal templates is a significant part of dealing with bureaucracy.

Finding the appropriate legal documents requires precision and carefulness, which is why it is crucial to source Trust Administration Companies samples exclusively from reputable providers, such as US Legal Forms.

Eliminate the complications associated with your legal documents. Explore the extensive US Legal Forms collection where you can locate legal templates, assess their applicability to your situation, and download them immediately.

- Employ the catalog navigation or search box to find your document.

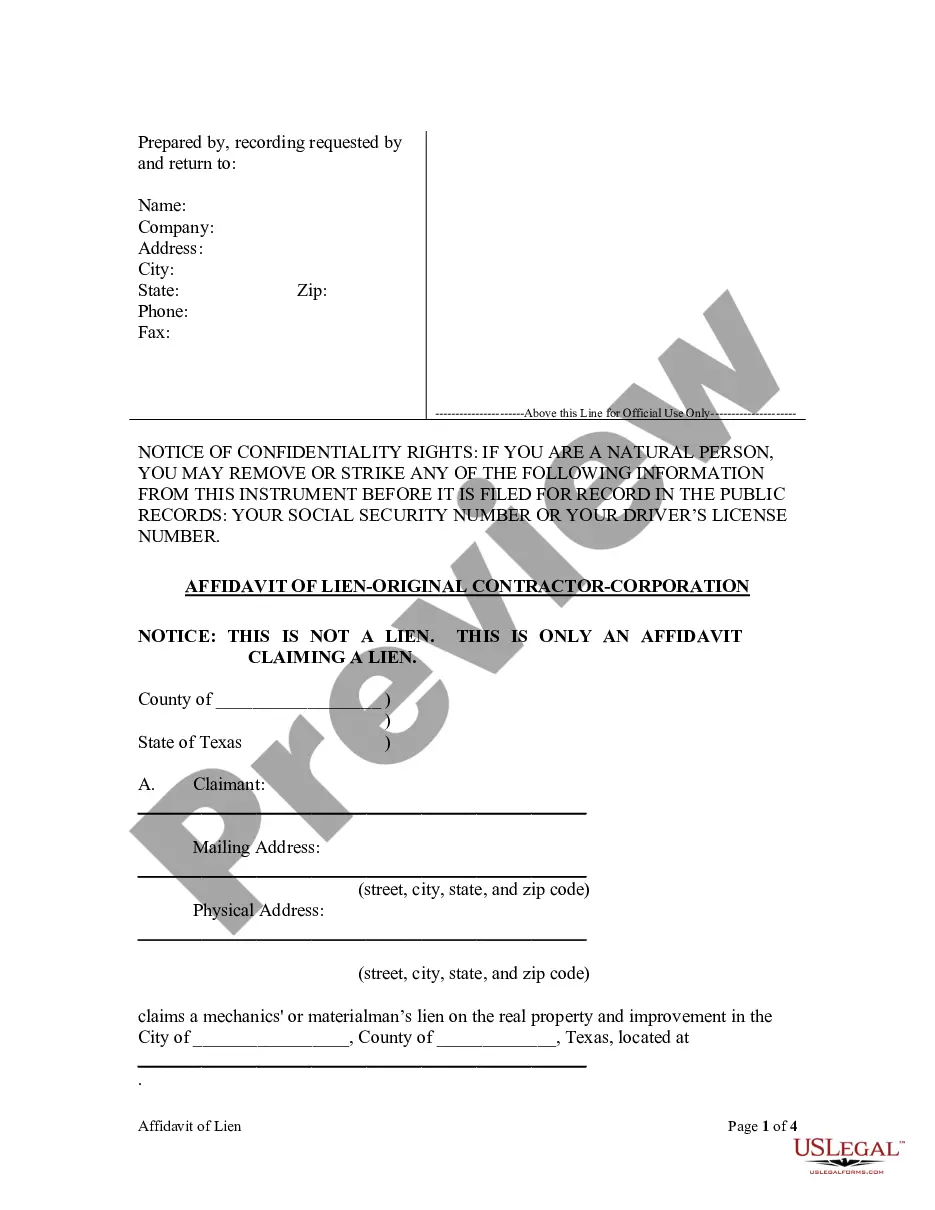

- Review the form’s details to confirm it meets the specifications of your state and locality.

- Examine the form preview, if available, to verify that it is indeed the document you need.

- Return to the search to find the appropriate template if the Trust Administration Companies does not fulfill your requirements.

- Once you are confident about the document’s suitability, proceed to download it.

- If you are an existing user, click Log in to verify and access your selected forms in My documents.

- If you haven’t created an account yet, click Buy now to purchase the form.

- Select the payment plan that best meets your needs.

- Complete the registration to finish your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Trust Administration Companies.

- Once you have the document on your device, you can modify it using the editor or print it to complete it manually.

Form popularity

FAQ

An administrative trust functions by designating a trustee to manage the trust's assets and fulfill its terms. The trustee is responsible for making decisions that align with the trust's purpose, such as investing assets and distributing funds to beneficiaries. Trust administration companies play a crucial role in this process, offering guidance and support to ensure the trust operates smoothly. Their services allow you to focus on your priorities, knowing that your trust is in capable hands.

Trust administration involves managing the assets held in a trust according to the trust document's terms. This includes paying bills, filing taxes, and distributing assets to beneficiaries. Trust administration companies specialize in these tasks, providing you with peace of mind that your trust is being handled professionally. Their expertise ensures adherence to legal standards and proper asset management.

The primary purpose of a trust company is to manage trust assets on behalf of beneficiaries. This includes overseeing investments, distributing income, and ensuring compliance with legal obligations. Trust administration companies provide expertise to help you achieve your financial goals while maintaining your wishes. By partnering with a trust company, you can ensure that your assets are managed responsibly.

A trust does not always have to be filed with the IRS. Whether a trust must be reported depends on its structure and income generation. For example, revocable trusts typically do not require a separate tax return, while irrevocable trusts do. Trust administration companies can help you navigate these requirements effectively.

The 5% rule for trusts refers to a guideline that allows trustees to distribute up to 5% of the trust's principal annually without triggering tax consequences. Trust administration companies help you navigate these regulations, ensuring compliance while maximizing benefits for beneficiaries. Understanding this rule can aid in effective trust management and maintain the trust's long-term health. For tailored advice on trust distributions, consider consulting with a trusted service like uslegalforms.

The trust administration process involves managing and distributing assets according to the terms of the trust. Trust administration companies ensure that all legal requirements are met, including filing necessary documents and paying taxes. They also communicate with beneficiaries to keep everyone informed about the trust's status. By utilizing a professional service, you can streamline this process and avoid potential disputes.

The best person to manage a trust is typically someone who is knowledgeable about financial matters and has a strong sense of responsibility. Many people choose a professional from trust administration companies, as they offer expertise and experience in managing trusts effectively. Alternatively, a trusted family member or friend with financial acumen may also be suitable. Regardless of your choice, ensure that the person or company you select understands your goals and the specific needs of the trust.

A trust administration company is a specialized firm that manages trusts on behalf of beneficiaries. These companies handle various responsibilities, including asset management, tax reporting, and distribution of trust assets. By working with trust administration companies, you ensure that your trust is administered according to your wishes and in compliance with state laws. This can provide peace of mind for both the trust creator and the beneficiaries.