Class C Corp For Sale By Owner

Description

How to fill out Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

Whether for corporate objectives or personal matters, everyone encounters legal circumstances at some stage in their lives.

Completing legal documents demands meticulous care, starting with choosing the correct form template. For example, if you pick an incorrect version of a Class C Corp For Sale By Owner, it will be declined once you submit it.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the suitable template across the web. Utilize the library’s user-friendly navigation to find the right template for any circumstance.

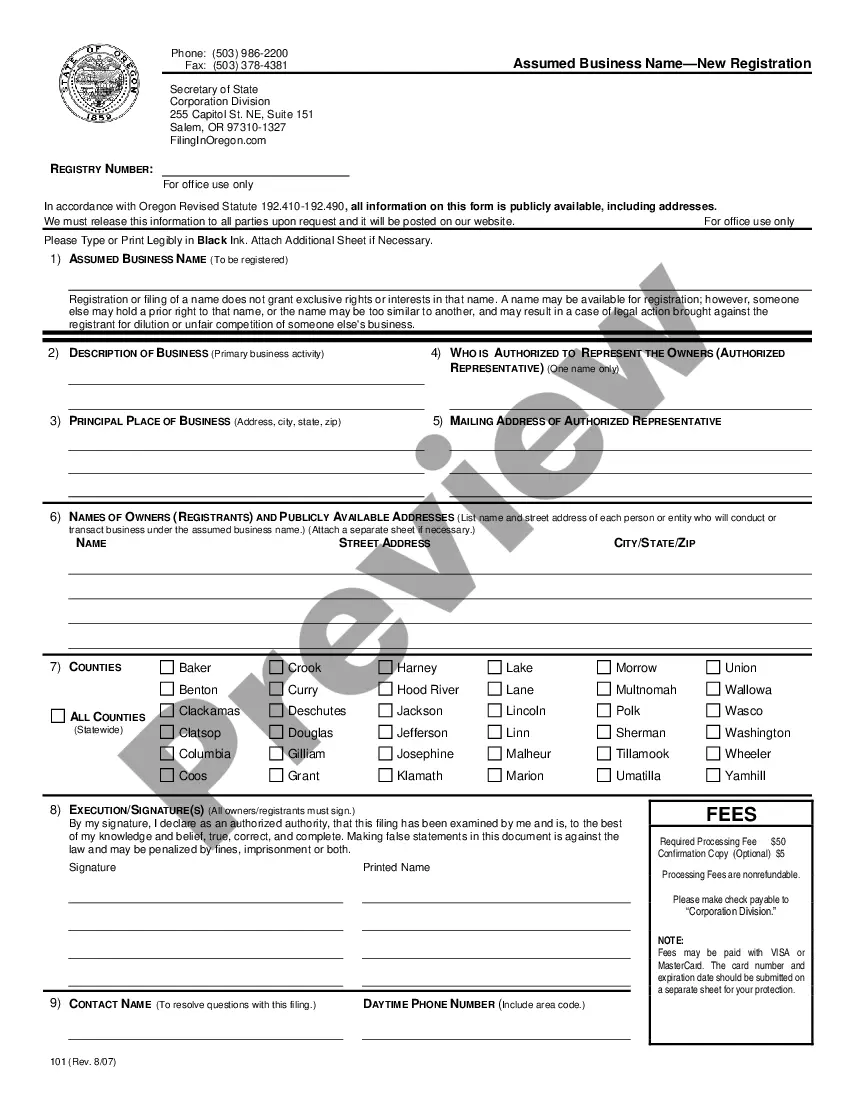

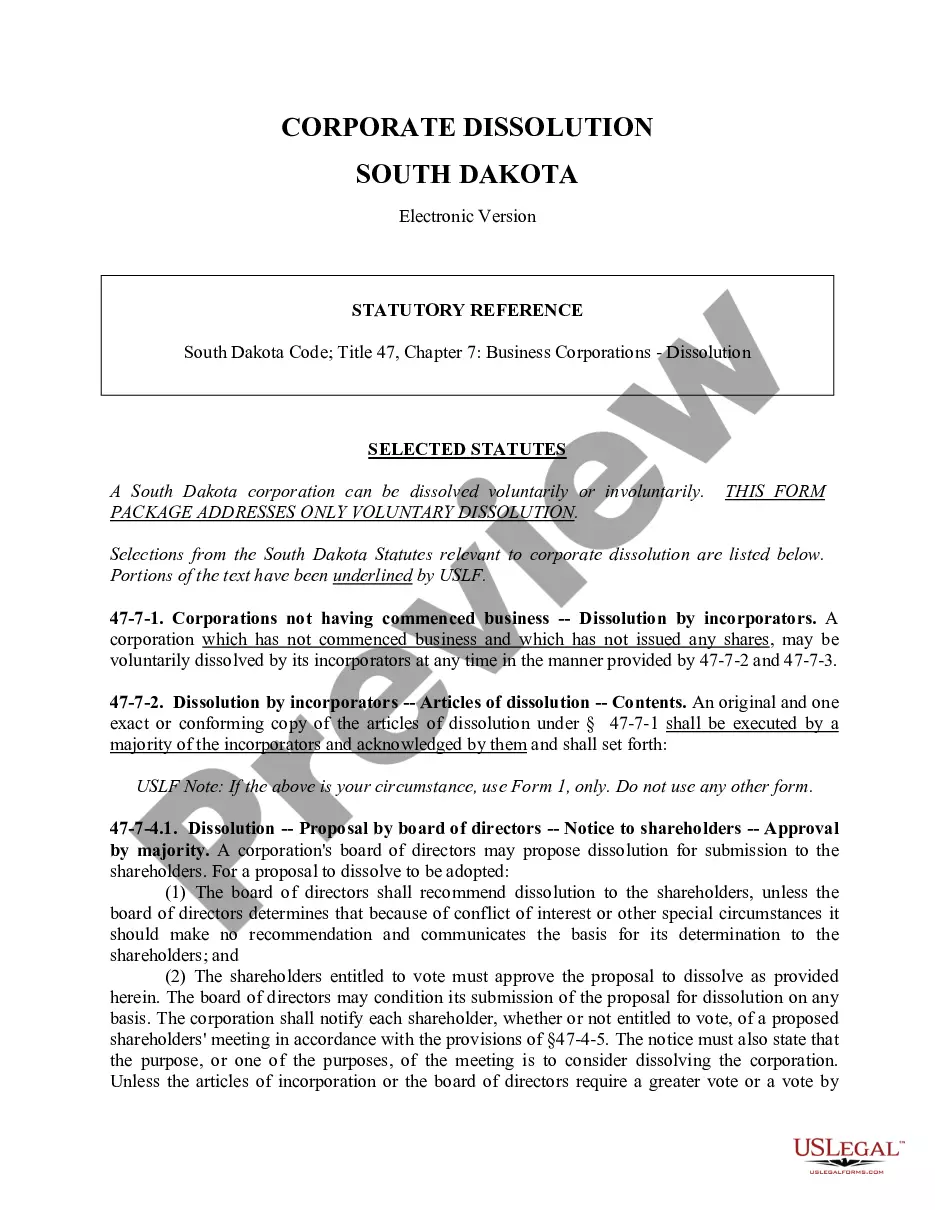

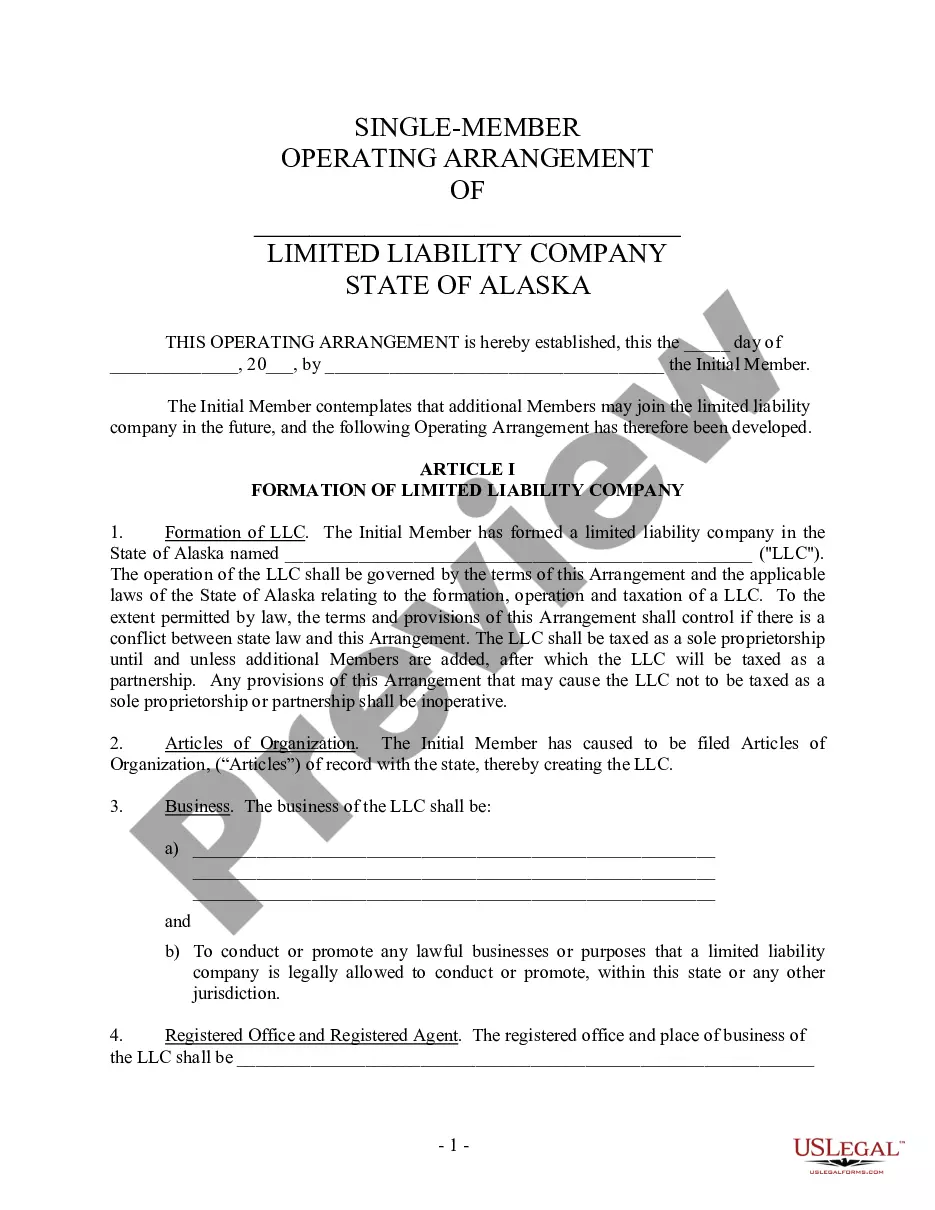

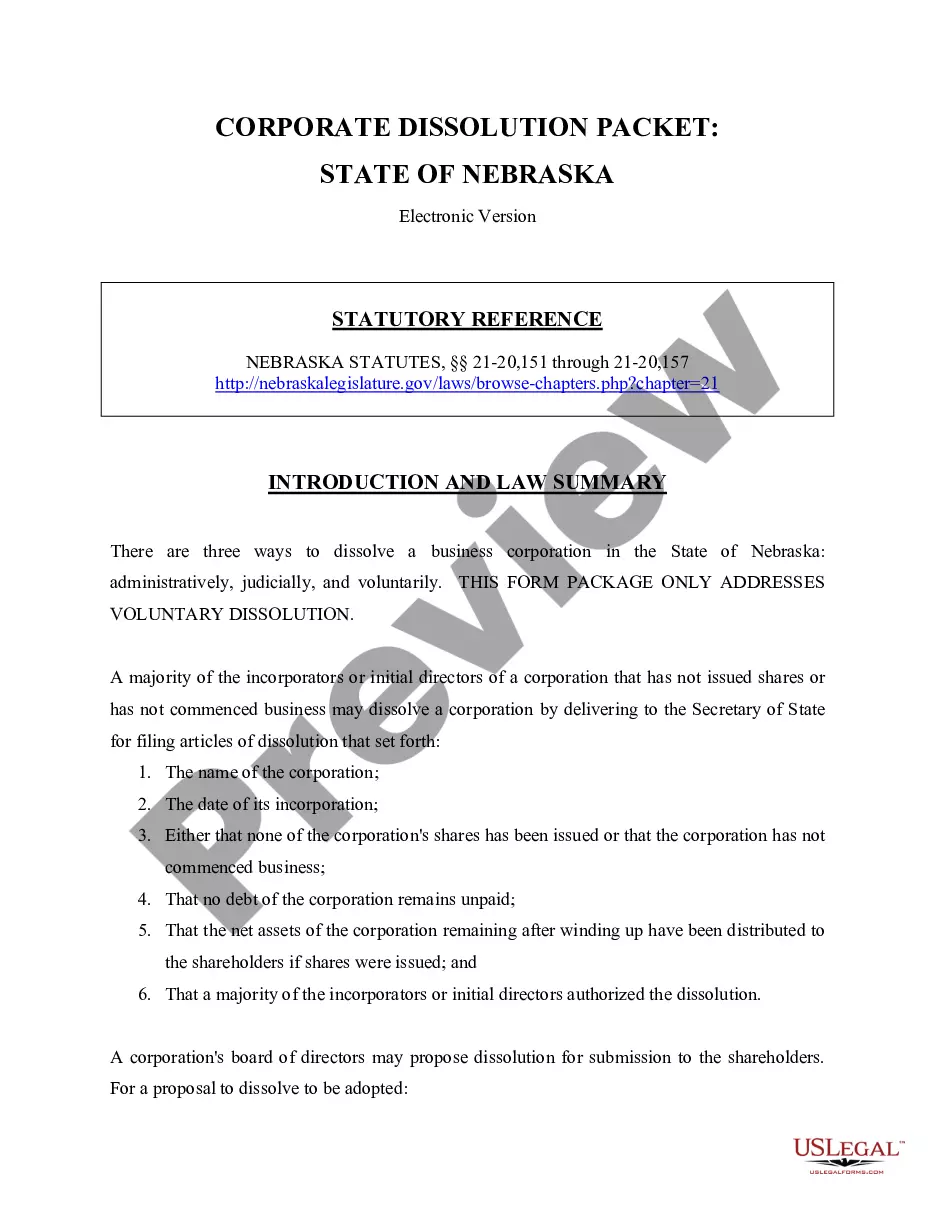

- Locate the template you require using the search bar or catalog navigation.

- Review the form’s description to ensure it meets your circumstances, state, and area.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search feature to find the Class C Corp For Sale By Owner template you need.

- Download the template when it aligns with your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the account registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the document format you desire and download the Class C Corp For Sale By Owner.

- Once it is saved, you can complete the form with the assistance of editing applications or print it and finish it manually.

Form popularity

FAQ

Absolutely, the sale of C Corp stock is generally subject to the Net Investment Income Tax if applicable income thresholds are exceeded. If you are involved in selling a Class C corp for sale by owner, your capital gains from that sale may trigger additional tax liabilities. Staying informed about the specifics can help you navigate your tax responsibilities effectively.

Yes, when you sell a business structured as a C corporation, the NIIT can apply to any gains realized from that sale. This means that if you are considering a Class C corp for sale by owner, be mindful that your gains might be impacted by this additional tax. It’s vital to assess your financial condition to understand all tax obligations associated with your sale.

The title search is conducted by accessing the information related to that particular property via public records. You need only locate your Michigan county's register of deeds and search the recorded property information. All documents recorded with the register of deeds are available to the public.

Simply put, yes, you can write your own legal contract. You just need to be sure to include key components such as an offer, an acceptance, an exchange of value, and the willingness of both parties to enter into a contract. Legally binding contracts can be done both in writing or orally.

The following should be in a contract for deed: Purchase price. Interest rate. Down payment. Number of monthly installments. Buyer and seller information. Party responsibilities. Legal remedies in the event of default.

How to draft a contract between two parties: A step-by-step checklist Check out the parties. ... Come to an agreement on the terms. ... Specify the length of the contract. ... Spell out the consequences. ... Determine how you would resolve any disputes. ... Think about confidentiality. ... Check the contract's legality. ... Open it up to negotiation.

A contract for deed, also known as a "bond for deed," "land contract," or "installment land contract," is a transaction in which the seller finances the sale of his or her own property. In a contract for deed sale, the buyer agrees to pay the purchase price of the property in monthly installments.

This Contract for Deed should be submitted along with a Certificate of Value containing the name and address of the buyer and seller, the legal description of the real property, the actual consideration exchanged for the real property, the relationship of the seller and buyer, if any, and the terms of the payment if ...

If you're the buyer in a contract for deed arrangement, you need to be aware of the following risks. Property maintenance. One contract for deed drawback is the uncertainty over who's responsible for what. ... No foreclosure protection. ... Balloon payment. ... Seller retains title. ... Less consumer protection.

If you do not have your deed, then you can get a recorded copy of it at the Register of Deeds; and a recorded copy is just as good as the original. You can come in person, send us a request by mail, or search online. Search and copy fees will apply.