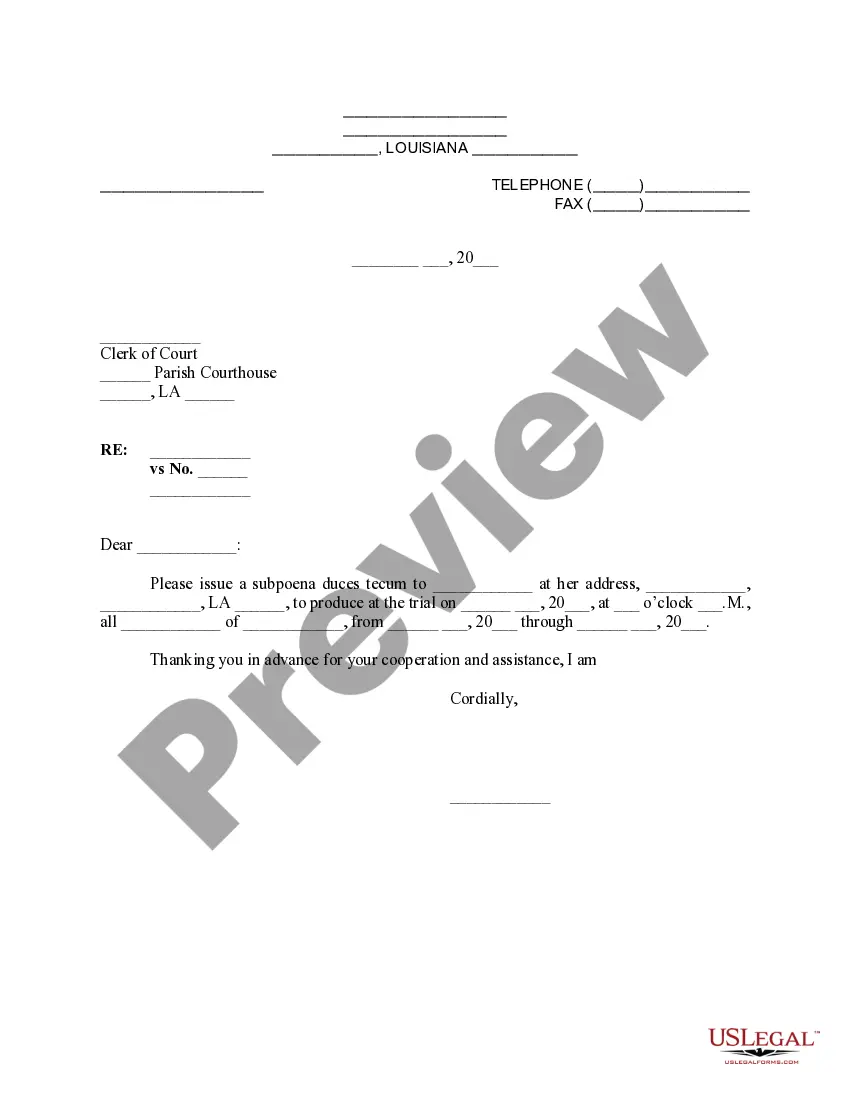

Insurance Agreement Form

Description

How to fill out Insurance Agreement?

Whether you handle paperwork often or occasionally need to submit a legal paper, it is essential to have a source where all the samples are connected and current.

One task you must perform with an Insurance Agreement Form is to ensure that it is indeed the latest version, as it determines its submittability.

If you wish to simplify your search for the most recent document examples, look for them on US Legal Forms.

To obtain a form without an account, follow these instructions: Use the search menu to find the needed form. Review the Insurance Agreement Form preview and outline to ensure it matches your requirements precisely. After confirming the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card details or PayPal account to finalize the purchase. Select the document format for download and validate it. Eliminate confusion about working with legal papers. All your templates will be organized and authenticated with a US Legal Forms account.

- US Legal Forms is a repository of legal forms featuring nearly any document sample you might seek.

- Look for the templates you need, review their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 form templates across various sectors.

- Locate the Insurance Agreement Form samples in just a few clicks and store them anytime in your account.

- A US Legal Forms account will allow you to access all the samples you need with greater ease and fewer complications.

- Simply click Log In in the website header and navigate to the My documents section where all the needed forms will be at your fingertips, saving you time searching for the appropriate template or verifying its authenticity.

Form popularity

FAQ

Every insurance policy has five parts: declarations, insuring agreements, definitions, exclusions and conditions.

There are 4 requirements for any valid contract, including insurance contracts:offer and acceptance,consideration,competent parties, and.legal purpose.

An insurance policy is a written agreement between you (the named insured) and the insurance company. Every insurance policy contains an insuring clause or agreement, which is a general statement of the promises the insurance company makes to the insured.

There are two basic forms of an insuring agreement: Namedperils coverage, under which only those perils specifically listed in the policy are covered. If the peril is not listed, it is not covered. Allrisk coverage, under which all losses are covered except those losses specifically excluded.

In the insurance world there are six basic principles that must be met, ie insurable interest, Utmost good faith, proximate cause, indemnity, subrogation and contribution. The right to insure arising out of a financial relationship, between the insured to the insured and legally recognized.