Stock Exchangen Agreement For The Us

Description

How to fill out Stock Exchange Agreement And Plan Of Reorganization By Jenkon International, Inc., Multimedia K.I.D. Intelligence In Education, Ltd., And Stockholders?

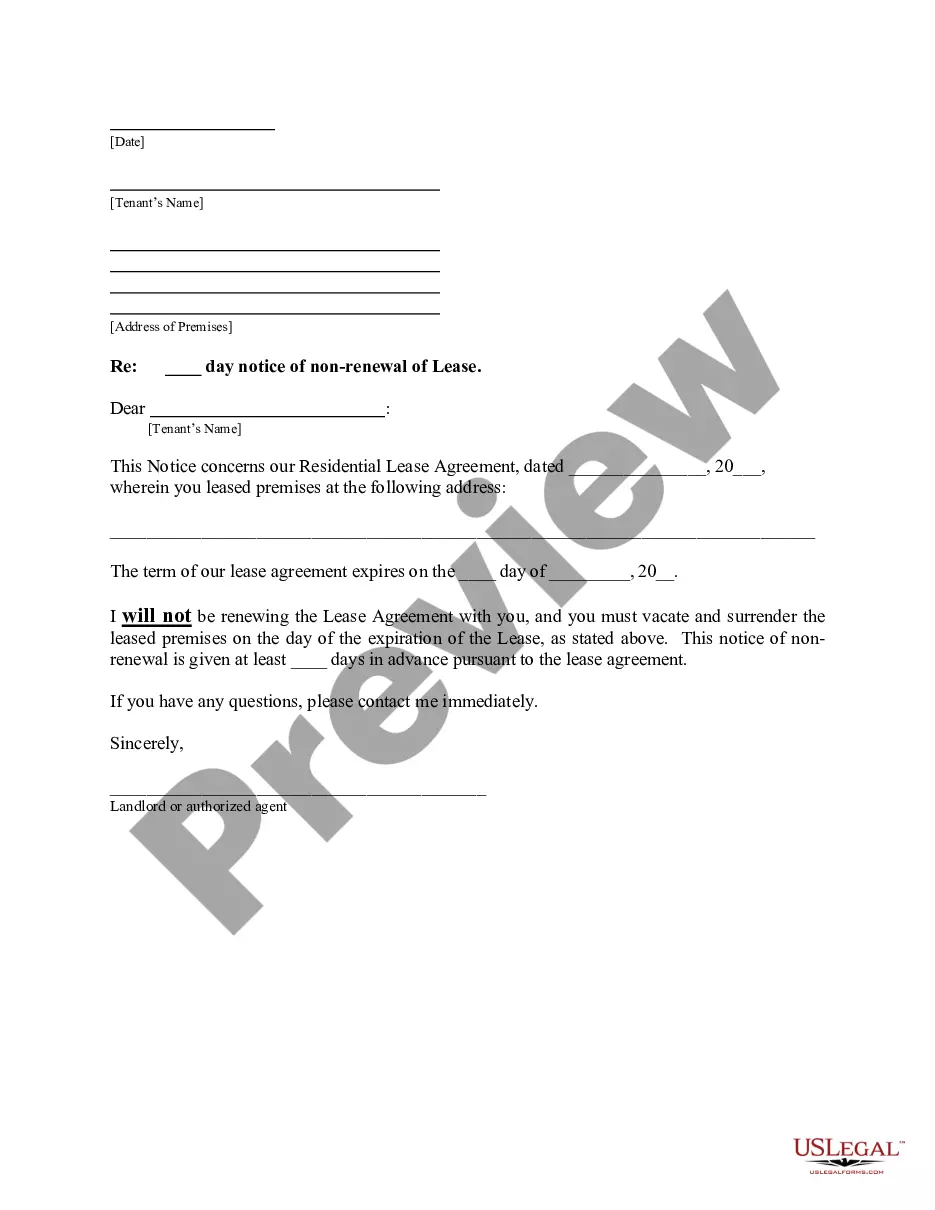

- Log in to your existing US Legal Forms account to download the required document if you are a returning user. Ensure your subscription is active; renew it if necessary.

- For new users, start by checking the Preview mode along with the form description. Confirm that you have selected the correct stock exchange agreement that meets your jurisdiction's requirements.

- If you're uncertain about the template, utilize the Search tab to find another suitable agreement and ensure it aligns with your needs.

- Purchase the document by clicking the Buy Now button. Choose your preferred subscription plan and register for an account to unlock access to the entire library.

- Complete the payment process using your credit card or PayPal for the subscription.

- Finally, download your form and store it on your device. You can always access it again from the 'My Forms' section of your profile.

By following these steps, users can effortlessly secure high-quality legal documents tailored to their specific needs.

Experience the efficiency of US Legal Forms today, and ensure your stock exchange agreements are handled with precision. Start your journey now!

Form popularity

FAQ

Yes, you can write your own shareholder agreement if you understand the essential components required. Ensure that you clearly outline the rights, responsibilities, and procedures relevant to the shares being issued. However, because these agreements can be complex, using resources like USLegalForms can provide valuable templates and guidance, particularly for stock exchange agreements for the US.

To write a share agreement, begin by detailing the number of shares being issued and the rights associated with those shares. It is important to address matters such as shareholding structure, voting rights, and dividend distribution. Additionally, consider including clauses for dispute resolution to avoid future conflicts. For convenience, look for templates related to stock exchange agreements for the US on USLegalForms.

A stock exchange agreement is a formal contract that establishes the terms under which stocks are bought and sold. This document details the rights and obligations of all parties, ensuring clarity and legal protection. It is crucial for maintaining orderly trading and compliance with regulatory standards, especially in stock exchange agreements for the US. You can find templates on USLegalForms to help guide you.

Writing a stock exchange involves outlining the rules and procedures that govern transactions within the exchange. You first need to define the scope, including trading conditions and participant responsibilities. Then, it is essential to clarify the regulatory framework that ensures compliance with laws pertaining to stock exchange agreements for the US. Utilizing platforms like USLegalForms can streamline this process.

The three major stock exchanges in the US are the New York Stock Exchange (NYSE), the Nasdaq, and the American Stock Exchange (AMEX). Each of these exchanges plays a crucial role in the economy by facilitating the buying and selling of shares for public companies. Understanding the stock exchange agreement for the US helps enhance your investment strategy in these major markets.

The regulation of the US stock exchange involves oversight mechanisms to ensure fair trading practices and protect investors. Regulatory bodies, such as the Securities and Exchange Commission (SEC), are responsible for enforcing laws that govern the trading of securities. Navigating the stock exchange agreement for the US requires awareness of these regulations to ensure compliance and safeguard your investments.

In simple terms, a stock exchange is a marketplace where buyers and sellers come together to trade stocks and other securities. It provides a regulated environment where companies can raise capital by issuing shares to the public. Knowing about the stock exchange agreement for the US is essential for participating effectively in these transactions.

A stock exchange agreement is a legal document outlining the terms and conditions under which businesses trade securities on a stock exchange. This agreement delineates the rights and obligations of the involved parties, ensuring transparency and fairness in transactions. Understanding the stock exchange agreement for the US can help you engage in compliant trading practices and protect your investments.

The SEC is governed by a commission consisting of five members appointed by the President of the United States. These commissioners serve to implement and enforce federal securities laws, ensuring market integrity. When developing a stock exchange agreement for the US, staying informed about the SEC's governance structure allows for better compliance. Utilize resources from USLegalForms to facilitate creating agreements with seamless adherence to these regulatory principles.

The stock market is overseen by multiple entities, but the SEC plays a pivotal role in regulating its operations and maintaining investor confidence. Additionally, self-regulatory organizations like the Financial Industry Regulatory Authority (FINRA) also help govern market activities. When creating a stock exchange agreement for the US, considering the regulatory landscape is vital. USLegalForms aids in crafting agreements that comply with these regulations and protect your interests.