Amend A Lease With Bad Credit

Description

How to fill out Amended Lease - Amendment For Office Building?

Engaging with legal paperwork and processes can be a lengthy addition to your schedule.

Modifying a Lease With Poor Credit and similar forms typically require you to search for them and comprehend the most efficient way to fill them out properly.

Consequently, if you are managing financial, legal, or personal issues, having a comprehensive and user-friendly online collection of forms at your disposal will significantly help.

US Legal Forms is the premier online resource for legal templates, featuring over 85,000 state-specific documents and a range of tools to help you complete your paperwork with ease.

Is this your first time using US Legal Forms? Sign up and create your account in a few minutes, and you’ll be able to access the form library and Modifying a Lease With Poor Credit. Then, follow the instructions outlined below to finish your form.

- Browse the selection of pertinent documents available to you with just a single click.

- US Legal Forms provides you with state- and county-specific templates accessible at any time for download.

- Safeguard your document management activities with exceptional support that enables you to create any form in minutes without any extra or concealed charges.

- Simply Log In to your account, search for Modifying a Lease With Poor Credit and obtain it immediately within the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

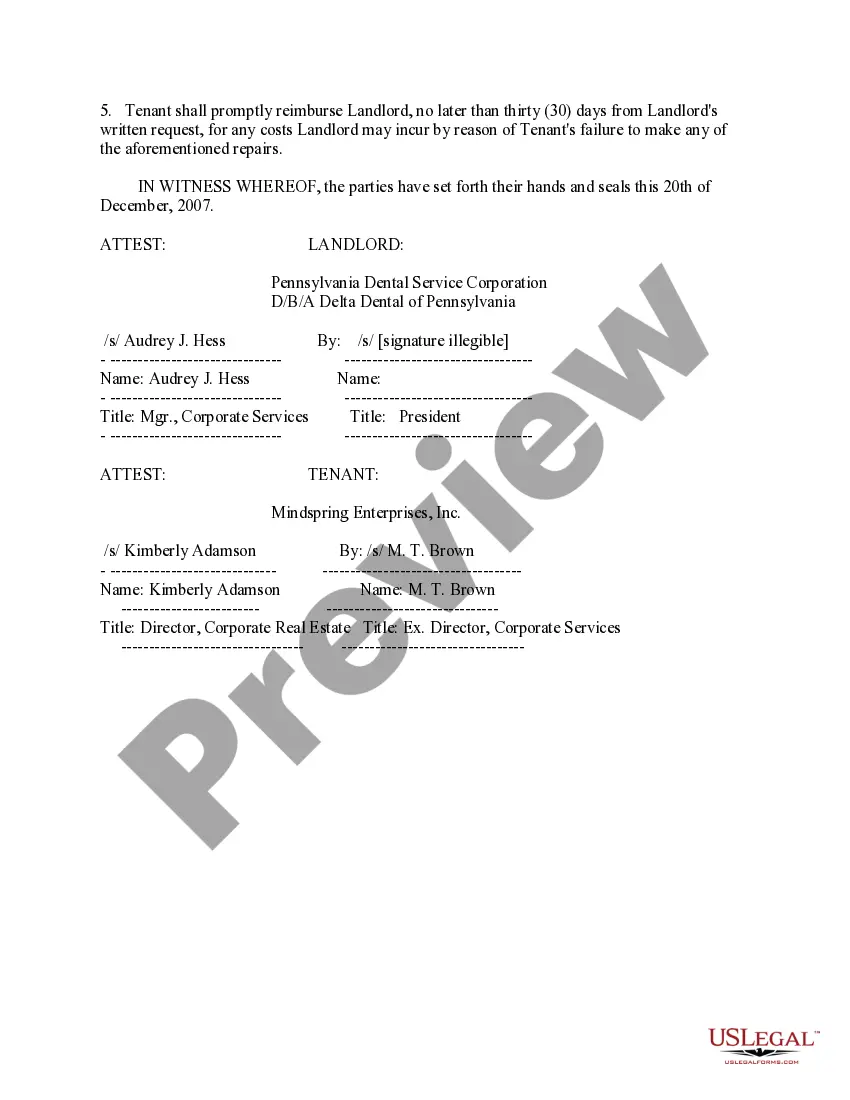

What Is a Lease Amendment? A lease amendment is a document between a landlord and tenant that can be used to legally modify the terms in an active lease agreement. Adding a lease amendment to an existing lease can ensure landlords are fully protected when changes occur that the original document does not cover.

Explain why your credit score may be low, whether you're dealing with medical bills, divorce, or other financial situations, and your landlord may be more lenient. Show Proof of Payments- If your credit score is low, but you've always paid rent on time, show your potential landlord proof of your on-time rent payments.

Explain Your Situation- Be extremely honest with your landlord or property manager about your credit history. Explain why your credit score may be low, whether you're dealing with medical bills, divorce, or other financial situations, and your landlord may be more lenient.

Credit enhancement is a method whereby an entity attempts to improve its credit worthiness. With credit enhancement, the lender is provided with reassurance that the borrower will honor its obligation through insurance, additional collateral, or a third party guarantee.

The North Carolina Office of Administrative Hearings and the Fair Housing Act prohibit landlords from discriminating against potential tenants because of their race, religion, familial status, sex, gender, etc.