Investors Purchase Common Stock Primarily For

Description

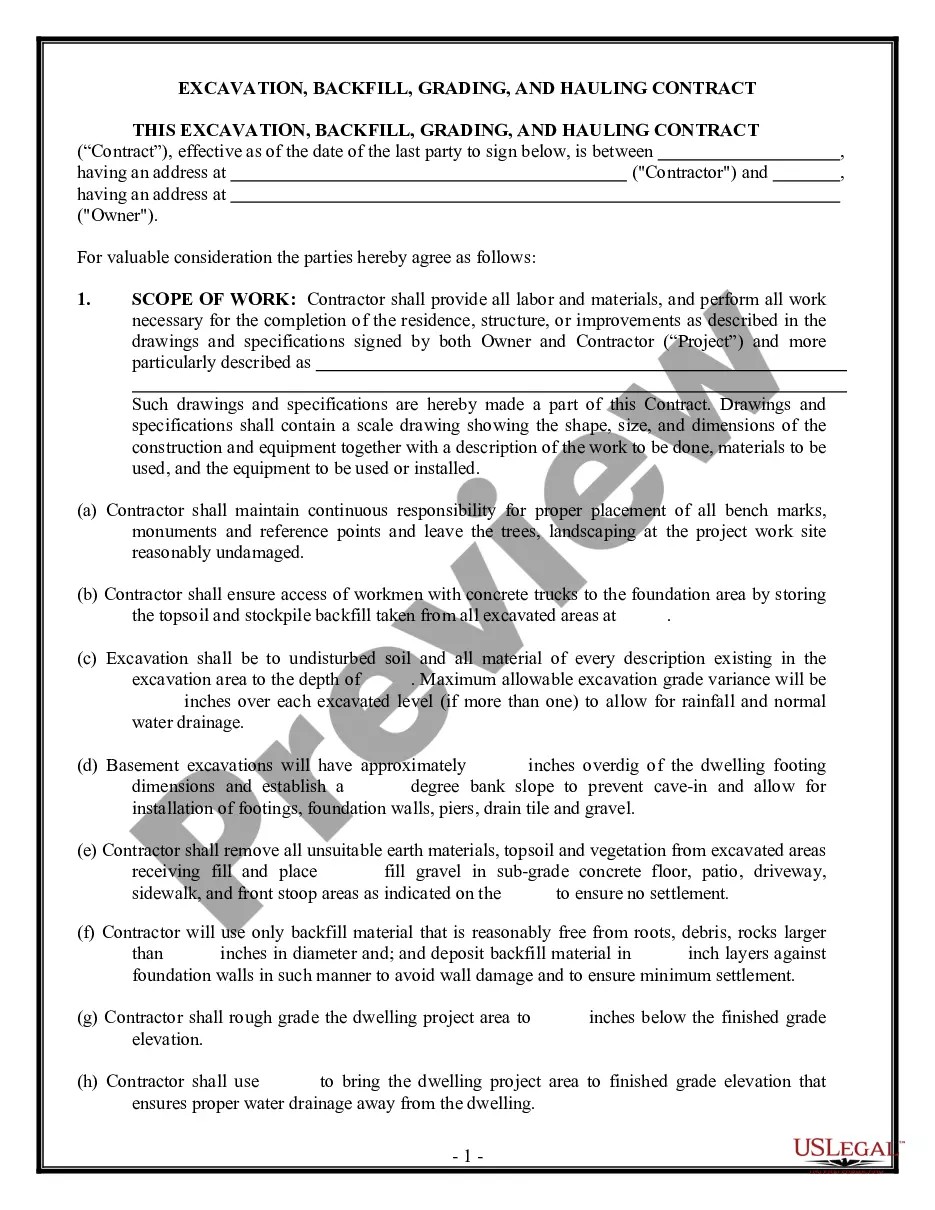

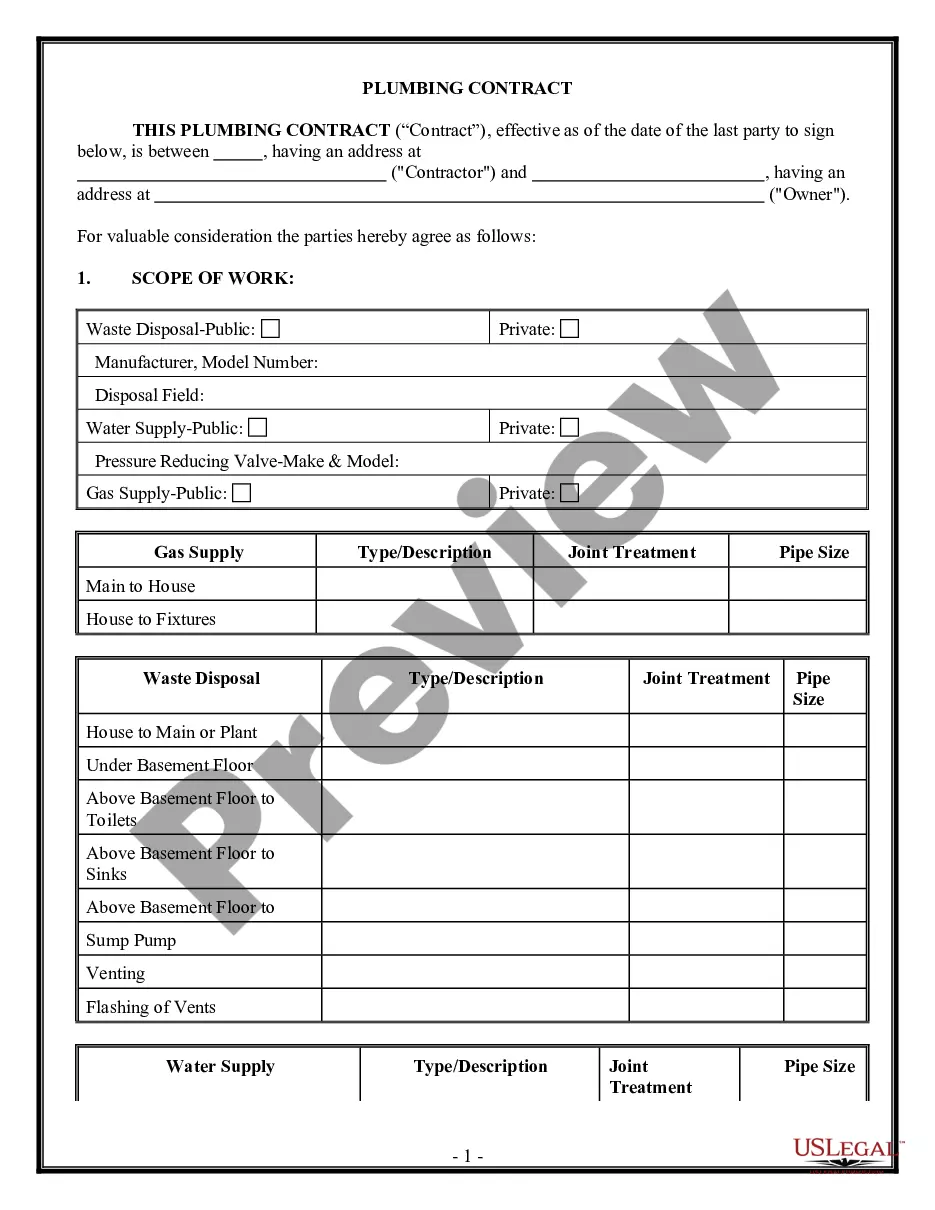

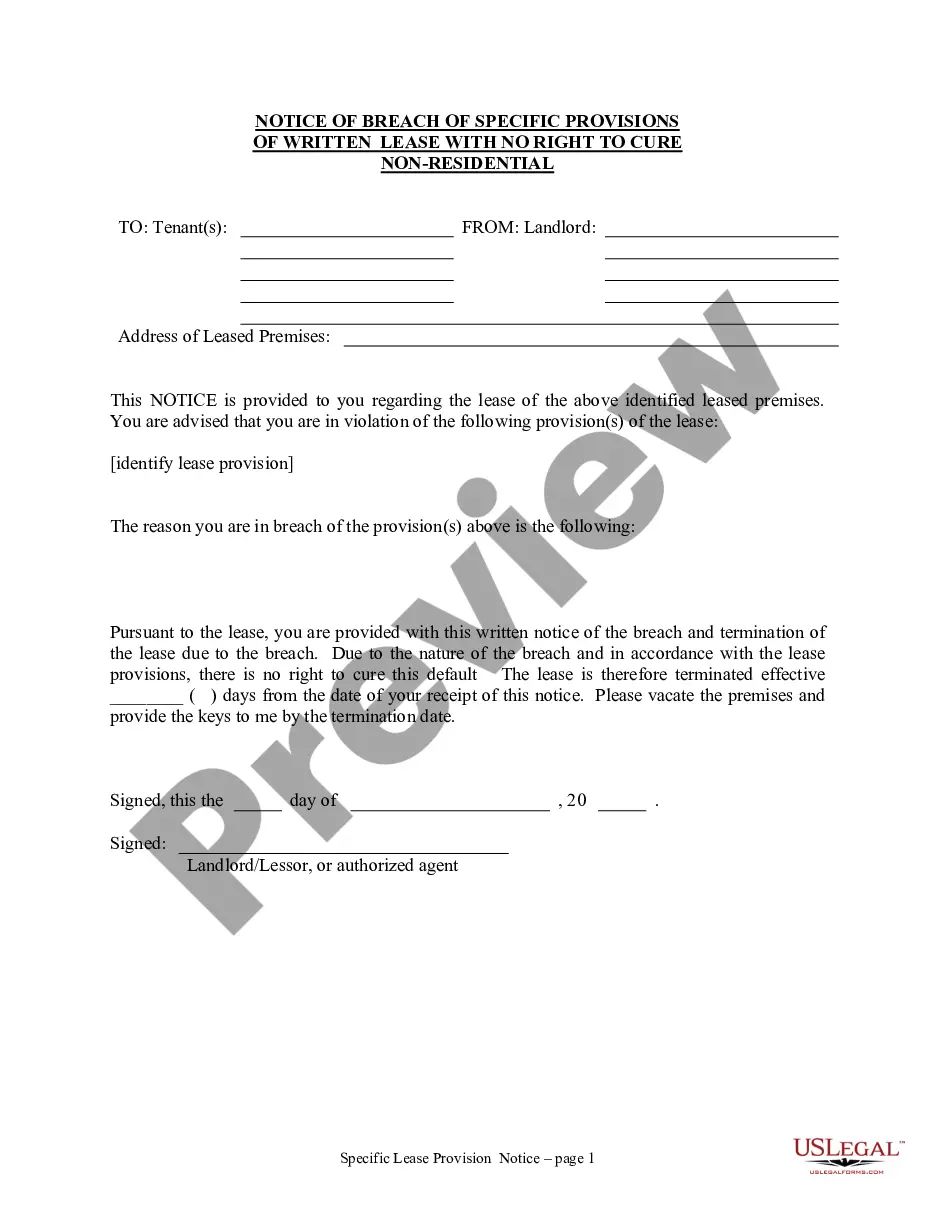

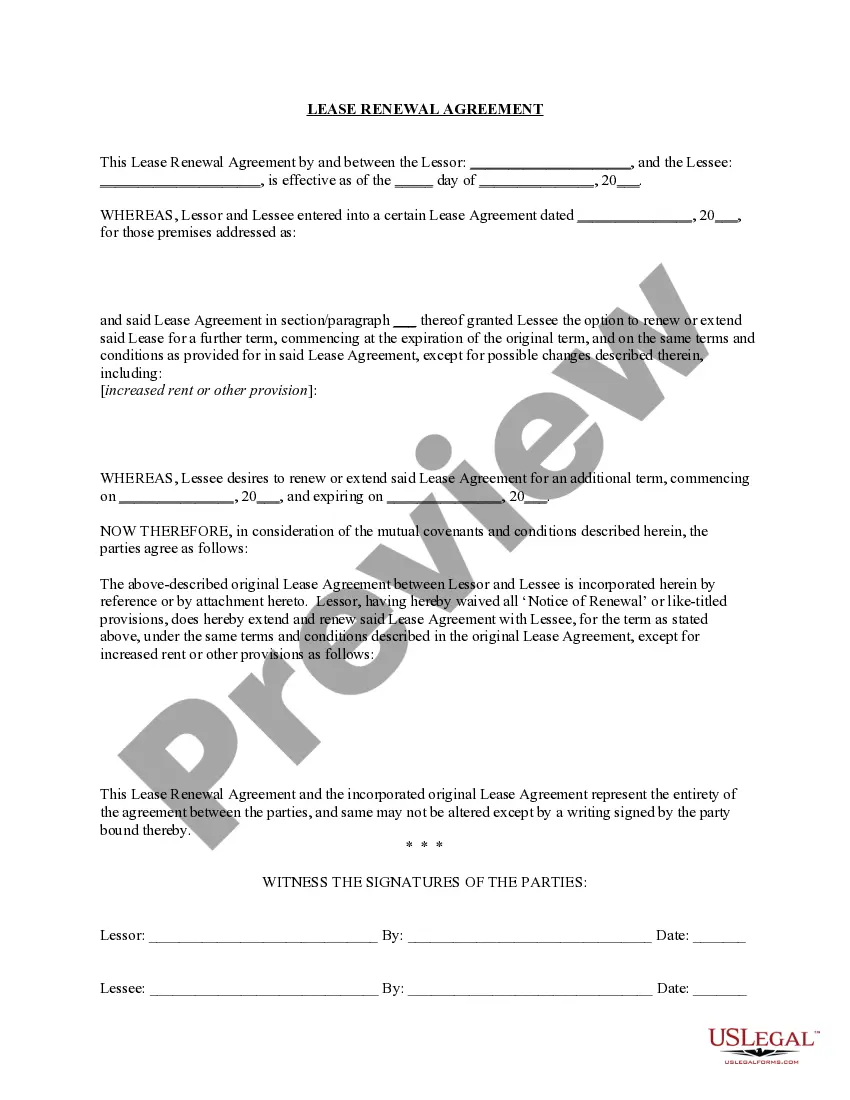

How to fill out Subscription Agreement Between Ichargeit.Com, Inc. And Prospective Investor For The Purchase Of Units Consisting Of Common Stock And Common Stock Warrant?

Working with legal papers and operations can be a time-consuming addition to your day. Investors Purchase Common Stock Primarily For and forms like it usually require that you look for them and understand the best way to complete them appropriately. As a result, whether you are taking care of financial, legal, or personal matters, using a comprehensive and practical web library of forms at your fingertips will go a long way.

US Legal Forms is the top web platform of legal templates, featuring more than 85,000 state-specific forms and a number of resources to help you complete your papers quickly. Check out the library of appropriate documents open to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Safeguard your papers administration procedures with a top-notch service that lets you prepare any form within a few minutes without having additional or hidden fees. Just log in to your profile, identify Investors Purchase Common Stock Primarily For and download it right away within the My Forms tab. You can also gain access to previously saved forms.

Could it be the first time utilizing US Legal Forms? Register and set up your account in a few minutes and you’ll have access to the form library and Investors Purchase Common Stock Primarily For. Then, stick to the steps below to complete your form:

- Make sure you have found the proper form using the Preview feature and looking at the form description.

- Select Buy Now once ready, and select the monthly subscription plan that meets your needs.

- Select Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience supporting users manage their legal papers. Obtain the form you require right now and improve any process without having to break a sweat.

Form popularity

FAQ

Common stock isn't just common in name only; this type of stock is the one investors buy most often. It grants shareholders ownership rights and allows them to vote on important decisions such as electing the board of directors. They also get a say in certain policy decisions and management issues.

Upon issuance, common stock is recorded at par value with any amount received above that figure reported in an account such as capital in excess of par value. If issued for an asset or service instead of cash, the recording is based on the fair value of the shares given up.

Upon issuance, common stock is generally recorded at its fair value, which is typically the amount of proceeds received. Those proceeds are allocated first to the par value of the shares (if any), with any excess over par value allocated to additional paid-in capital.

A common shareholder is someone who has purchased at least one common share of a company. Common shareholders have a right to vote on corporate issues and are entitled to declared common dividends. Common shareholders are paid out last in the event of bankruptcy after debtholders and preferred shareholders.

Earning income from common stock is often based on capital appreciation as the value of the stock goes up when the business succeeds. There may be dividends, but they can only be paid out after preferred stock dividends are paid out. Earning income from preferred stock is primarily through the dividend offered.