Mortgage California Regarding Foreclosure Process

Description

How to fill out Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

Creating legal documents from the beginning can frequently be intimidating.

Certain situations may require extensive research and substantial financial investment.

If you’re looking for a more direct and economical method of preparing Mortgage California Regarding Foreclosure Process or any other forms without unnecessary hassle, US Legal Forms is always available to assist you.

Our online catalog of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters.

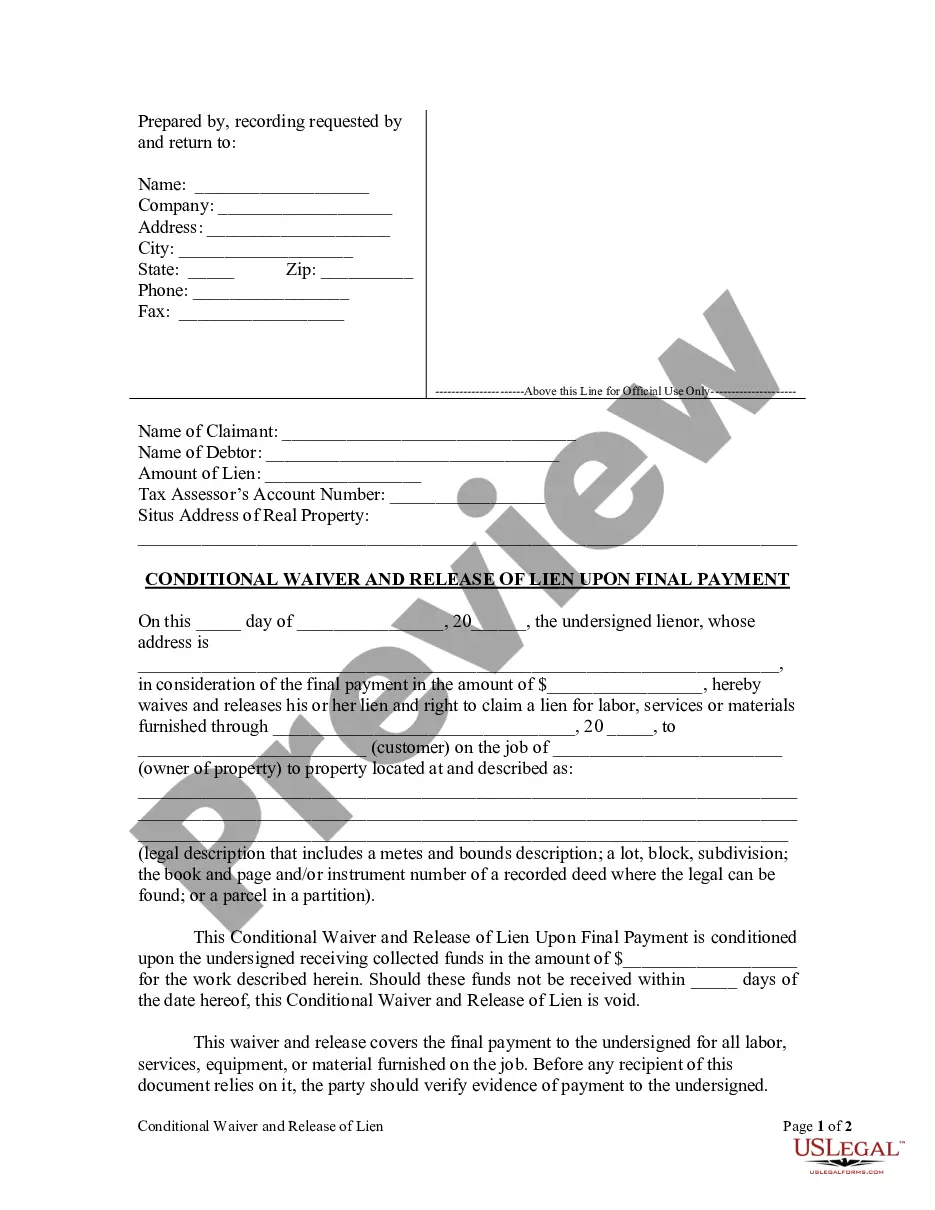

However, before proceeding to download Mortgage California Regarding Foreclosure Process, adhere to these guidelines: Verify the document preview and descriptions to confirm that you are viewing the document you need. Ensure that the form you select meets the requirements of your state and county. Choose the most appropriate subscription option to obtain the Mortgage California Regarding Foreclosure Process. Download the form, then complete, sign, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document execution a straightforward and efficient process!

- With just a few clicks, you can quickly access state- and county-specific forms carefully prepared by our legal professionals.

- Utilize our platform whenever you need a dependable and trustworthy service through which you can swiftly find and download the Mortgage California Regarding Foreclosure Process.

- If you’re already familiar with our website and have previously registered an account with us, simply Log In to your account, choose the form and download it or re-download it at any time in the My documents section.

- Not signed up yet? No problem.

- It requires minimal time to set it up and browse the library.

Form popularity

FAQ

Under California laws, lenders can pursue a foreclosure case through the courts, but they almost always use non-judicial foreclosure instead. The non-judicial process can be completed in approximately 120 days (4 months). However, the timeline can sometimes be 200 days or more.

California changed its law at the beginning of the 2023 to require that certain sellers of foreclosed properties containing one to four residential units only accept offers from eligible bidders during the first 30 days after a property is listed.

California Foreclosure Timeline 90 days late: If your mortgage payment is 90 days late, your lender might consider starting the foreclosure process. This doesn't mean you'll automatically lose your home the first time you miss a payment.

AB 2170: Prioritizing Eligible Bidders and Ensuring Transparency AB 2170 introduced a significant shift in the foreclosure process for Institutions and investors. It mandates that Institutions prioritize ?Eligible Bidders? during the initial 30-day window after listing a real estate-owned (REO) property for sale.

How long before they take my house? is the worried question put by a homeowner in California who can't make their mortgage payment. There are two answers, each equally true: California statutes tell us the minimum time for an unpaid lender to foreclose: about 4 months, from start to sale. In practice, it's far longer.