Stockholders Corp Withholding Tax

Description

How to fill out Stockholders Agreement Between Schick Technologies, Inc., David Schick, Allen Schick, And Greystone Funding Corp?

Dealing with legal papers and operations can be a time-consuming addition to your day. Stockholders Corp Withholding Tax and forms like it typically require you to search for them and understand how you can complete them appropriately. Therefore, whether you are taking care of economic, legal, or individual matters, using a thorough and practical web catalogue of forms at your fingertips will greatly assist.

US Legal Forms is the best web platform of legal templates, boasting more than 85,000 state-specific forms and numerous resources that will help you complete your papers effortlessly. Explore the catalogue of pertinent papers available to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Protect your papers management processes having a high quality support that lets you put together any form within minutes without any additional or hidden charges. Simply log in to the profile, find Stockholders Corp Withholding Tax and download it right away within the My Forms tab. You can also access previously downloaded forms.

Could it be the first time making use of US Legal Forms? Sign up and set up your account in a few minutes and you will have access to the form catalogue and Stockholders Corp Withholding Tax. Then, follow the steps below to complete your form:

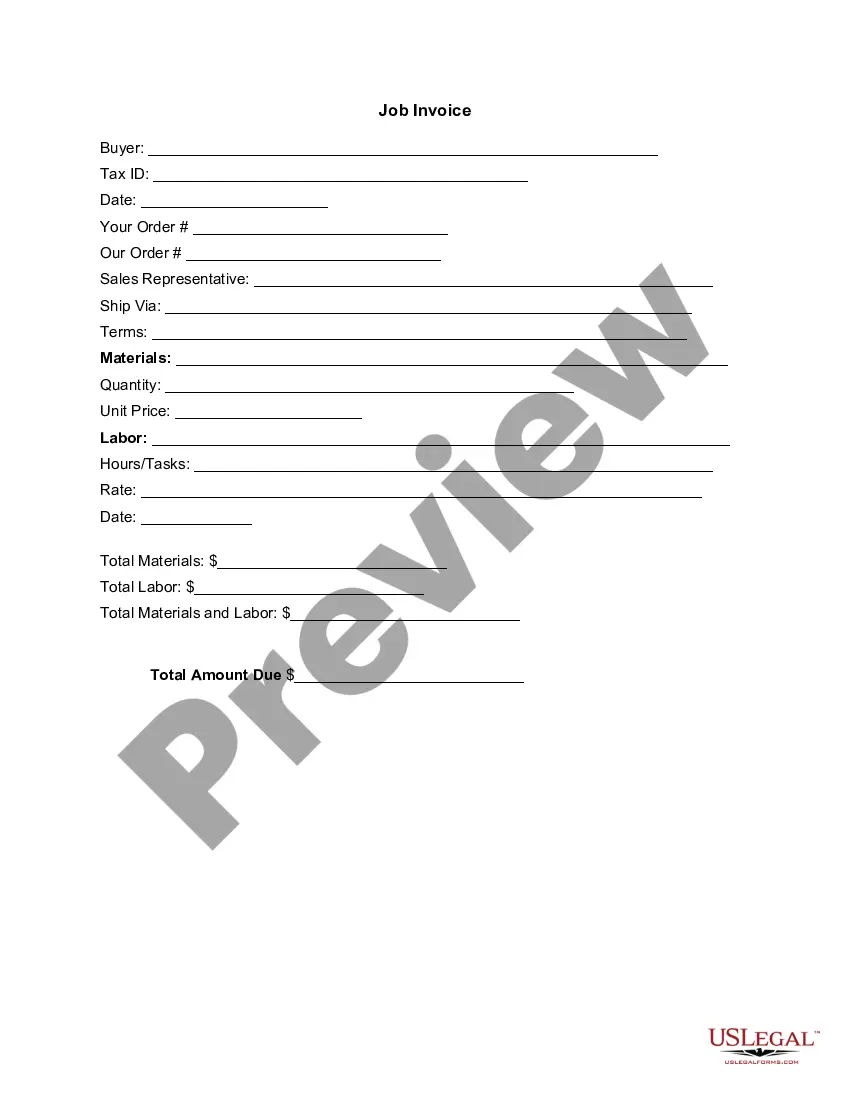

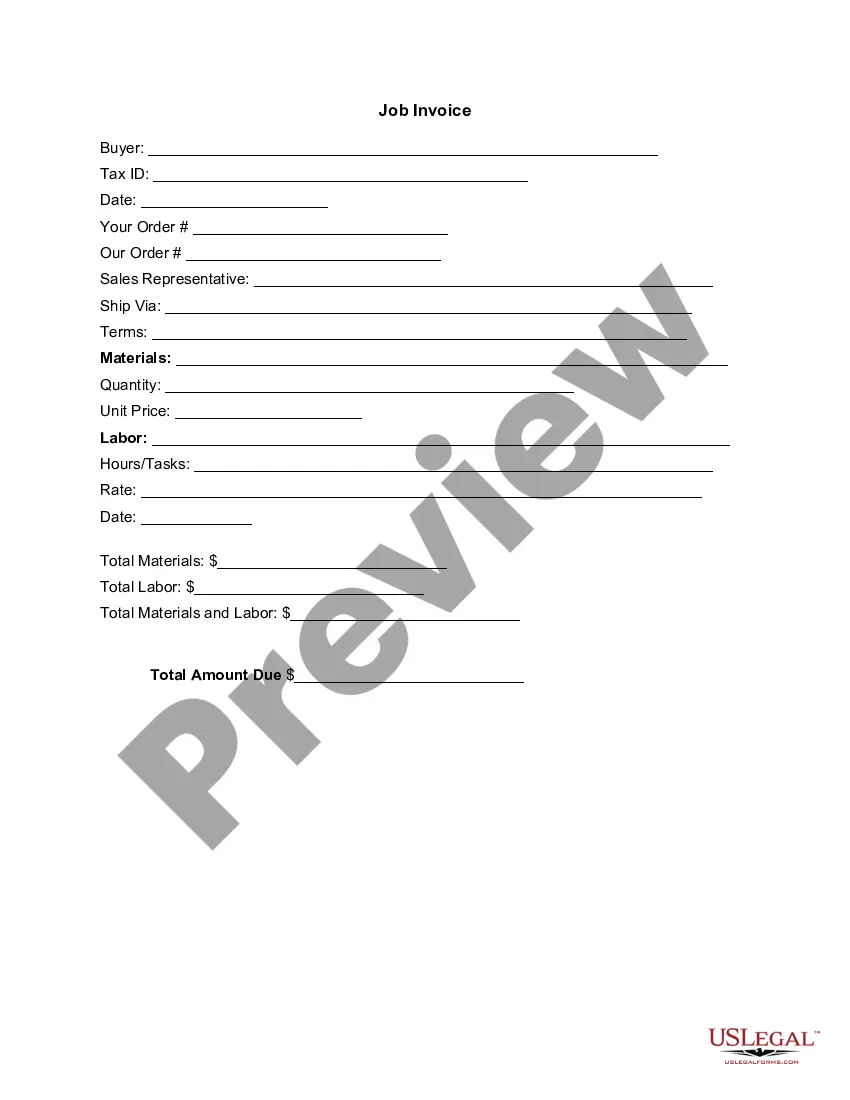

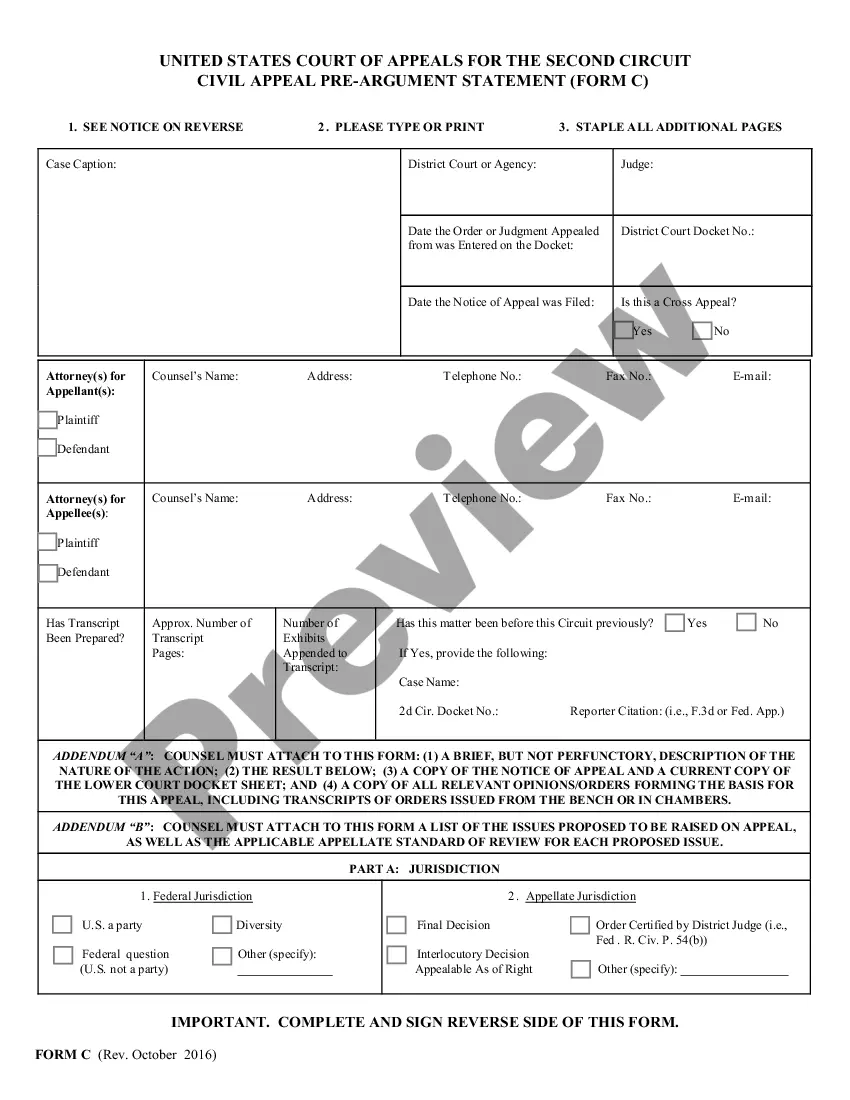

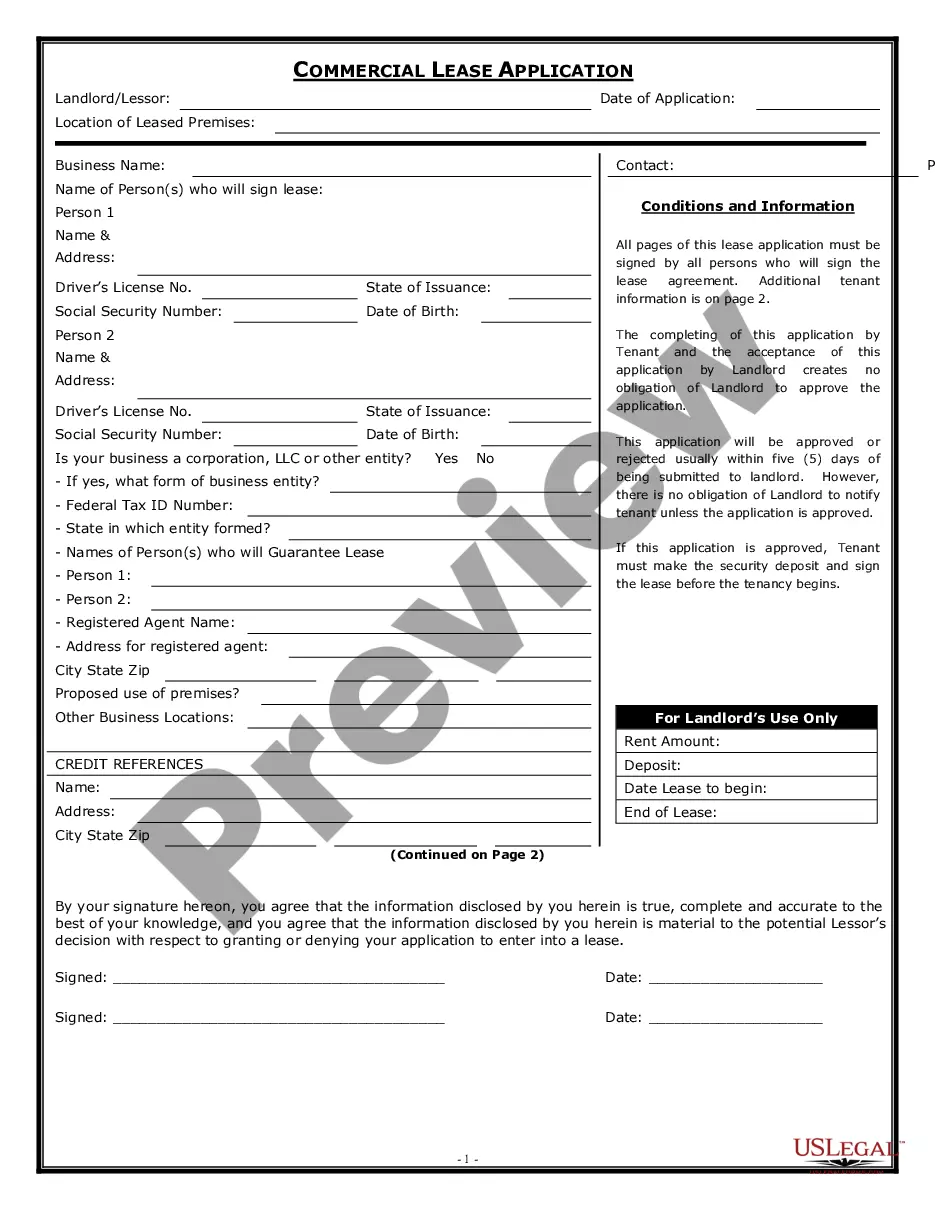

- Be sure you have found the right form by using the Review option and reading the form information.

- Choose Buy Now once ready, and choose the subscription plan that suits you.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience supporting consumers control their legal papers. Obtain the form you want today and enhance any operation without having to break a sweat.

Form popularity

FAQ

Dividends are taxable to a shareholder as ordinary income. Corporations issue shareholders an annual Form 1099 Dividend, which reports dividends paid during the year. The amount paid is reported by the shareholder as income on Schedule B of the shareholder's return.

A withholding tax is an amount of income that a company withholds from an employee's paycheck or from dividends paid to a foreign shareholder. The corporation pays the money withheld to the IRS directly, instead of to the employee or shareholder.

How to fill out Form 1120 Employer Identification Number (EIN) Date you incorporated. Total assets. Gross receipts and sales. Cost of goods sold (COGS) Tax deductions. Tax credits. Capital gains.

Ing to the IRS: Generally, an S corporation is exempt from federal income tax other than tax on certain capital gains and passive income. It is treated in the same way as a partnership, in that generally taxes are not paid at the corporate level.

So, what's the tax benefit of an S Corp? The S Corp advantage is that you only pay FICA payroll tax on your employment wages. The remaining profits from your S Corp are not subject to self-employment tax or FICA payroll taxes. Those profits are only subject to income tax.