Stockholders Corp Formula 1

Description

How to fill out Stockholders Agreement Between Schick Technologies, Inc., David Schick, Allen Schick, And Greystone Funding Corp?

Accessing legal templates that meet the federal and local regulations is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the appropriate Stockholders Corp Formula 1 sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life case. They are simple to browse with all documents collected by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your form is up to date and compliant when getting a Stockholders Corp Formula 1 from our website.

Obtaining a Stockholders Corp Formula 1 is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

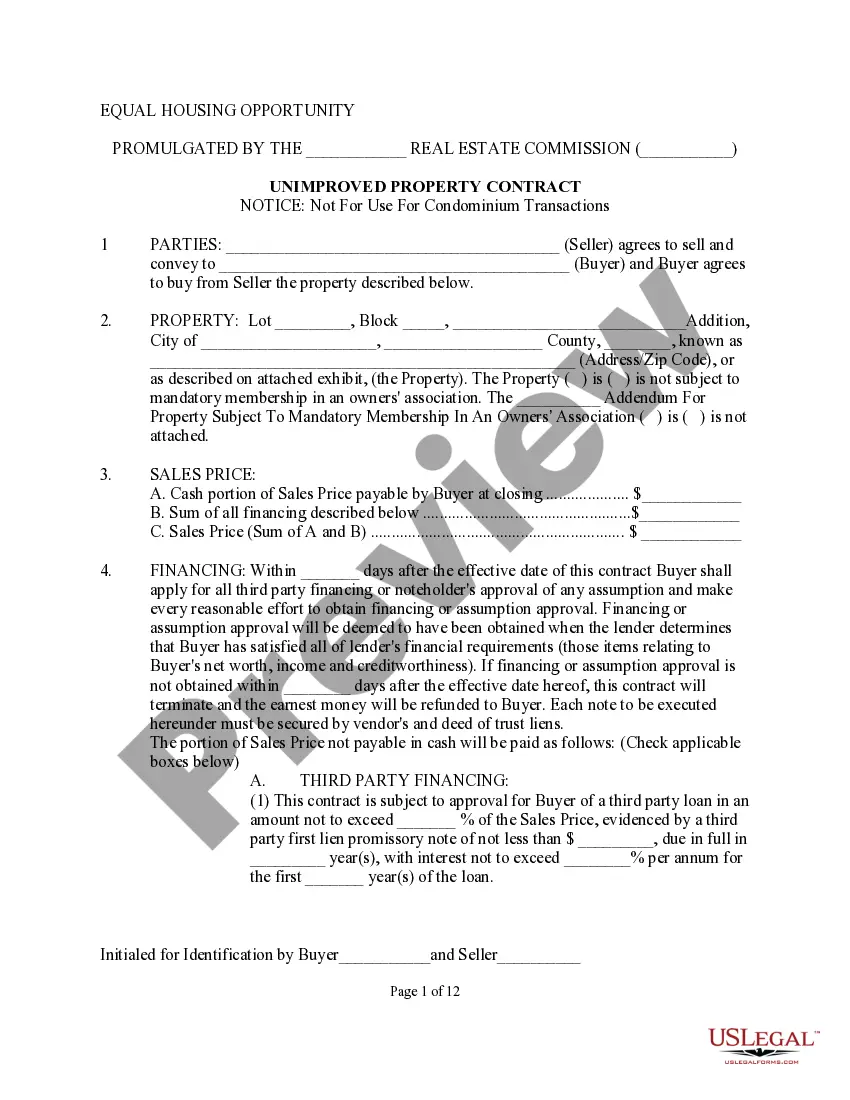

- Take a look at the template using the Preview option or via the text description to ensure it meets your requirements.

- Browse for another sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Stockholders Corp Formula 1 and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Shareholders' equity may be calculated by subtracting its total liabilities from its total assets?both of which are itemized on a company's balance sheet. Total assets can be categorized as either current or non-current assets.

Summary. Shareholders' equity is the shareholders' claim on assets after all debts owed are paid up. It is calculated by taking the total assets minus total liabilities. Shareholders' equity determines the returns generated by a business compared to the total amount invested in the company.

By rearranging the original accounting equation, Assets = Liabilities + Stockholders Equity, it can also be expressed as Stockholders Equity = Assets ? Liabilities. Stockholders Equity provides highly useful information when analyzing financial statements.

The equation for the balance sheet is Assets = Liabilities + Stockholders' Equity. The stockholders' equity section of the balance sheet reports the worth of the stockholders. It has two subsections: Paid-in capital (from stockholder investments) and Retained earnings (profits generated by the corporation.)

Stockholders' equity refers to the assets remaining in a business once all liabilities have been settled. This figure is calculated by subtracting total liabilities from total assets; alternatively, it can be calculated by taking the sum of share capital and retained earnings, less treasury stock.