Trust Mortgage Corp Forum

Description

How to fill out Grantor Trust Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA And Bank One, National Assoc.?

Legal documents management can be overwhelming, even for the most adept professionals.

When you are looking into a Trust Mortgage Corp Forum and lack the time to invest in finding the appropriate and current version, the procedures may be challenging.

US Legal Forms meets any requirements you might have, from personal to business documentation, all in one place.

Utilize advanced tools to complete and manage your Trust Mortgage Corp Forum.

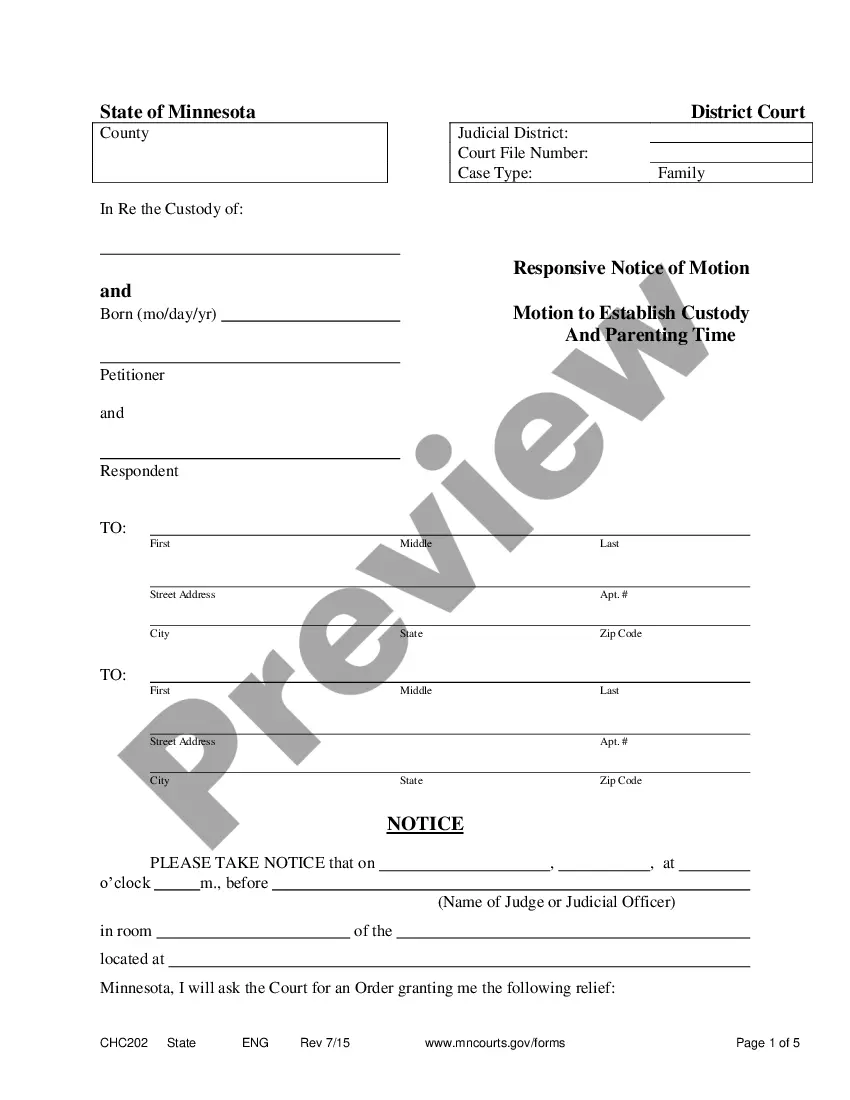

Here are the steps to follow after obtaining the form you need: Validate that it is the correct form by previewing it and reviewing its description. Ensure that the sample is valid in your state or county. Select Buy Now when you are ready. Choose a monthly subscription plan. Select the file format you require, and Download, complete, sign, print, and send your documents. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Streamline your daily document management into a simple and user-friendly process today.

- Access a valuable library of articles, guides, and resources pertinent to your situation and needs.

- Save time and effort in obtaining the documents you require, and use US Legal Forms’ sophisticated search and Review tool to find and acquire Trust Mortgage Corp Forum.

- For those with a subscription, Log Into your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to view the documents you have previously downloaded and to manage your folders as you wish.

- If it is your first time with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- A robust online form repository can be transformative for anyone aiming to handle these matters effectively.

- US Legal Forms is a leader in online legal documents, with over 85,000 state-specific forms accessible at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

Refinancing a house in an irrevocable trust is possible but only from irrevocable trust loan lenders. Conventional lenders cannot refinance a house in an irrevocable trust as the borrower is not currently on title of the property.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

Note: A trust must meet Fannie Mae's revocability and other eligibility requirements at the time the loan is delivered. Trust eligibility is not affected if the trust documents contain a provision that the trust will, in the future, become irrevocable upon the death of one of the settlors.

It's possible to refinance a property that's in a trust, but the process has a few extra steps and you'll need the consent of the trustor. Before you can start the transactional process of refinancing, you need to temporarily transfer the title to the property out of the trust.

Conventional lenders, such as banks and credit unions, are reluctant (or in most cases unable) to offer loans to irrevocable trusts in California. This reluctance is partly due to the complexity, lack of personal guarantee, as well as the hassle to set up this loan.