Trust Mortgage Corp For Sale

Description

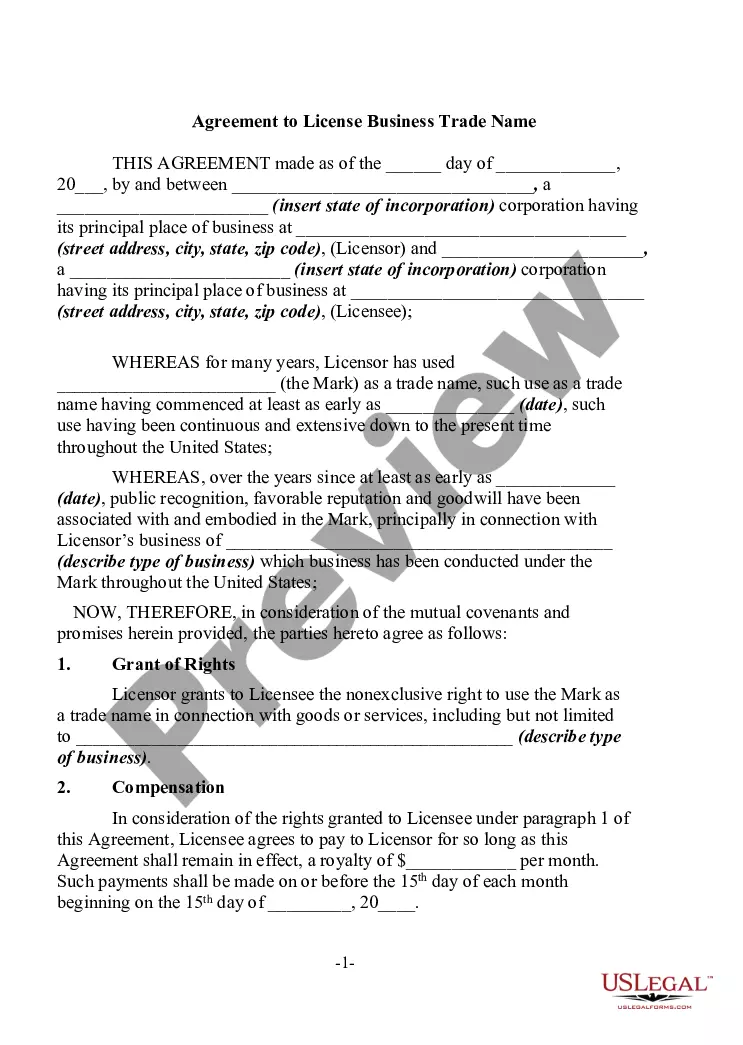

How to fill out Grantor Trust Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA And Bank One, National Assoc.?

The Trust Mortgage Corporation For Sale displayed on this page is a versatile official template created by expert attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any commercial and personal event. It’s the fastest, easiest, and most reliable method to acquire the forms you require, as the service ensures bank-level data security and anti-malware safeguards.

Register for US Legal Forms to have validated legal templates for all of life's circumstances readily available.

- Explore the document you require and examine it.

- Scan through the file you sought and preview it or assess the form description to ensure it meets your needs. If it doesn't, utilize the search feature to find the appropriate one. Click Buy Now when you have found the template you require.

- Register and Log In.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the fillable template.

- Choose the format you prefer for your Trust Mortgage Corporation For Sale (PDF, DOCX, RTF) and download the sample to your device.

- Fill out and sign the documents.

- Print the template to fill it out manually. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately complete and sign your form with an electronic signature.

- Download your documents again.

- Reutilize the same document whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

A mortgage in trust may be something that you have never previously considered, but it may be appropriate. Anyone who owns property can put their mortgage in a revocable living trust so as to not deal with the probate process after death and utilize other estate planning benefits.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

A grantor may place a mortgaged home in a living trust by signing a warranty or quitclaim deed from the current owners to the trust. In this case, the deed would name the living trust as grantee and would be and recorded just like any other property transfer.

Mortgage trusts, also commonly known as mortgage funds, are an investment vehicle that provides loans to commercial borrowers to finance land subdivision, property development or construction. These loans are generally secured by mortgages over property as the primary security.