State Military Law With Most

Description

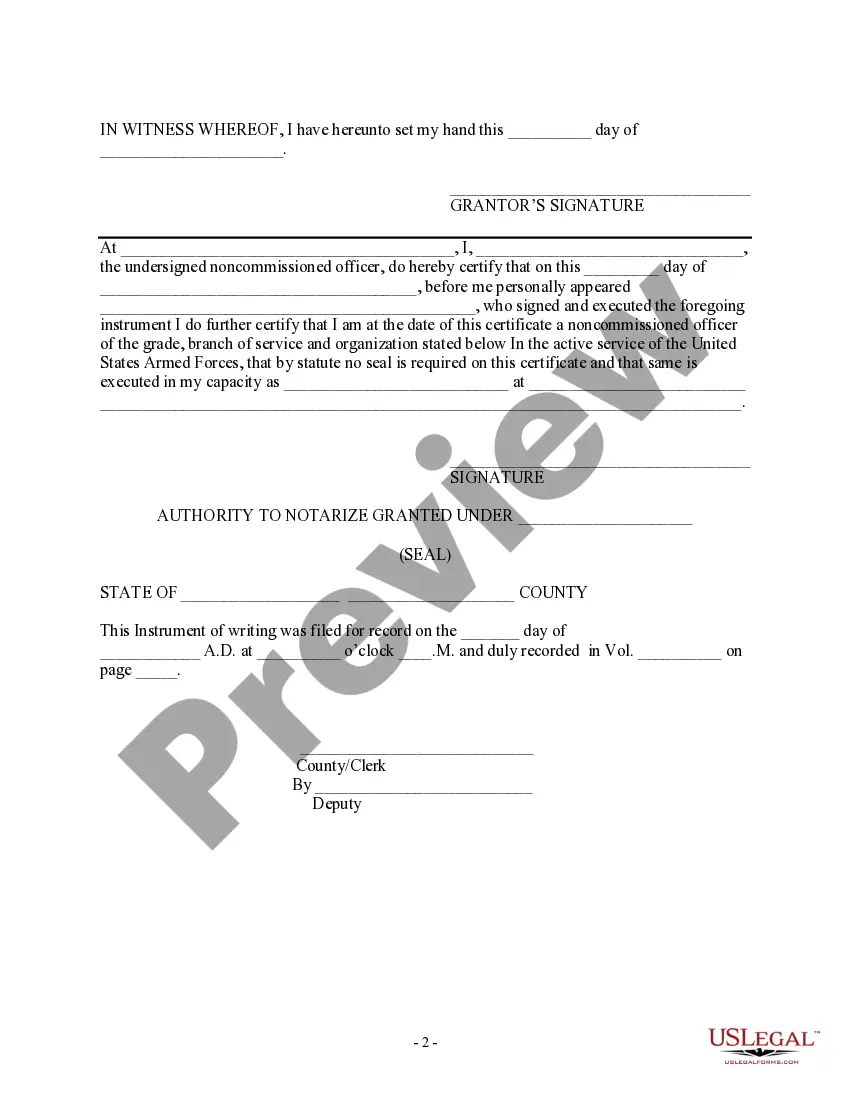

How to fill out Special Military Power Of Attorney?

It’s obvious that you can’t become a legal professional overnight, nor can you figure out how to quickly draft State Military Law With Most without the need of a specialized background. Creating legal forms is a long venture requiring a certain training and skills. So why not leave the creation of the State Military Law With Most to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the document you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether State Military Law With Most is what you’re looking for.

- Begin your search again if you need any other template.

- Register for a free account and select a subscription plan to purchase the template.

- Choose Buy now. As soon as the transaction is complete, you can get the State Military Law With Most, fill it out, print it, and send or send it by post to the designated individuals or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

If you're in the military, you're probably taxed in your state of legal residence rather than in the state where you're stationed. Filing taxes while deployed can depend on your state of residence as well. To establish legal residence in a state, you usually must prove you live ? and intend to continue living ? there.

You may qualify for a California tax exemption under the MSRAA if all of the following apply: You're not in the military. You're legally married to the military servicemember. You live with your military spouse/RDP. Your military spouse must have permanent change of station (PCS) orders to California.

Active-duty service members file state income taxes in their state of legal residence. Military service members are not required to change their legal residence when they move to a new state solely because of military orders; they may maintain their legal residence in a state where they have previously established it.

So, both the non-military income earned by you and the military income earned by your spouse are exempt from state tax in the duty-station state. This makes military tax filing much simpler overall. Both of you still have to pay income and property taxes in your home state.

Under the SCRA, servicemembers retain the state they claimed when they entered active duty as their state of legal residence unless they take affirmative steps to change their state of legal residence.