Special Power Of Attorney For Banking Purposes

Description

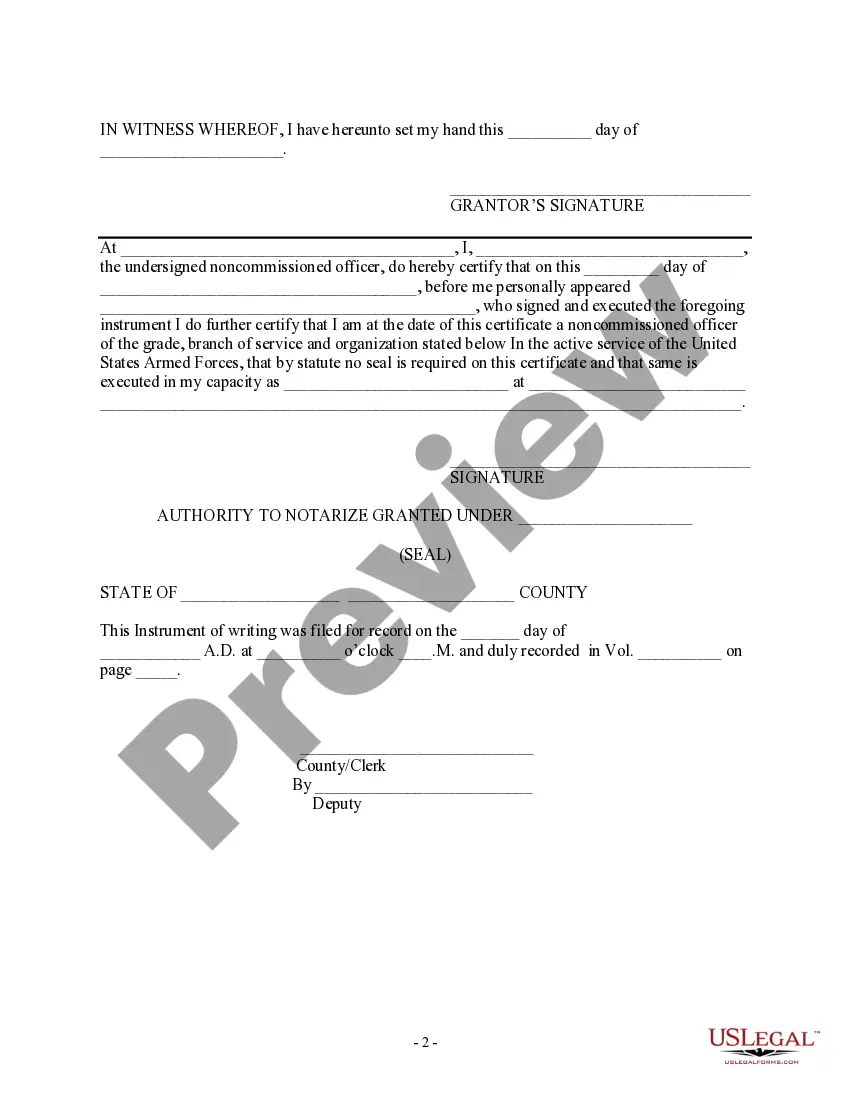

How to fill out Special Military Power Of Attorney?

Managing legal documents can be exasperating, even for the most knowledgeable professionals.

When you seek a Special Power Of Attorney For Banking Purposes and lack the opportunity to spend time looking for the correct and current version, the processes can be overwhelming.

With US Legal Forms, you are enabled to.

Access legal and business forms specific to your state or county. US Legal Forms addresses any needs you may have, ranging from personal to business documents, all in one location.

If this is your first experience with US Legal Forms, create an account and enjoy unrestricted access to all platform benefits. Follow these steps after obtaining the form you need.

- Employ state-of-the-art tools to complete and manage your Special Power Of Attorney For Banking Purposes.

- Access a valuable resource library of articles, guidelines, handbooks, and materials pertinent to your circumstances and requirements.

- Conserve time and effort locating the documents you need, and take advantage of US Legal Forms’ sophisticated search and Preview tool to retrieve the Special Power Of Attorney For Banking Purposes and download it.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you have previously saved and manage your folders as desired.

- Utilize a comprehensive online form catalog which can be transformative for anyone looking to handle these matters effectively.

- US Legal Forms stands as a leader in web-based legal forms, offering over 85,000 state-specific legal documents accessible anytime.

Form popularity

FAQ

In order to become a licensed CPA in the state of Michigan, you must meet the following requirements: Pass all four sections of the CPA Examination. Submit application along with the $300 nonrefundable fee to the Michigan Board of Accountancy. Be of good moral character.

The Building Official of the city, or his or her designee, is designated as the enforcing agency responsible for discharging the city's duties of administration and enforcement under the Michigan Building Code, as promulgated from time to time.

The 2023 version of the NEC, which is the most current edition, contains provisions relating to revised standards and new materials. The proposed rules will adopt by reference the 2023 edition of the NEC with amendments, deletions, and additions deemed necessary for use in Michigan.

If changing the name of the pharmacy, complete the Application for Miscellaneous Pharmacy Change form. If the location of the pharmacy has changed, complete the Application for Pharmacy License form. Both forms can be obtained online. MANUFACTURER/WHOLESALER: DO NOT use this form for a name and/or address change.

How do I update my information connected to my Michigan CPA license? To make changes to your CPA license with the state (i.e. phone number, address, apply for a firm license) log into your MiPLUS account and select Modify.

What are CPE Requirements for Michigan Certified Public Accountants (CPA) Professionals? All licensed CPAs in Michigan must complete 80 hours of approved continuing education over a two-year renewal period with a minimum of 40 hours per year.

Applicability (statewide, local, limited): STATEWIDE The State provides a Statewide Jurisdiction List to assist users of the code with their permitting needs. State inspectors exist for projects where local code officials do not provide inspection.

Michigan CPA Exam Cost Breakdown Application Fee$170.00Total for all 4 CPA Exam Sections$952.60Licensing & Registration FeesCPA New Application Fee$300.00License Renewal Fee$200.006 more rows