Debt Collector Take With Americollect

Description

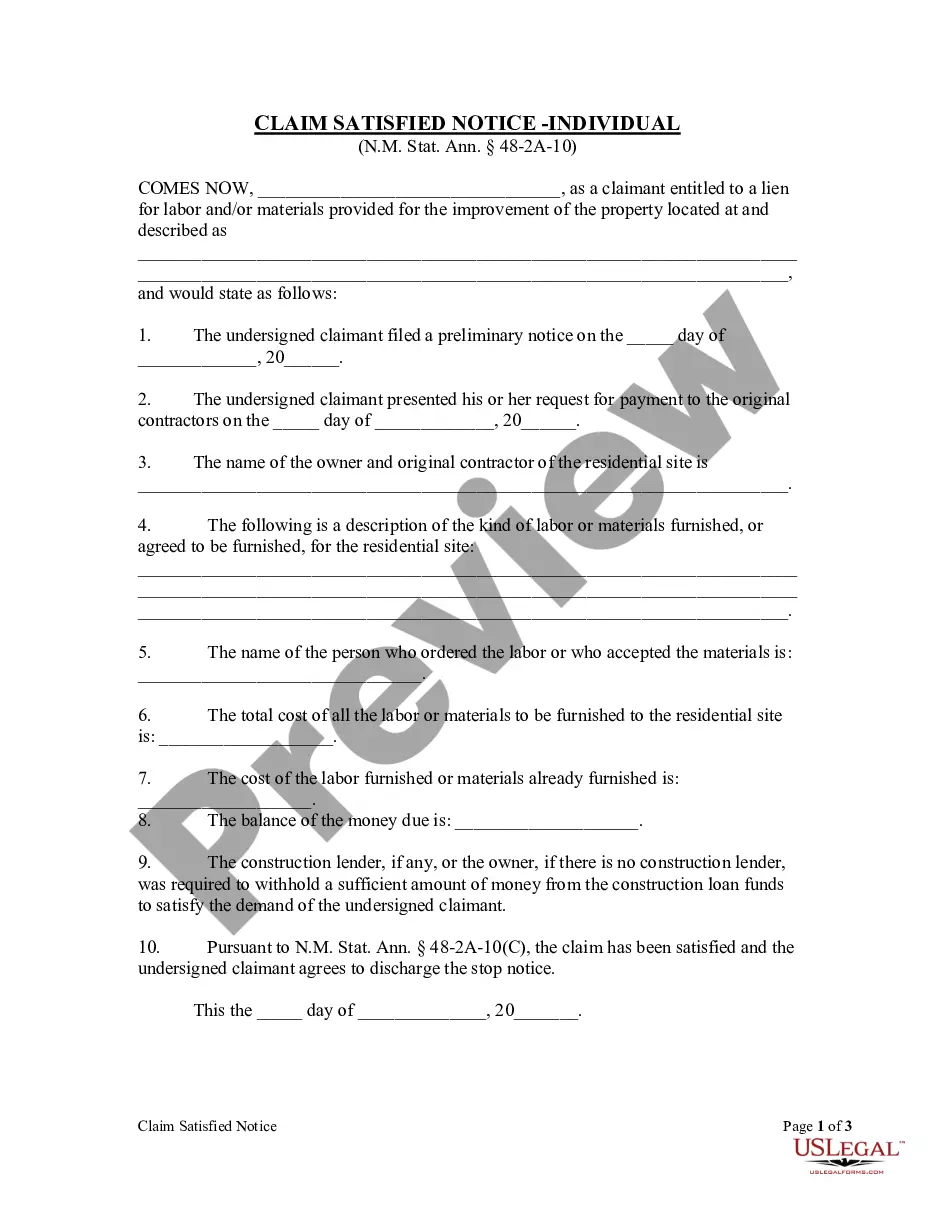

How to fill out Letter Informing Debt Collector Of False Or Misleading Misrepresentations In Collection Activities - Threatening To Take An Action That Cannot Legally Be Taken Or That Is Not Intended To Be Taken?

Accessing legal document samples that meet the federal and regional laws is a matter of necessity, and the internet offers many options to pick from. But what’s the point in wasting time looking for the right Debt Collector Take With Americollect sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are easy to browse with all documents collected by state and purpose of use. Our experts keep up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a Debt Collector Take With Americollect from our website.

Obtaining a Debt Collector Take With Americollect is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the guidelines below:

- Examine the template utilizing the Preview feature or through the text description to make certain it fits your needs.

- Locate a different sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Debt Collector Take With Americollect and download it.

All documents you locate through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again. Fact Sheet - Refused offers | Negotiating with creditors nationaldebtline.org ? fact-sheet-library ? refused-... nationaldebtline.org ? fact-sheet-library ? refused-...

We ONLY collect for healthcare, which means when your patient speaks to one of our collection teammates, they're speaking to someone that understands the complexities and nuances of the medical collections landscape.

You can cancel your debt by paying the amount you owe, but it won't improve your credit score. To remove Americollect from your credit file, you'll need to dispute the debt or negotiate a pay-for-delete agreement. Find someone local to review your credit report. Free consult.

Can a debt collector take money from my paycheck or bank account? Yes, but the collector must first sue you to get a court order ? called a garnishment ? that says it can take money from your paycheck to pay your debts. A collector also can get a court order to take money from your bank account.

One of the best ways to deal with Americollect Collections is a combination of disputes, debt validation, cease and desist orders, and CFPB investigations. The most hassle-free way to do this is to call (800) 750-1416 or sign up online.