Letter Sample For Debt Collection

Description

How to fill out Notice Letter To Debt Collector Of Section 806 Violation - Harassment?

When you need to present a Sample Letter for Debt Recovery that adheres to your local state's laws, there are numerous choices to consider.

There's no requirement to review every document to ensure it satisfies all the legal stipulations if you are a subscriber to US Legal Forms.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Navigate through the provided page and verify it for alignment with your requirements.

- US Legal Forms has the most extensive online collection with an archive of over 85k ready-to-use documents for both business and personal legal matters.

- All templates are verified to comply with each state's laws and regulations.

- Thus, when you download a Sample Letter for Debt Recovery from our site, you can be confident that you hold a legitimate and up-to-date document.

- Acquiring the necessary template from our platform is very easy.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can visit the My documents tab in your profile and access the Sample Letter for Debt Recovery at any time.

- If this is your first experience with our library, please follow the instructions below.

Form popularity

FAQ

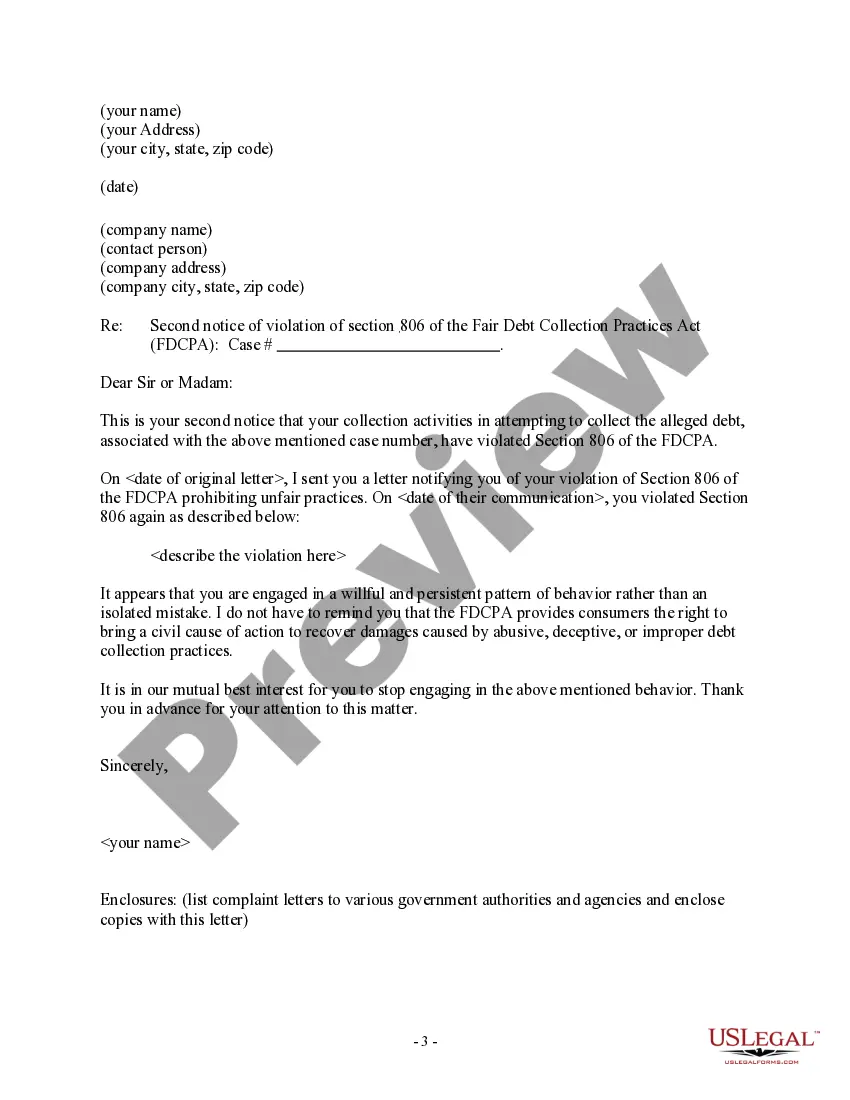

A collection letter should be clear, concise, and courteous while effectively communicating the debt details. The tone must remain professional, even if the situation is frustrating. By using a letter sample for debt collection, you can ensure your letter conveys the right message. A well-crafted letter can foster a positive dialogue and potentially lead to a faster resolution.

When writing a collection letter, start with a clear subject line and a professional greeting. Include the debtor's details, the amount owed, and any relevant deadlines for payment. Additionally, you can reference a letter sample for debt collection to help structure your content effectively. This approach can boost clarity and encourage the debtor to respond.

A collection letter is a formal document sent to notify a debtor of an overdue payment. It serves to outline the specifics of the debt and often includes payment instructions. By utilizing a letter sample for debt collection, you can craft a professional and persuasive message. This can significantly enhance your chances of receiving payment promptly.

An example of a collection notice is a letter that informs a debtor about an outstanding balance. This letter typically includes details like the amount owed, the creditor's information, and a request for payment. For those who need guidance, a letter sample for debt collection can provide a clear framework to follow. Using such a sample can help ensure that no important details are overlooked.

The 7 7 7 rule for debt collection refers to contacting a debtor seven times within seven days, followed by a pause for seven days. This method aims to maximize communication chances without overwhelming the debtor. Understanding this rule can help streamline your collection efforts. Consider using a letter sample for debt collection to adhere to this strategy effectively.

During negotiations for a debt settlement, begin by expressing your willingness to resolve the issue. Mention your financial constraints and propose a specific settlement amount that you can afford. Be open to discussion and ready to reach a mutually beneficial agreement. Reference a letter sample for debt collection to guide your negotiation strategy.

When you receive a debt collection letter, it's important to respond promptly. Acknowledge the claim and evaluate your options, deciding whether to negotiate or dispute the debt. Clearly state your position in your response and include any supporting documents. Using a letter sample for debt collection can help ensure your response is professional and effective.

To write a letter for debt collection, start by addressing the recipient properly. Clearly state the purpose of the letter, which is to collect the debt owed. Include the specific amount, any relevant dates, and a request for payment. A well-structured letter sample for debt collection reinforces your position while remaining professional.

An example of a collection letter generally includes the creditor’s information, the debtor's details, and a clear statement of the unpaid amount. It should also provide a deadline for payment and outline any potential consequences for non-payment. For added assistance, you can refer to a letter sample for debt collection to see a complete and accurate representation of such letters.

To write a letter to collect a debt, start with a clear subject line and address the debtor with respect. Include pertinent details about the debt, such as the amount due, previous communications, and payment options. A letter sample for debt collection can offer insight into effective wording and structure for your communication.