Letter Request For Credit Card

Description

How to fill out Letter To Trans Union Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

The Request Letter For Credit Card you see on this page is a reusable formal template crafted by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners more than 85,000 authenticated, state-specific documents for various business and personal scenarios. It’s the fastest, most direct, and most reliable method to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have authenticated legal templates for every aspect of life readily available.

- Search for the document you need and examine it.

- Review the sample you found and view it or read the form description to confirm it meets your requirements. If it doesn’t, use the search bar to find the correct one. Click Buy Now once you have identified the template you need.

- Create an account and Log In.

- Choose the pricing option that fits you and establish an account. Use PayPal or a debit/credit card to complete a quick transaction. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Request Letter For Credit Card (PDF, Word, RTF) and download the sample onto your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately fill out and sign your form with an eSignature.

- Download your documents again.

- Utilize the same form again whenever needed. Access the My documents tab in your profile to redownload any forms you've previously purchased.

Form popularity

FAQ

Writing a simple official letter begins with your address and the date at the top, followed by the recipient's address. Use a formal greeting, and in the body of the letter, clearly state your purpose and any relevant information. Close the letter politely with your name and signature to convey formality in your message.

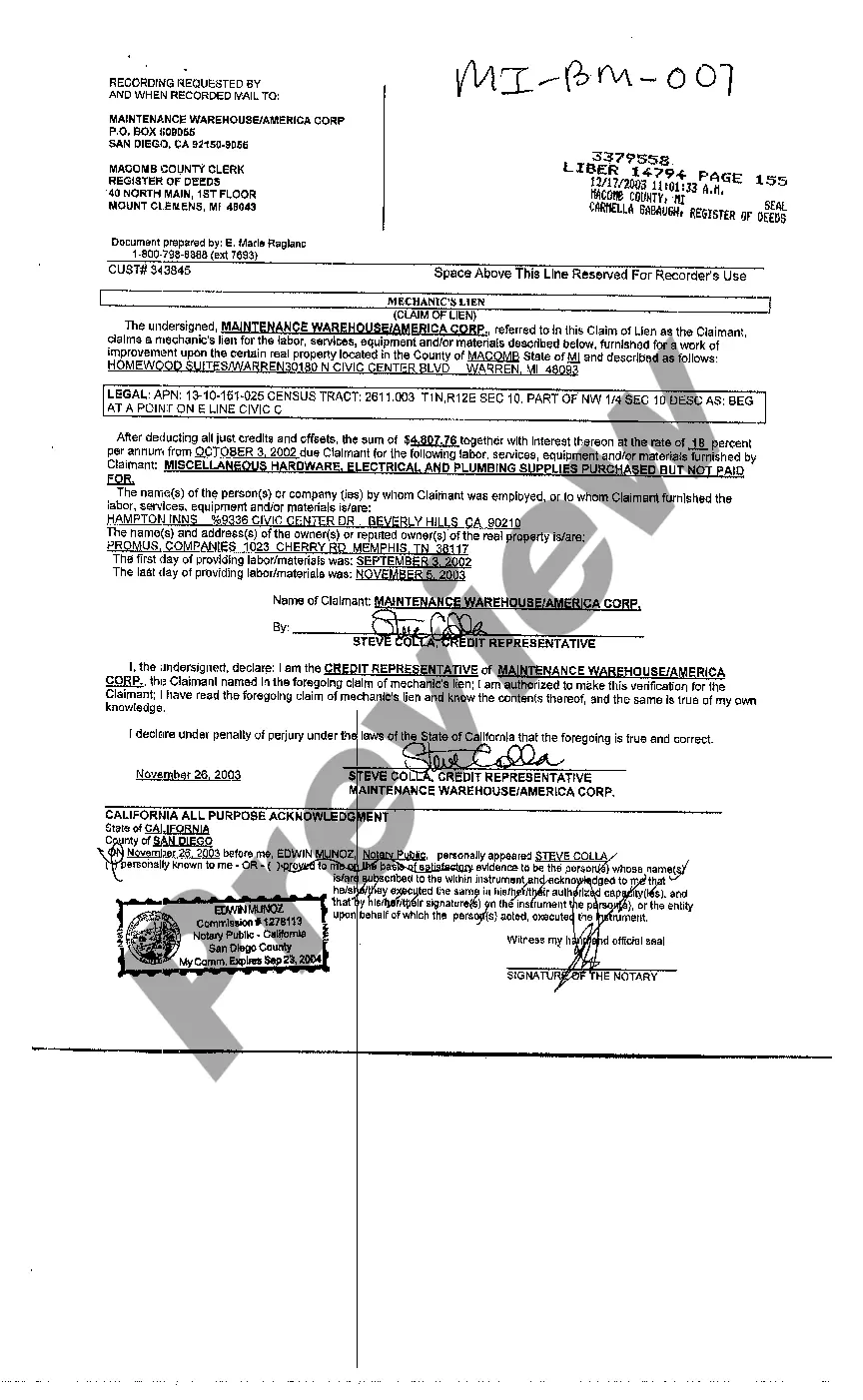

To request a letter of credit, start by identifying the bank or financial institution that will issue the letter. Write a formal letter request for credit card, explaining the purpose for needing the letter of credit, and detailing your financial history as needed. Providing clear information will help facilitate a smooth process and fulfill your request effectively.

To write an official letter request for credit card, begin with your address followed by the date and the recipient's address. Use a professional greeting, then clearly articulate your request, ensuring to include relevant details. Finally, end with a formal closing and your signature to affirm the legitimacy of your request.

The 2/3/4 rule refers to a credit management strategy where you should ideally keep your credit utilization ratio at 30% or below. The '2' indicates having two credit cards, '3' advises on having three open lines of credit, and '4' suggests limiting inquiries to four credit applications per year. This strategy helps maintain a healthy credit profile, especially if you are working on a letter request for credit card.

When writing an email for a credit card application, start with a clear subject line indicating your intention. In the body, introduce yourself, state your request concerning the letter request for credit card, and provide all necessary information like your financial background. Be concise, professional, and ensure that you attach any required documents for a smooth application process.

An example of a formal request could be a letter request for credit card issued to your bank, asking for an increase in your credit limit. The letter should clearly express your intentions, providing reasons and supporting details. Such a request ensures that you communicate your needs effectively while maintaining a professional tone.

To write a professional letter request for credit card, start with your address and the date. Next, include the recipient's address and a formal greeting. Clearly state your purpose, provide necessary details, and conclude with a polite closing. Remember to proofread your letter to ensure clarity and professionalism.

To write a formal letter to a bank, use a professional tone and standard business format. Start with your contact information, followed by the bank's information, and a clear subject stating your purpose. When drafting your letter request for credit card, maintain clarity, and be concise, ensuring you articulate your needs effectively without unnecessary details.

When writing a letter to the bank for a credit card application, begin with your account information if applicable and specify that you are applying for a credit card. Include relevant personal information, such as your income and employment details, to support your application. A well-organized letter request for credit card increases your chances of a favorable response.

To write a simple letter of request, start by addressing the letter to the appropriate recipient. Clearly state the purpose of your letter, such as a letter request for credit card, and include any necessary details that facilitate understanding. End the letter with a thank you and your signature, reinforcing your appreciation for their attention to your request.