Surety Bond Claim Form For Insurance

Description

How to fill out Bond Claim Notice?

Legal documents management can be daunting, even for seasoned professionals.

When searching for a Surety Bond Claim Form For Insurance and lacking the time to explore the correct and most recent version, the process can become overwhelming.

Tap into a repository of articles, guidelines, and materials associated with your case and needs.

Save time and energy tracking down the necessary documents, and leverage US Legal Forms’ advanced search and Review tool to find your Surety Bond Claim Form For Insurance.

Select Buy Now when you're prepared, choose a monthly subscription plan, find the format you need, and Download, complete, sign, print, and send your document. Enjoy the US Legal Forms online library, supported by 25 years of expertise and reliability. Turn your routine document management into a smooth and user-friendly experience today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents section to review previously saved documents and manage your folders as desired.

- If this is your first time using US Legal Forms, create a free account for unlimited access to all the library’s benefits.

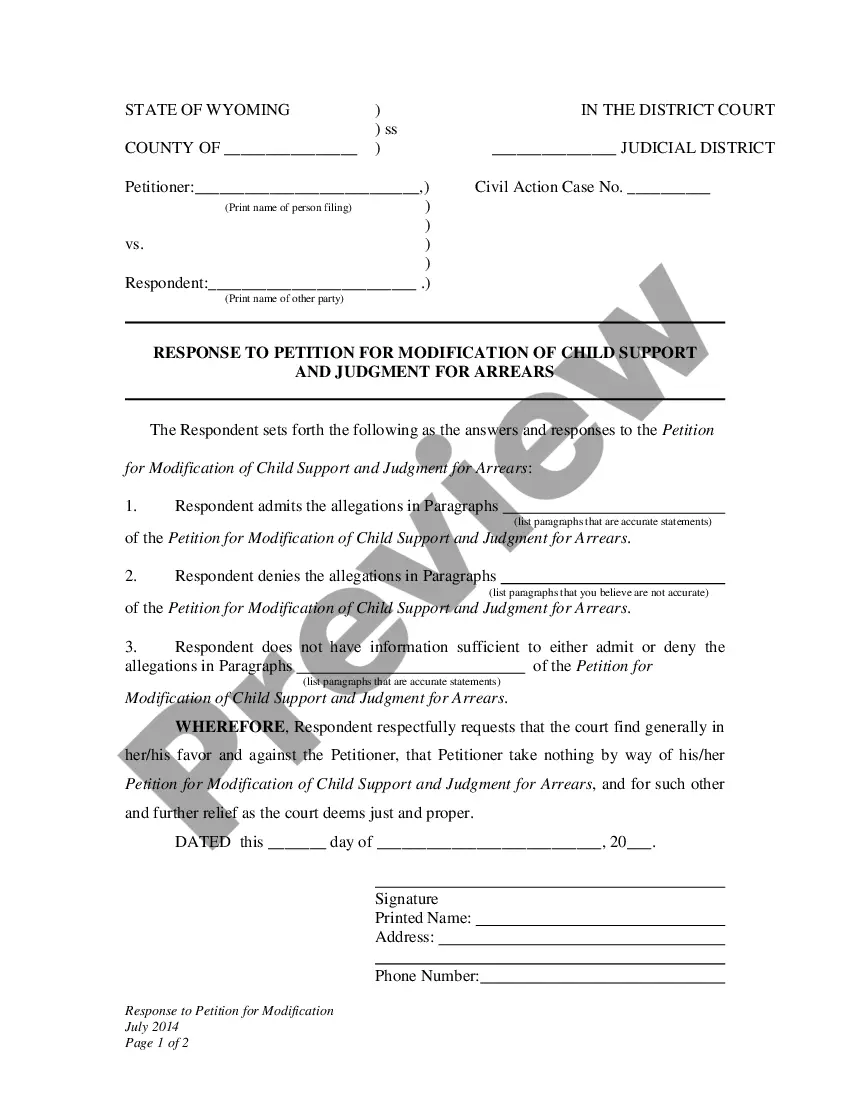

- After downloading the required form, ensure it is the correct one by previewing and reviewing its details.

- Confirm that the template is accepted in your state or county.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all requirements you may have, from personal to organizational forms, all in one location.

- Utilize advanced tools to fill out and manage your Surety Bond Claim Form For Insurance.

Form popularity

FAQ

Filing a Bond Claim The consumer will contact the surety directly to engage this process. Claims against a surety company may be filed by homeowners, any person damaged by a willful and deliberate violation of a construction contract or by employees damaged by the contractor's failure to pay wages.

Surety bonds are financial instruments that tie the principal, the obligee?often a government entity?and the surety. In the case of surety bonds, the surety is providing a line of credit to the principal so as to reassure the obligee that the principal will fulfill their side of the agreement.

These bond types are also referred to as ?commercial bonds" or ?business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

Anatomy of a Surety Bond Form Bond Number. The surety company assigns this unique identifying number to the bond. ... Principal. The principal is the person or business required to obtain the bond. ... Surety Company. ... Bond Penalty (Penal Sum) ... Obligation. ... Obligee. ... Effective Term. ... State.